“Margin debt is the amount of money that investors borrow against their portfolios. It can be great for leveraging – or boosting – returns as markets rise but can really hurt if markets fall, not least as investors often find themselves forced to sell to meet margin calls – and repay their debts at an inopportune time, locking in a loss as stocks slide.

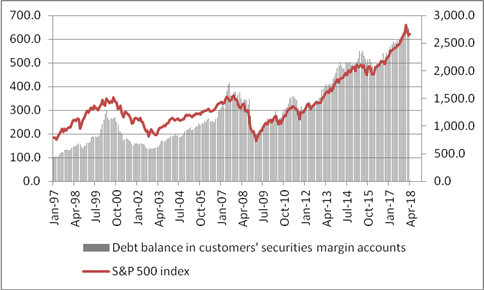

“According to the latest monthly data from America’s Financial Industry Regulatory Authority (FINRA), which took over from the New York Stock Exchange (NYSE) in December last year, total US margin debt rose by $171 million in March, to $645.2 billion.

Source: FINRA, Thomson Reuters Datastream

“That is still a fraction below the all-time high of $665.7 billion reached in January and may be a sign that confidence is returning after the correction seen in US stocks this spring.

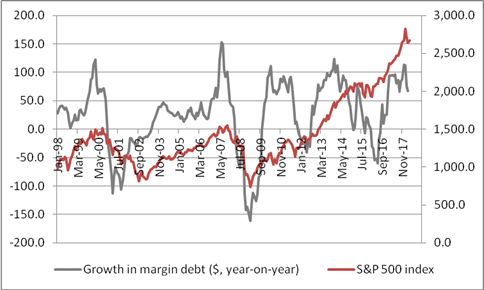

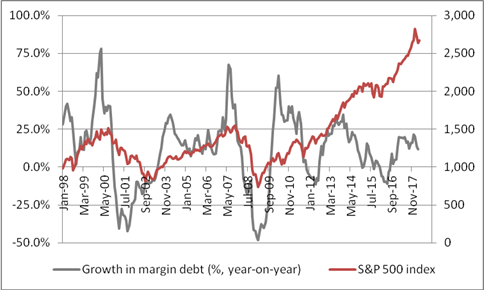

“In some ways it may need to be. If confidence ebbs, or a further market slide obliges investors to liquidate positions, then the S&P 500 could have further to fall. Large-scale reductions in margin debt in 2000-03 and 2007-09, which came after equally huge increases in borrowing against portfolios as stocks surged during 1997-2000 and 2003-2007, contributed to the broad sell-off in US stocks.

“Lesser reductions in margin positions came alongside the summer 2011 and the growth scares of 2015-16.

Source: FINRA, Thomson Reuters Datastream

“This just goes to show how powerful the combination of liquidity (currently provided cheaply by central banks in the form of near-record-low or even negative interest rates and Quantitative Easing) and leverage (investor borrowing) can be on the way up, as markets rise – but also on the way down as markets fall.

Source: FINRA, Thomson Reuters Datastream

“Any sudden air-pocket in stocks can lead to forced fire sales, which in turn beget more liquidations as more investors hit their debt thresholds and brokers call for more capital to meet their debt repayments.

“This is why markets are dominated, in the short term at least, by greed and fear, even if in the long run it is fundamentals – in the form of profits and particularly cash flow – which win out in the end.”