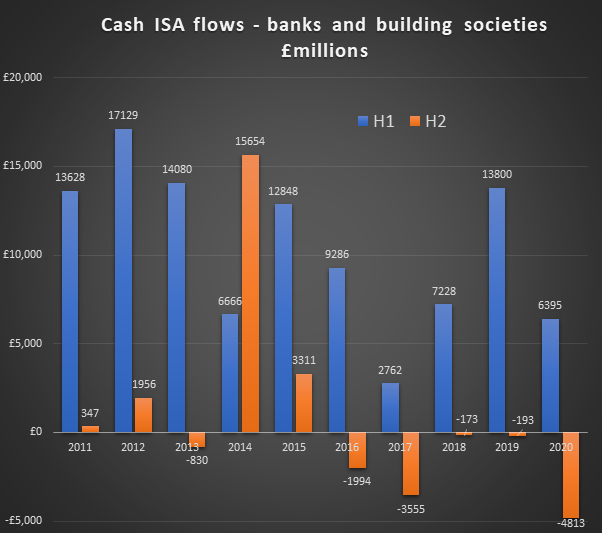

• £4.8 billion* was withdrawn from bank and building society Cash ISAs in the last six months of 2020, the highest H2 outflow on record, according to Bank of England data released yesterday

• This is despite £72 billion* flowing into cash deposit accounts in the same period

• Low interest rates, rising stock markets, NS&I flows, and the pandemic are all probably responsible for Cash ISA withdrawals

• The number of Cash ISA subscriptions dropped 30% following the introduction of the Personal Savings Allowance in 2016

• Why use a Cash ISA?

*Source: Bank of England

Laith Khalaf, financial analyst at AJ Bell, comments:

“It’s not unusual to see money coming out of Cash ISAs at the back end of the calendar year, because most of the inflows happen in March and April. However, the last six months of 2020 saw record withdrawals from bank and building society Cash ISAs, which is particularly surprising when you consider households saved £72 billion in deposit accounts over the same period.

“There are probably a number of factors which explain the scale and timing of these Cash ISA withdrawals. Interest rates on cash are exceptionally low, with the average Cash ISA now offering just 0.35% per annum. That doesn’t help to keep bums on Cash ISA seats. At the same time stock markets are doing relatively well, and November saw particularly high levels of investment thanks to the arrival of vaccines and the election of Joe Biden as US President. Indeed net retail sales of investment funds hit a record £8.3 billion in November, according to the Investment Association.

“NS&I flows may also have played a part in withdrawals, as the NS&I Direct ISA is not included in the Bank of England Cash ISA data. It’s not clear to what extent NS&I disrupted flows into banks and building societies, seeing as over the last six months of 2020, NS&I experienced both significant inflows and then substantial outflows, following the drastic rate cuts announced in September. Nonetheless it may have had a material impact on outflows from other Cash ISA products before the rate reductions.

“Some withdrawals have also likely been used to fund spending. Activity in the housing market was elevated at the back end of last year, and no doubt some savers used their Cash ISA savings to fund a deposit. Meanwhile other savers may have had to raid their Cash ISAs to cover the bills, if they lost some or all of their income as a result of the pandemic.

“While the winter is normally a fallow period for Cash ISAs, the forthcoming peak ISA season may continue to be affected by some of these headwinds. In particular low interest rates look unlikely to inspire many savers to plump for Cash ISAs, particularly when the rates are often pitched below other savings accounts, and the 1% currently paid on Premium Bonds, where winnings are also tax-free.”

The personal savings allowance has undermined Cash ISAs

“The Personal Savings allowance has also helped to undermine the case for Cash ISAs, particularly when combined with low interest rates. For basic rate taxpayers, the allowance means £1,000 of savings interest can be paid tax-free, while for higher rate taxpayers this is reduced to £500. Still, based on the 0.35% interest rate currently on offer from the typical Cash ISA, that would mean a basic rate taxpayer would need £285,700 held in a Cash ISA account before the wrapper delivers any tax benefit. For a higher rate taxpayer, the figure is £142,800.

“Additional rate taxpayers, however, don’t qualify for a personal savings allowance, so for them the Cash ISA is a valuable tax shelter from the first £1 they save into it, as it protects them from paying 45% tax on the interest received. In a clear case of the law of unintended consequences, a progressive tax policy introduced in 2016 has therefore tilted Cash ISAs towards being a product which is best suited to wealthier members of society. HMRC ISA statistics bear this out - they show a 30% reduction in the number of people subscribing to a Cash ISA in the two years following the introduction of the Personal Savings Allowance. The number of Cash ISA accounts opened fell from 10.1 million in 2015/16 to 7 million in 2017/18. With interest rates now lower than they have ever been, we can expect the protection afforded by the personal savings allowance to weigh on Cash ISA flows this tax year too.”

Why use a Cash ISA?

“Cash ISAs can still be useful. When interest rates rise, the wrapper will potentially become more valuable. It’s not going to happen anytime soon, but at an interest rate of 4%, a cash ISA would offer tax protection for balances over £12,500 for higher rate taxpayers, or £25,000 for basic rate taxpayers. However, the Cash ISA allowance is now generous, at £20,000 a year, which does allow savers to react to rising interest rates by stashing away £40,000 into Cash ISAs in any given April, across two different tax years, or £80,000 for a couple.

“Of course, tax policy can change, and putting money into a Cash ISA means you secure that allowance and aren’t looking a gift horse in the mouth. Nowadays ISAs are also more flexible, allowing you to switch between Cash ISA and Stocks and Shares whenever you want, so committing to one or other right now doesn’t mean you can’t switch horses further down the line if circumstances change.”

Source: Bank of England, Monthly changes of monetary financial institutions' sterling individual savings accounts held by the private sector (in sterling millions) not seasonally adjusted