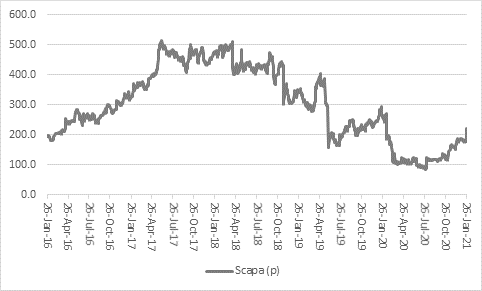

“Those investors who stuck with adhesives and bonding specialist Scapa through the early stages of the pandemic and backed last May’s fund raising at 105p could be about to double their money, thanks to a 210p-a-share cash bid from American resins expert Schweitzer-Mauduit,” says Russ Mould, AJ Bell Investment Director. “Scapa’s board is recommending the offer although the shares are trading higher still, to perhaps suggest shareholders may look to hold out for a little more from the would-be buyer, or even a counter-offer from another company. After all, Scapa’s shares were trading at 272p just prior to last February’s profit warning and the shares peaked at 516p in June 2017.

Source: Refinitiv data

“The bid may provide succour to bulls of UK equities more generally, as well as Scapa’s shareholders.

“Schweitzer-Mauduit is the latest trade or financial buyer to launch a bid for a publicly-owned company, to suggest that there could be some value to be had from the UK stock market.

“The UK has consistently underperformed on the global stage since June 2016’s Brexit vote and sterling has failed to regain the levels at which it traded before Britain decide to leave the EU. That combination may mean that some assets are going cheap and the average bid premium of 45% across the 20 or so takeover offers made for UK firms since the autumn would support that view – even if Schweitzer-Mauduit’s bid represents only a 19% premium to Scapa’s pre-offer price (and CFE is trying to buy CIP Merchant Capital at a sizeable discount to net asset value today).

|

|

|

Price before |

|

Type of |

|

Bid |

|

Date |

Company |

bid (p) |

Offer (p) |

offer |

Bidder |

Premium |

|

27-Jan-21 |

Scapa |

177 |

210 |

Cash |

Schweitzer-Mauduit |

19% |

|

27-Jan-21 |

CIP Merchant Capital |

56 |

50 |

Cash |

CFE |

(11%) |

|

17-Dec-20 |

Signature Aviation |

261.8 |

405 |

Cash |

Global Infras Partners******* |

55% |

|

11-Dec-20 |

Calisen |

206.6 |

261 |

Cash |

BlackRock / Mubadala |

26% |

|

10-Dec-20 |

Applegreen |

354.0 |

522.7 |

Cash |

B&J / Blackstone Infrastructure |

48% |

|

07-Dec-20 |

IMImobile |

402.5 |

595 |

Cash |

Cisco |

48% |

|

25-Nov-20 |

GoCo |

110 |

136 |

Cash and stock |

Future |

24% |

|

25-Nov-20 |

AA |

31.8 |

35 |

Cash |

Towerbrook / Warburg Pincus |

10% |

|

09-Nov-20 |

Countrywide |

145 |

395 |

Cash |

Connells** |

172% |

|

06-Nov-20 |

Codemasters |

435 |

604 |

Cash and stock |

Electronic Arts****** |

39% |

|

06-Nov-20 |

Urban & Civic |

211 |

345 |

Cash |

Wellcome Trust |

64% |

|

06-Nov-20 |

Sportech |

21 |

28.5 |

Cash |

TBC |

36% |

|

05-Nov-20 |

RSA |

460 |

685 |

Cash |

Intact / Tryg |

49% |

|

03-Nov-20 |

G4S |

205 |

245 |

Cash |

Allied Universal**** |

20% |

|

02-Nov-20 |

LiDCO |

6.8 |

12 |

Cash |

Masimo |

78% |

|

02-Nov-20 |

Horizon Discovery |

89 |

185 |

Cash |

Perkin Elmer |

108% |

|

23-Oct-20 |

McCarthy & Stone |

83 |

120 |

Cash |

Lone Star Real Estate***** |

45% |

|

20-Oct-20 |

4D Pharma |

93 |

110 |

Cash |

Longevity (SPAC) |

18% |

|

|

|

|

|

|

AVERAGE |

47% |

|

|

|

|

|

|

|

|

|

|

ABANDONED |

|

|

|

|

|

|

04-Jan-21 |

Entain |

1,132 |

1,383 |

Stock |

MGM Resorts |

22% |

|

03-Nov-20 |

Telit Communications |

152.4 |

250 |

Stock |

u-blox*** |

64% |

|

12-Nov-20 |

Elementis |

98 |

117 |

Cash |

Minerals Technologies* |

19% |

|

|

|

|

|

|

AVERAGE |

35% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OVERALL AVERAGE |

45% |

Source: Company accounts

* Bid raised from initial offer of 107p

** Alchemy initially offered a refinancing, Connells offered 250p, Alchemy offered 250p plus firm placing/open offer. Connells offered 325p 7 Dec 2020. Connells offered 395p on 31 Dec 2020. Alchemy pulled out on 22 Jan 2020 and sold its stake to Connells.

*** DBAY Advisers offered 175p on 27 Oct 2020 and raised to 195p on 4 Dec 20. u-blox' preliminary interest made public on 20 Nov. when shares were 168p. DBAY dropped out 15 Dec 2020

**** GardaWorld initially offered 190p. Allied Universal offered 210p and Garda World then made a further, final offer of 235p on 2 Dec 20, which Allied Universal countered on 8 Dec 2020

***** Initial offer of 115p raised to 120p on 7 Dec 20

****** Take-Two Interactive had offered 485p. EA countered on 14 Dec 2020

“Admittedly, three approaches have been rebuffed and failed, perhaps knocking a bit of a hole in the value argument. However, three of those offers featured at least some element of stock and not just cash, whereas the all-cash offers have had a warmer reception. Perhaps the failure of those all-stock or part-stock bids showed that investors had doubts over the valuation of the paper they would or have received or simply felt keeping the shares in the UK-based target offered greater upside potential.

“The recommended bid for Scapa does at least vindicate the judgement of those investors who backed last May’s £33 million fund raising during the first wave of the pandemic and just three months after a profit warning.

“The potential profits enjoyed by those shareholders also reaffirm the importance of valuation when it comes to assessing a stock, despite what some might tell you as the current equity bull market roars onwards, especially in the USA, where the surge in Gamestop stock continues to make waves.

“When Scapa’s shares peaked at north of 500p, investors were paying 27 times forward earnings for the company (which ultimately achieved earnings per share of 18.9p the following year). That suggests investors mistook perceived stability and reliability of earnings for safety and overpaid for the privilege, especially as profits ultimately disappointed and sagged.

“Yet anyone who snapped up the placing shares at 105p was effectively paying barely seven times past peak earnings (adjusting that 18.9p EPS number to 15.6p to account for the increased share count). While there is no guarantee that Scapa’s profits will return to their previous highs – analysts are forecast 12p in EPS for the years to March 2022 and 2023 - paying such a lowly multiple means that the investor is less of a hostage to fortune, has more downside protection it they do not and more upside if they do get back to where they came from.

“This is a further example of Benjamin Graham’s adage that ‘The intelligent investor is a realist who sells to optimists and buys from pessimists’ – something which those currently involved in ramping Gamestop’s shares might need to bear in mind as well.”