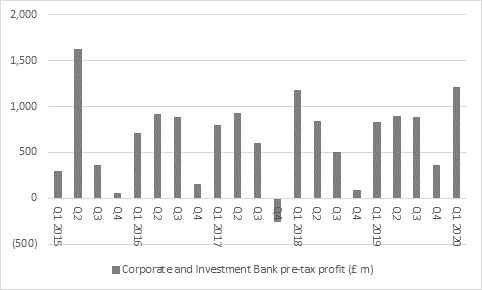

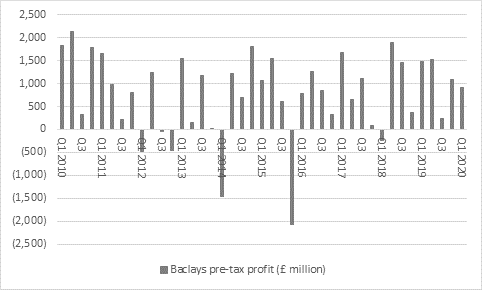

“Surging loan loss provisions and plunging pre-tax profits are already losing their ability to shock investors, who are already familiar with these trends after the first quarter results from HSBC and the big US banks, so in this respect Barclays’ Q1 results feature no additional nasty surprises,” says Russ Mould, AJ Bell Investment Director. “Instead Barclays’ investment bank can take some plaudits rather than brickbats with revenues from the Markets business up 77% year-on-year and pre-tax profit from the whole operation reaching its highest level since Q2 2015.

Source: Company accounts

“A return on equity of 12.5% from the corporate and investment bank is more like it, too, and this good first-quarter showing goes a long way to justifying the commitment shown by CEO Jes Staley’s and Barclays’ board to decision to retain, back and develop the operation.

“The £375 million, or 45%, year-on-year increase in investment banking profits helped to offset a £390 million drop in earnings at Barclays UK and a £296 million slide at Barclays International’s consumer and credit card business, with the result that the bank’s total Q1 pre-tax profit fell by ‘just’ 38% year-on-year, compared to the 48% slump at HSBC (although Standard Chartered was down by ‘just’ 29%).

Source: Company accounts

“However, one good quarter is unlikely to persuade chief critic Edward Bramson of Sherborne Investors that Barclays is still on the right track. If the investment bank couldn’t make money in the last quarter then it was never going to, and with the corporate and investment bank’s allocation of nearly 60% of group tangible equity it needs to continue performing like this to earn its keep.

“That will be harder to do if central banks’ efforts fail to stave off a bear market and the market is seemingly yet to be entirely convinced, since Barclays shares trade at just 0.36x times their stated (tangible) book, or net asset, value per share.

|

|

Q1 2020 |

Q1 2020 |

Q1 2020 |

Q1 2020 |

Q1 2020 |

Q1 |

Q1 |

Q1 2020 |

|

|

|

Net interest |

Cost/income |

Impairment |

Loan/deposit |

2020 |

2020 |

Leverage |

|

|

Price/book |

margin (%) |

ratio (%) |

ratio (%) |

ratio (%) |

RoTE |

CET 1 ratio |

ratio |

|

HBSC |

0.69 x |

1.54% |

57.6% |

1.18% |

72% |

4.2% |

14.6% |

5.3% |

|

Lloyds* |

0.66 x |

1.62% |

65.9% |

0.33% |

107% |

4.8% |

13.8% |

5.2% |

|

RBS* |

0.43 x |

1.99% |

65.1% |

0.21% |

89% |

9.4% |

16.2% |

5.8% |

|

StanChart |

0.41 x |

1.52% |

54.6% |

0.27% |

62% |

5.1% |

13.4% |

4.9% |

|

Barclays |

0.36 x |

2.91% |

52.0% |

2.23% |

79% |

5.1% |

13.1% |

4.5% |

Source: Company accounts. Data for Barclays, HSBC and Standard Chartered refers to Q1 2020. *Data for Lloyds and RBS refers to Q4 2019 - the last set of published numbers in all cases.

“Granted, all of the Big Five FTSE 100 banks trade at a discount to NAV but Barclays has the lowest rating of the lot. Today’s strong result from the investment bank is a good response from Barclays and helps it make the case that its strategy and operations are misunderstood and undervalued as a result, although the danger now is that loan provisions relating to COVID-19, the oil price collapse and a wider economic downturn drown that out.

“This is perhaps the biggest issue of all. Who would want to be – or own – a bank in the current environment?

“Global indebtedness stands at record highs and individuals, corporations and Governments are in many cases suffering serious drops in their near-term incomes to help them meet their interest payments, let alone repay any of the loans. Governments are therefore looking to banks to be part of the solution, either by offering more cheap credit or extending the maturity date or refinancing existing loans.

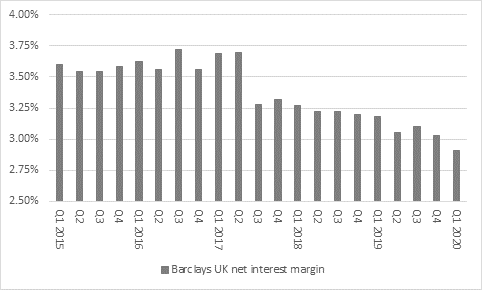

“None of this is good for net interest margins, which are already under pressure thanks to record low interest rates and bond yields which central banks are working hard to manipulate lower, compressing yield curves and credit spreads as best they can. The net interest margin at Barclays UK sagged yet again in Q1.

Source: Company accounts

“This makes it hard to banks to make money and tighter regulation is clamping down on the use of leverage and therefore potentially crimping returns on equity.

“Throw in the sluggish trend growth that prevailed before the COVID-19 crisis and worries that the West was in danger of ‘turning Japanese,’ thanks to excess debt and a growing reliance on either Government fiscal stimulus or ever-more extreme central bank intervention to keep the show on the road, and investors’ move to shun the banks and let their shares trade at discounts to stated tangible book value is more understandable.

“Those investors who think such fears are overdone may find Barclays’ current valuation tempting, especially if the bank starts paying dividends again at some stage. Those who do fear that the experiences of Japan since 1989 are going to seep westward will steer clear, in the knowledge that the Topix banks index is down some 93% from its all-time high, some 31 years after it was reached, despite some sensational rallies along the way.”