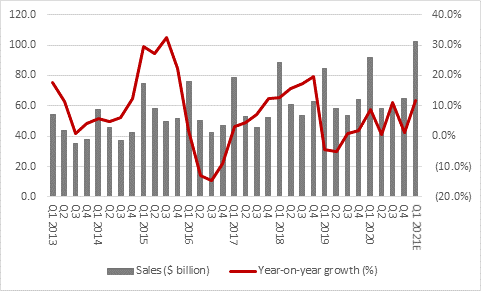

“Netflix is getting results season for the FAANG stocks off to a good start and Apple reports its fiscal first-quarter results on the evening of Wednesday 27th January. This three-monthly ritual might grab a few more headlines than normal because analysts expect Apple to generate sales of more than $100 billion a single quarter for the first time in its history,” says Russ Mould, AJ Bell Investment Director. “If the consensus forecast of $102.6 billion is attained, that would equate to year-on-year sales growth of 12%, the fastest rate of advance in ten quarters.”

Source: Company accounts, NASDAQ, Zack’s, analysts’ consensus forecasts. Fiscal year to September.

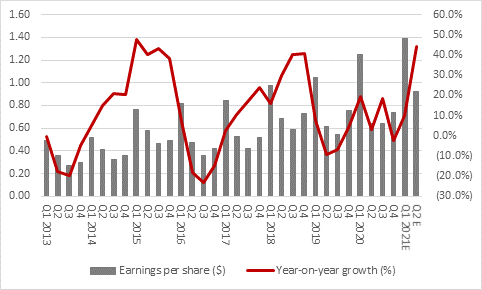

“Helped by the launch in October of the iPhone 12 and further double-digit percentage increase in sales from services, as well as wearables and accessories, Apple could therefore start to shrug off the earnings slowdown seen in fiscal 2020 when the pandemic and global recession even made their presence felt at the Cupertino, California-based giant.

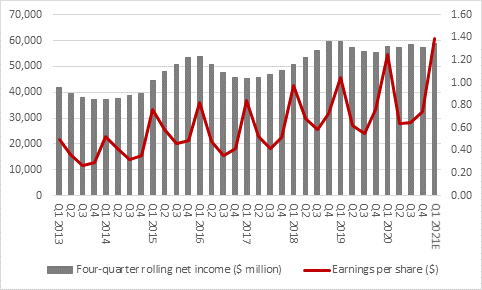

“The consensus estimate for Q1 is earnings per share (EPS) of $1.39 compared to $1.25 a year ago.

“Just as important will be any guidance from boss Tim Cook for the second quarter, where analysts currently forecast EPS of $0.92.

“That would represent the traditional post-Christmas sequential dip, but it would still equate to a big year-on-year increase.

Source: Company accounts, NASDAQ, Zack’s, analysts’ consensus forecasts. Fiscal year to September.

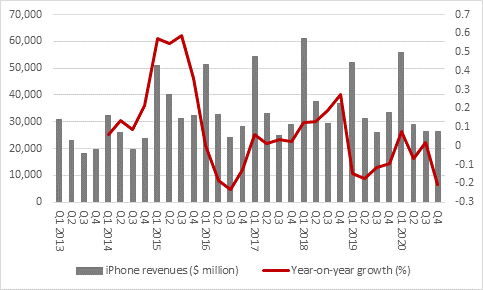

“Those forecasts suggest that Apple is about to ride its latest iPhone upgrade cycle, thanks to iPhone 12 and the rise of 5G mobile devices and systems. Shareholders would welcome such news, as iPhone revenues have fallen year-on-year six times in the last eight quarters, amid signs that customer upgrade cycles are lengthening as devices become more expensive and the benefits of switching to a new device have become less pronounced.

“Industry data also show that Apple slipped to fourth in the global smartphone market share rankings in the third quarter of calendar 2020 (Apple’s fiscal fourth quarter) as Xiaomi slipped past it for third, behind Samsung and Huawei. The impact of outgoing President Trump’s trade policies should not be underestimated here, as Chinese consumers have leaned more toward the domestic brands. Data from Mobile Devices Monitor now ranks Apple fifth in the Chinese smartphone market behind Huawei, Vivo, Oppo and Xiaomi.

Source: Company accounts. Fiscal year to September.

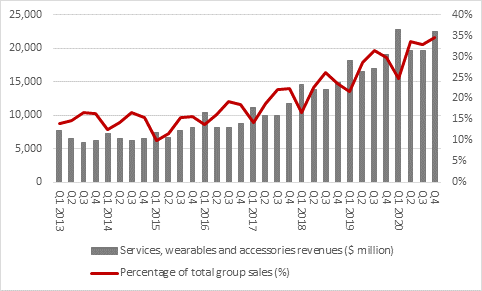

“Bulls of Apple will counter that the company is not just a maker of hardware devices but the provider of an ecosystem of services and apps. This view is supported by how revenues from wearables and accessories, such as the Apple Watch and air pods, and particularly services and apps continue to mushroom. Between them, they now generate 35% of group sales, double their contribution of just three years ago.

Source: Company accounts. Fiscal year to September.

“Those investors who are not Apple-holics will argue it is a good thing that Apple is forecast to generate rapid earnings growth going forward, after 2020’s dip in momentum. Such sceptics might argue that a company whose shares trade on over 30 times forward earnings needs to generate some rapid growth to justify such a multiple.

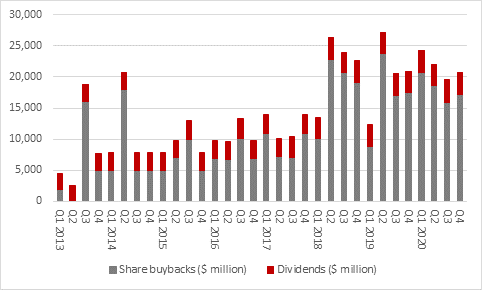

“That is a conclusion which only investors can draw for themselves but it is worth noting that over the past 12 months, Apple’s market cap has increased by $745 billion and has done so when its four-quarter rolling net profit is expected to come in unchanged at $59 billion, no higher than it was 9 quarters. EPS has then been padded out by share buybacks that have reduced the share count by a third since their launch in 2013.

Source: Company accounts, NASDAQ, Zack’s, analysts’ consensus forecasts

“Holders of the stock will argue that the buybacks are all part of the package and a tribute to Apple’s competitive position, pricing power, profit margins and cash flow. Apple has paid out $100 billion in dividends and returned a further $361 billion in cash via buybacks since the first quarter of fiscal 2013 – when Apple’s market cap was just $443 billion. In effect, anyone buying then has already got their entire investment back and any capital returns or income from here on are pure profit.

Source: Company accounts. Fiscal year to September.

“Those who growl about lofty valuations will suggest that buyers of the stock at these levels are already pricing in plenty of future, post-pandemic growth, with the result that any disappointment, even minor, could put pressure on the share price.”