“Japan’s Nikkei 225 index may not be moving much this morning, but holders of Japanese equities will doubtless be feeling happier this morning now that Prime Minister Shinzō Abe has convincingly won the latest triennial vote for the leadership of the Liberal Democratic Party,” says Russ Mould, AJ Bell Investment Director.

“This will give the PM a clear run toward the next General Election, due by October 2021 at the latest, and more chance to implement the ‘Three Arrows,’ or ‘Abenomics’ reforms which have done so much to boost Tokyo stock market and the wider Japanese economy.

“Since his General Election victory in December 2012, Abe has followed up with crushing wins in snap polls in 2014 and 2017, while maintaining his grip on the ruling Liberal Democratic Party with leadership victories in 2015 and 2018. The LDP even changed the rules to permit him to stand for a third, three-year term as party head.

“The win puts Abe on course to become Japan’s longest-serving Prime Minister ever, come November 2019, providing he can stay clear of scandals and avoid any self-inflicted wounds.

|

Prime Minister |

Party |

Span of office * |

Total days in office |

|

Tarō Katsura |

Dōshikei |

1901-1913 |

2,883 |

|

Eisaku Satō |

Liberal Democratic Party |

1964-1972 |

2,797 |

|

Hirobumi Itō |

Seiyūkai |

1885-1901 |

2,716 |

|

Shigeru Yoshida |

Liberal Democratic Party |

1946-1954 |

2,614 |

|

Shinzō Abe |

Liberal Democratic Party |

2006-current * |

2,459 |

|

Junichiro Koizumi |

Liberal Democratic Party |

2001-2006 |

1,979 |

|

Yasuhiro Nakasone |

Liberal Democratic Party |

1982-1987 |

1,805 |

|

Hayato Ikeda |

Liberal Democratic Party |

1960-1964 |

1,574 |

|

Kinmochi Saionji |

Seiyūkai |

1901-1912 |

1,421 |

|

Nobusuke Kishi |

Democratic Party |

1957-1960 |

1,265 |

Source: Asahi Shimbun, Nikkei Newspaper. Dates span all periods in office which may not have been consecutive. * As of 20 September 2018. Abe’s first span in office ran from September 2006 to September 2007 and the second began on 26 December 2012

“More fundamentally for investors in Japanese assets, it will give the PM a chance to continue to pursue the Abenomics programme, implemented immediately after his 2012 election win. This has three thrusts:

• Huge fiscal stimulus and infrastructure spending programmes

• Huge monetary stimulus, initiated with the relaunch of Quantitative Easing (QE) by the Bank of Japan in April 2013

• Structural reform across areas such as employment law, agriculture, tax, energy and foreign direct investment

A run of year-on-year GDP growth which stretches back to late 2014 suggests that the reforms are having some impact, even if they are relying on a colossal Quantitative Easing programme for support. There has been no official comment on any plans to taper its ¥80 trillion-a-year asset-purchase programme, which equates to £550 billion a year, or more than the Bank of England has done across all of the last decade (£445 billion).

In addition, inflation – and especially wage inflation – are creeping higher, albeit slowly, to suggest that Japan may finally be emerging from the debt-and-deflation mire into which it plunged when its stock and real estate market bubble burst in 1990.

A drive for corporate reform is also bearing fruit. Encouraged by the creation of the JPX-Nikkei 400 index, which includes firms on the base of profits and governance not size, Japanese corporates are raising their game. The 2014 Japanese Stewardship Code, laid down by the Abe Government, laid down a minimum target for return on equity of 8% and data suggests that corporate Japan is now reaching or exceeded that goal as profit margins are driven higher.

Higher margins also mean improved profits and improved cash flow, a trend supplemented by near-record levels of non –core asset disposals, as companies focus on their core strengths. The cash raised on both fronts means that share buybacks are also running at near-record levels.

As a result, investors in Japanese stocks have done well under Abenomics.

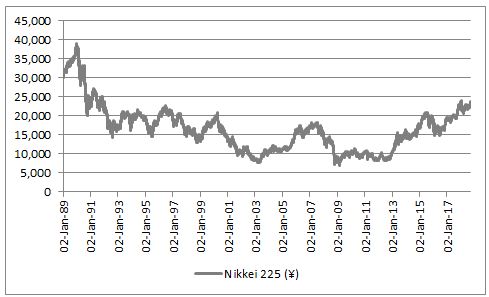

Since Abe took office on 26 December 2012, the Nikkei 225 is up 156% on a total return basis in yen (and 139% in sterling) compared to an equivalent gain of 60% from the FTSE All-Share.

And despite that advance, in capital terms, the Nikkei 225 is still trading some 40% below its all-time high of December 1989, encouraging Japan bulls to think there is more to go for, especially now Abe has more time on his side.

Source: Thomson Reuters Datastream