“It is remarkable that Ashtead’s shares are setting a new all-time high today given the still-uncertain economic backdrop, but its second-quarter figures do show a further improvement in business momentum and investors are clearly still in the mood to price in a full-blown recovery in 2021 and beyond,” says Russ Mould, AJ Bell Investment Director.

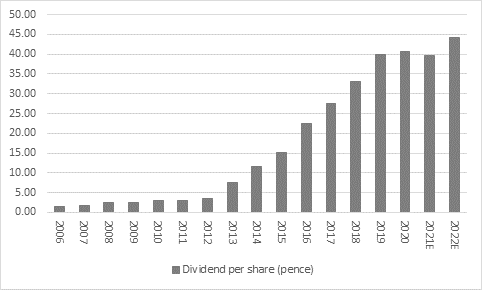

“A mid-year increase in the capital expenditure budget hints at growing confidence in the boardroom too, as the more kit Ashtead has the more it can rent out and earn, although the company is again being cagey with its dividend. The interim payment is unchanged on a year ago, so Ashtead has a little work to do yet if it is to maintain the annual dividend growth streak which dates back to 2005.

Source: Company accounts, Sharecast, consensus analysts’ forecasts. Company financial year to April.

“In capital terms, Ashtead is the single-best performer in the FTSE 350 over the past ten years (Games Workshop just edges it out if dividends are included and the calculation is based on total returns.

|

|

Top 10 performing stocks in the FTSE 350 over the past decade |

||||

|

|

Based on share price only |

|

Based on total returns |

||

|

|

|

% change |

|

|

% return |

|

1 |

Ashtead |

2,230 |

1 |

Games Workshop |

2,420 |

|

2 |

Games Workshop |

2,230 |

2 |

Ashtead |

2,390 |

|

3 |

Avon Rubber |

1,700 |

3 |

Avon Rubber |

1,740 |

|

4 |

JD Sports |

1,700 |

4 |

JD Sports Fashion |

1,730 |

|

5 |

Liontrust Asset Mgt. |

1,420 |

5 |

Liontrust Asset Mgt. |

1,570 |

|

6 |

Ocado |

1,300 |

6 |

Ocado |

1,290 |

|

7 |

London Stock Exchange |

1,100 |

7 |

London Stock Exchange |

1,160 |

|

8 |

4imprint |

1,010 |

8 |

4imprint |

1,130 |

|

9 |

GVC |

782 |

9 |

GVC |

996 |

|

10 |

Rightmove |

726 |

10 |

Barratt Developments |

861 |

Source: Refinitiv data

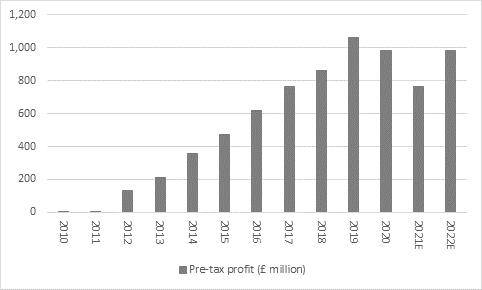

“One reason for this is the company’s phenomenal profit growth since the end of the financial crisis, where organic growth has been supplemented by select bolt-on acquisitions. The year to April 2021 is expected to see the second straight decline but investors are clearly willing to look through that, to the expected recovery in fiscal 2022 and then beyond that.

Source: Company accounts, Sharecast, consensus analysts’ forecasts. Company financial year to April.

“An end to cuts and the start of upgrades to near-term profit forecasts is also helping sentiment toward the stock. After frantic cuts to estimates as the pandemic and recession swept the globe in spring, analysts are now increasing their forecasts.

|

Analysts' consensus pre-tax profit forecast (£ m) |

||||||||

|

|

Mar-19 |

Jun-19 |

Sep-19 |

Dec-19 |

Mar-19 |

Jun-19 |

Sep-19 |

Dec-19 |

|

2021E |

1,276 |

1,277 |

1,164 |

1,325 |

1,325 |

761 |

715 |

767 |

|

2022E |

|

|

|

|

|

968 |

945 |

984 |

Source: Sharecast, consensus analysts’ forecasts. Company financial year to April.

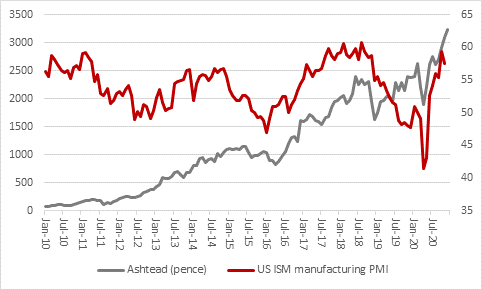

“Ashtead has been helped in this respect - at least so far – by its business mix.

“The firm gets around 90% of its sales from its American Sunbelt operation, with the bulk of the rest coming from the A-Plant business in the UK. An increase in the US purchasing managers’ index (PMI) for manufacturing, based on data from the Institute for Supply Management (ISM), provides evidence of a bounce-back in US industrial output and Ashtead’s shares do show some historic relationship with this forward-looking economic indicator.

Source: ISM, Refinitiv data

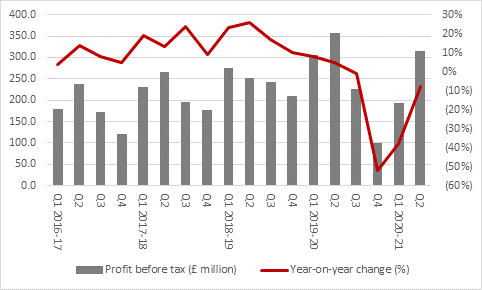

“The improved levels of US manufacturing and industrial activity can be seen in the trend in Ashtead’s quarterly profits, too. Pre-tax income fell just 8% year-on-year in the second quarter after a plunges of 52% and 38% in the preceding two three-month periods.

“Markets feed off the second derivative – changes in the rate of change – so a continued improvement here and then further acceleration is what investors will be wanting to see.

Source: Company accounts. Company financial year to April.

“However, America’s ongoing struggles to contain the virus could yet become an issue, although markets are already clearly looking toward more fiscal stimulus from Congress and possible monetary policy support from the Federal Reserve – even if the former is currently log-jammed on Capitol Hill in Washington.

“To maintain their giddy run, Ashtead’s shares may need to show ongoing profit forecast momentum. If they fail, then the shares could start to look pricey. Earnings per share peaked at 175p before the pandemic and at £33.50 the stock trades on 19 times that figure, a multiple that represents a big premium to the wider FTSE 100. As such, it does seem as if a decent upturn in the global economy and earnings is already partly priced in, although if the combination of ultra-loose monetary policy and ultra-loose fiscal policy sparks a (still-unexpected) rip-roaring inflationary expansion, then Ashtead could be one of the stocks to which investors will turn, at least initially.”