The Department for Work and Pensions has today published its latest in-depth analysis of the flagship automatic enrolment pension reforms.

You can read the full document here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/764964/Automatic_Enrolment_Evaluation_Report_2018.pdf

Key points:

• Almost 10 million workers have now been automatically enrolled into a pension scheme as a result of the reforms

• New data collected following the first contribution increase in April suggests no spike in opt-outs (see Table 6.2 below)

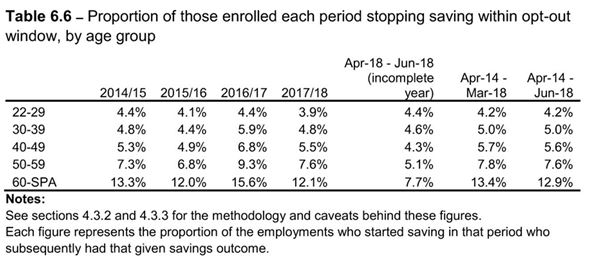

• Encouragingly, opt-out rates among younger savers are particularly low (see Table 6.6 below)

• Number of compliance notices issued by The Pensions Regulator has almost doubled, from 34,000 in 2016/17 to 61,000 in 2017/18

Tom Selby, senior analyst at AJ Bell, comments:

“A combination of people embracing the importance of saving for retirement and the power of inertia means the early stages of automatic enrolment have been an enormous success.

“Early indications suggest the increase in minimum total contributions introduced in April this year has not caused savers to flee for the exit door. Rising average wages will have helped here, dampening the effect saving in a pension has on people’s take-home pay.

“The next big test of the reform programme comes in April next year when contributions will be hiked once again, from 5% of relevant earnings to 8%.

“The omens for the impact this will have on people’s saving behaviour look positive, although clearly any negative shocks to the economy could yet derail the progress made so far.

“As we look beyond the initial roll-out of auto-enrolment the Pensions Dashboards turns the focus towards boosting engagement and contribution levels beyond 8%.

“If Government and regulators seize this opportunity to radically rethink the way the industry is required to communicate with people, it could help cement the retirement revolution started by the Turner Commission in 2002.”