Is Shanghai’s stock market ready to surprise in 2019?

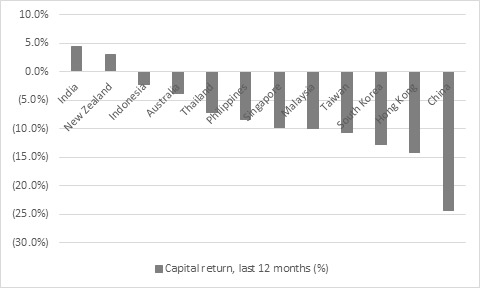

“’Shanghai Surprise’ was a pretty average comedy film that starred Madonna back in the mid-1980s but for investors there was nothing too funny about owning Chinese stocks or shares in companies exposed to China in 2018,” says Russ Mould, AJ Bell investment director. “The Chinese stock market was frankly a dog in the Year of the Dog, providing the worst performance of any major Asian nation, and investors will be hoping for more portfolio cheer from the Year of the Pig when it starts on Tuesday 5 February.

Source: Refinitiv data. Capital returns in local currency terms

“On the face of it, there seems to be little good news around, given worries over economic growth, burgeoning debt and the risk of a full-blown trade war with America. But the very fact that good news is hard to find may be the best news of all.

“The Shanghai Composite benchmark is no higher now than it was in January 2007 but China’s economy and the profits generated by its corporations have grown considerably since then.

“Depending upon whose estimates and which index you use, analysts’ forecasts put Chinese stocks on around 10.5 times forward earnings for 2019, down from 14 to 15 times a year ago.

“Such a steep de-rating points to a major loss of faith in Chinese stocks. It also suggests that it may not take too much to go right to persuade money to return, since expectations are now lower and thus easier to beat.

“Three issues weighed on the performance of Chinese stocks last year but there is a chance that these headwinds from 2018 may become a tailwind in 2019:

- Oil. China is a net buyer of crude so oil’s rise to $80 a barrel in early 2018 increased costs for corporations and squeezed profit margins. But oil has since settled back to $60 so that is a potential help this year.

- The dollar. There is a long-standing negative correlation between emerging market assets and the dollar. If the buck rises, emerging markets seem to struggle and vice-versa, not least because so much emerging market debt is dollar-denominated. A strong US currency makes it more expensive to service this borrowing, sucking cash out of emerging market economies and hampering growth. The dollar was strong in 2018 and China’s renminbi was weak. But the US Federal Reserve’s apparent U-turn on further interest rate increases in 2019 and hints it could slow or stop its programme to shrink its balance sheet and withdraw QE are hugely important. The dollar is softening and the renminbi is rallying as a result.

- Trade. This remains the most unpredictable element, given the ongoing negotiations between Washington and Beijing. If no deal is reached by the 2 March deadline and President Trump slaps 25% tariffs on all $500 billion-plus of China’s exports to the US that will hurt China (and quite possible America, too, not that the White House sees it that way). But Beijing is looking to support its economy, via tax cuts for consumers and lower pension contributions for corporations. These changes are more subtle than 2016’s debt-funded spending spree on fixed assets and property and may bring longer-term benefits, in the form of rising consumption and more productive investment, even if those benefits are less immediate.

“Debt and growth remain huge long-term issues and the trade talks remain a key near-term catalyst.

“But at least Chinese stocks are discounting a pretty negative outcome so any trade deal with the US could be the first step on the road to recovery for the downtrodden Shanghai stock market and firms who sell into China.

“Any investors who do think that Chinese stocks – or China’s economy – have several options available to them.

- Active or passive funds which specialise in China. On the active side, the best performers over the past five years include Fidelity China Focus and Janus Henderson China Opportunities. There are also 17 exchange-traded funds (ETFs) which are designed to track a number of different Chinese indices, including MSCI China, Hang Seng China Enterprises and FTSE 50 China 50, in dollar- or sterling terms.

- Active or passive funds which invest across emerging markets. For investors who feel direct exposure to just China entails too much risk they can glean more general emerging market exposure. On the active side, four of the top ten holdings within Fidelity Asia are Chinese companies, Invesco Asia has a 20% weighting toward China and JP Morgan Emerging Markets has 8% in Chinese onshore equities and a further 22% of its assets in Hong Kong. On the passive side, iShares Core MSCI Emerging Markets IMI ETF has a 29% weighting to China, twice that of any other Asian market.

- Stocks which have substantial Chinese exposure. Apple’s early-January profit warning may deter investors although the Californian giant’s earnings disappointment was not exclusively down to slower sales in China. Warnings from Taiwan Semiconductor Manufacturing Company and America’s NVIDIA also flagged a slowdown in China as an issue, so both could prosper again once inventory is worked down and should demand growth reaccelerate. Here in the UK stocks which would benefit from faster growth in China include miners such as BHP Group and Glencore, luxury goods leader Burberry and drinks giant Diageo while car maker Aston Martin Lagonda made great play of the potential of the Chinese market for its products during last autumn’s initial public offering roadshow.