“Very few firms will look back on 2020 with as much satisfaction – from a purely business point of view – as Avon Rubber, after three major transactions, an underlying increase in profit, a big hike in the dividend and an increase to its net cash pile, so investors may be a bit confused as to why the shares are down so much,” says Russ Mould, AJ Bell Investment Director. “The answer lies with Avon Rubber’s phenomenal performance over the past ten years, as during this span it is the third best performer in the FTSE 350. Such a tremendous run leaves the stock trading on a forward price/earnings ratio of 33 times for fiscal 2021, a huge premium to the wider market.

“For the moment at least, investors seem to be looking for cheap, recovery stocks rather than highly-priced havens which offer greater earnings reliability, like Avon Rubber. The theory is the long-awaited vaccines will prompt a bounce in economic activity, with the result that corporate profits and dividends will rise faster in 2021 at those firms whose business model suffered the most at the hands of the pandemic in 2020.

|

20 best performing shares in the FTSE 350, last ten years |

||||

|

Company |

Performance |

|

Company |

Performance |

|

Games Workshop |

2180% |

|

Rightmove |

750% |

|

Ashtead |

2130% |

|

Diploma |

696% |

|

Avon Rubber |

1990% |

|

Persimmon |

652% |

|

JD Sports Fashion |

1790% |

|

Marshalls |

596% |

|

Liontrust Asset Management |

1450% |

|

Dechra Pharmaceuticals |

581% |

|

Ocado |

1330% |

|

Howden Joinery |

579% |

|

London Stock Exchange |

993% |

|

Future |

566% |

|

4imprint |

921% |

|

Halma |

555% |

|

GVC |

784% |

|

Taylor Wimpey |

549% |

|

Barratt Development |

766% |

|

Safestore |

549% |

Source: Refinitiv data. Excludes investment trusts. Includes only stocks with a full ten-year trading history.

“Given their tremendous returns over the last ten years, shareholders in Avon Rubber are unlikely to be too shaken by the share price slide that has followed the full-year results.

“The Wiltshire-headquartered company is now a more focused entity following the sale of its dairy and milking equipment business, while the acquisitions of 3M’s ballistic helmets business and Team Wendy, another US business, cemented its position as the global leader in advanced respiratory protection systems for the military, security, fire and industrial markets, helping to protect soldiers and first responders from chemical, biological, radiological or nuclear (CBRN) threats. Better still, the receipts from the disposal of milkrite in September mean Avon Rubber has a net cash balance sheet, even allowing for its £23 million leases and £62.5 million in pension liabilities

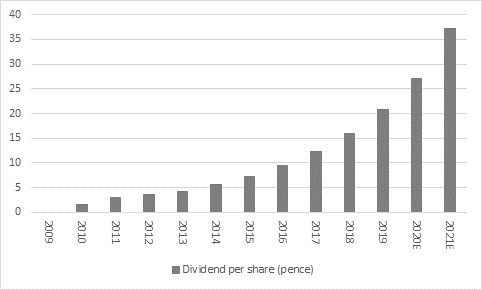

“Avon Rubber has an excellent track record of generating strong returns from investment in its business and this is reflected in the annual dividend’s lengthy growth streak, which now stretches back to 2010. Avon Rubber has just embellished that record with a 30% hike to its full-year payment to 27.08p a share, although that does equate to a dividend yield of just 0.6%, to again highlight the rich valuation currently attributed to the stock.”

Source: Company accounts, Sharecast, consensus analysts’ forecasts