“The old joke goes that an emerging market is one from which investors cannot emerge unscathed when things go wrong (as they inevitably will, according to the sceptics),” says Russ Mould, AJ Bell Investment Director. “But as inflation expectations creep higher, commodity prices rise and the dollar fights to hold its ground, investors could be forgiven for thinking that a decade or more of underperformance by emerging markets relative to developed ones might be about to come to an end.

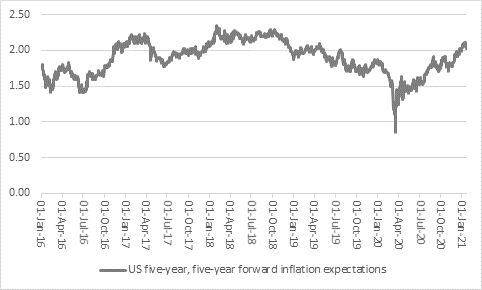

“A key debate which continues to exercise financial markets is whether inflation is primed to make a comeback and - if so – what this could mean for asset allocation and portfolio strategies.

Source: FRED - St. Louis Federal Reserve database

“The five-year, five-year forward inflation expectation in the US stands above 2% once more and financial markets are beginning to react: Government bond yields have ticked higher, Bitcoin has gone bananas and gold has held relatively firm.

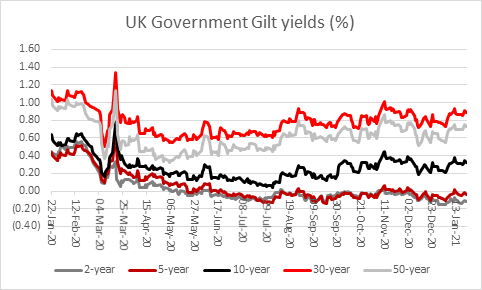

Source: Refinitiv data

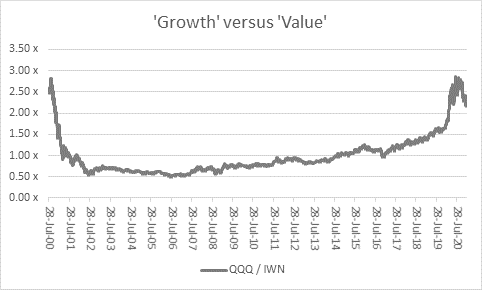

“Moreover, within the context of equity markets, ‘cyclical’ growth (or ‘value,’ for want of a better word) is again trying to cast aside a decade of underperformance relative to perceived ‘secular’ growth sectors such as technology.

“This battle for portfolio style (and performance) supremacy within equities can be seen by comparing the returns provided by two exchange-traded funds (ETFs) in the USA: the QQQ Invesco Trust, which follows the price of the biggest non-financial stocks on the NASDAQ, and the Russell 2000 Value ETF.

“If the line on this chart goes up, ‘growth’ is outperforming. If it goes down, ‘value’ is outperforming. As can be seen, cyclical growth can point to a streak of outperformance that stretches back to summer 2020 although value is trying to forge a fightback after more than a decade out in the cold.

Source: Refinitiv data

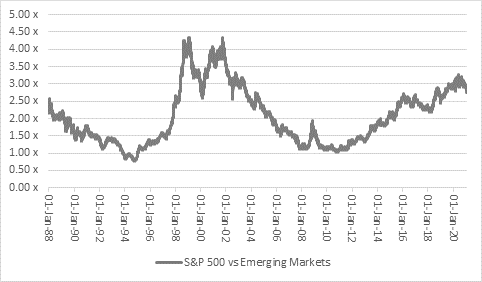

“This trend can be seen in another way too, this time on a geographic basis.

“Over the past decade, investors have adapted to the low-growth, low-inflation, low-interest-rate environment by buying long-dated assets such as bonds and equity growth (such as technology stocks), and forgetting about commodities, cyclical equities (‘value)’ and emerging markets. Yet as inflation creeps back onto the radar, perhaps for the first time in 40 years since then Fed chairman Paul Volcker set about wiping it out, emerging markets may be creeping back into fashion.

“This can be seen using the same technique as before, this time by dividing the performance of America’s S&P 500 index by the MSCI Emerging Markets (EM) benchmark. American outperformance peaked in September, since when emerging arenas have done better.

Source: Refinitiv data

“This apparent return to form for Emerging Markets coincides with a period of strength for commodity prices and dollar weakness. Whether it lasts may hinge to a great degree on those two trends, which also tie into the inflation narrative. If those three continue to coincide, then we could see a third major period of emerging market outperformance relative to the USA (and by implication developed markets), to match those of 1988-1994 and then 2000-2010, so this EM resurgence must be monitored closely. If it proves to be no mere flash in the pan, then it could have profound portfolio implications.

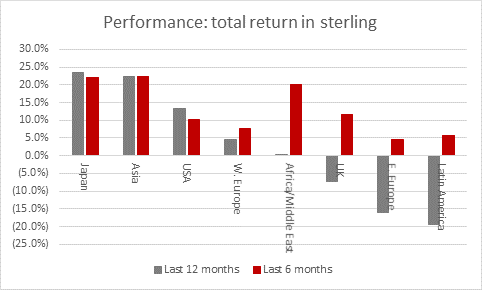

“The resurgence of EMs can also be seen by digging deeper into geographic performance trends.

“Japan may be the best performer, in total return, sterling-denominated terms over the past 12 months, but Asia is a close second. The data from just the past six months, when cyclical growth, or ‘value’, began to try and forge its latest comeback, show further outperformance from Asia and the Middle East and Africa region as well.

Source: Refinitiv data

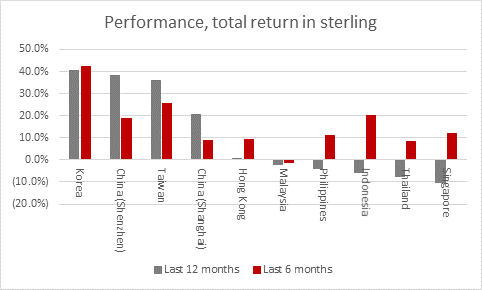

“The putative shift to cyclical from secular growth can also be seen by looking at individual Asia countries. Global export plays like Korea and Taiwan have done well of late, but tourism and travel destinations like Thailand and Hong Kong are clear laggards. Perhaps South East Asia becomes the next leg of the post-vaccine, global upturn story, should that develop as markets currently hope (for a multitude of different reasons).

Source: Refinitiv data

“There may be other reasons for the return to form of EM, beyond commodity strength, dollar weakness and markets’ preoccupation with inflation and a near-term economic recovery.

“Perhaps Asia’s outperformance reflects the view that region was first in and first out when it comes to the global pandemic (even allowing for recent local flare-ups). Given the experience of SARS in 2002-03, Asia may have been better prepared and equipped to deal with such a situation. In addition, Asian nations learned harsh lessons about debt during their currency crisis of 1997-98 and as a result aggregate Government borrowing levels are generally much lower as a percentage of GDP than they are in the West. This gives greater room for fiscal manoeuvre to support growth, should it be needed, and a potentially a firmer footing for currencies.”