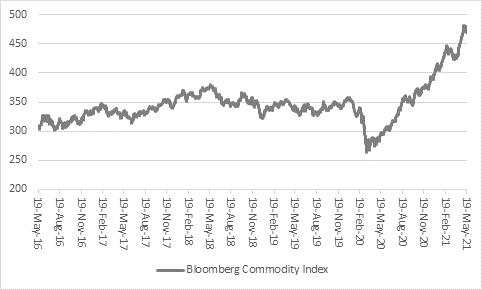

“Ultimately the best cure for high commodity prices is high prices, because in the end they both dampen demand and encourage increases in production. That is how capitalism works – high returns on capital attract more capital which in turn diminishes those returns – and central bankers will be looking toward that cycle as they continue to argue the current spike in inflation is transitory,” says Russ Mould, AJ Bell Investment Director. “Investors are also thinking about how high commodity prices can go. It remains to be seen whether galloping factory gate price inflation – where the latest readings from China and the USA are 6.8% and 6.2% respectively – translate into a sustained increase in consumer prices, and that one forces central banks to ease off on Quantitative Easing (QE) or even raise interest rates, developments that stock and bond markets both seem to fear.

Source: Refinitiv data

“No doubt much to the relief of central bankers, analysts are sceptical that the current burst higher in raw material prices will last. Their forecasts for miners’ earnings are one indicator of this, as estimates imply a drop in the big aggregate profits of the big seven FTSE 100 miners in 2022 and 2023.

“This can be seen in another way. Miners are expected to generate 29% of the FTSE 100’s pre-tax profit and 22% of its dividends in 2021, but the big seven represent just 12% of the index’s current market cap.

|

|

|

2021E |

2021E |

|

|

Percentage of |

Forecast percentage of |

Forecast percentage of |

|

|

FTSE 100 market cap |

FTSE 100 pre-tax profit |

FTSE 100 dividends |

|

Financials |

20% |

22% |

18% |

|

Consumer Staples |

17% |

16% |

18% |

|

Industrial goods & services |

13% |

8% |

8% |

|

Mining |

12% |

29% |

22% |

|

Consumer Discretionary |

11% |

4% |

5% |

|

Oil & Gas |

8% |

10% |

10% |

|

Health Care |

9% |

6% |

9% |

|

Utilities |

3% |

3% |

4% |

|

Telecoms |

3% |

3% |

4% |

|

Technology |

2% |

1% |

1% |

|

Real estate |

1% |

1% |

1% |

Source: Refinitiv data, Markestcreener, consensus analysts’ forecasts

“This has potential implications for investors who like to pick individual stocks or those who prefer to glean their access to the UK equity market via funds, whether they are actively managed or passively run.

“Further advances in commodity prices could mean the FTSE 100, and instruments that seek to track its performance, offer further upside potential as heavyweight miners’ profits and possibly dividends surprise on the upside. The same could be said of dedicated mining funds or UK equity collectives with overweight positions in mining stocks. The FTSE 100 could thus be a good hedge against, or play on, a robust, inflationary recovery.

“But the FTSE 100 does not offer just exposure to precious and industrial metals, when it comes to the commodities complex. It is home to two of the world’s oil majors, BP and Shell. The price of crude is more than double the level of a year ago and earnings are expected to rocket here as a result.

|

|

2021 E |

2021 E |

|

|

Percentage of forecast FTSE 100 profits growth |

Forecast profits growth (£ billion) |

|

Oil & Gas |

37% |

27.5 |

|

Mining |

30% |

22.8 |

|

Consumer Discretionary |

11% |

8.2 |

|

Financials |

9% |

6.9 |

|

Industrial goods & services |

8% |

5.7 |

|

Consumer Staples |

4% |

3.0 |

|

Real estate |

3% |

2.0 |

|

Utilities |

1% |

0.6 |

|

Telecoms |

0% |

0.3 |

|

Technology |

0% |

0.1 |

|

Health Care |

(2%) |

(1.9) |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“However, unlike the miners, the oils are not expected to provide much by way of dividend growth in the wake of last year’s cuts from both BP and Shell. Scepticism about the future of oil prices is also reflected in how the oil’s percentage contribution to the FTSE 100’s market cap (8%) reflects their forecast contribution to profits and dividends this year (10%).

|

|

2021 E |

2021 E |

|

|

Percentage of forecast FTSE 100 dividend growth |

Forecast dividend growth (£ billion) |

|

Mining |

47% |

6.0 |

|

Financials |

36% |

4.6 |

|

Consumer Discretionary |

9% |

1.2 |

|

Industrial goods & services |

8% |

1.0 |

|

Telecoms |

5% |

0.6 |

|

Consumer Staples |

2% |

0.3 |

|

Real estate |

1% |

0.1 |

|

Technology |

1% |

0.1 |

|

Utilities |

1% |

0.1 |

|

Health Care |

(2%) |

(0.2) |

|

Oil & Gas |

(8%) |

(1.0) |

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“Yet in some ways, the investment case for oils is similar to that of the miners: demand has collapsed but could rebound if the economy picks up strongly in the wake of the pandemic while supply growth is limited. BP and Shell’s forecast combined capex-to-sale ratio of 6.6% in 2021 is lot nearer to its recent lows than its highs.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“Better still, unlike the miners, whose shares have done well, the oils are loathed. BP and Shell’s market cap contribution to the FTSE 100 stands near its lows for this century.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“This may reflect ethical and environmental concerns as much as it does financial and operational ones, as well as the prospect that the world is trying to move away from hydrocarbons as fast as it can. But the globe relies on oil not just for fuel but for vital lubricants, plastics and chemicals, which could be around for a good while yet, whether we like it or not. And it will take time before renewables provide more power than oil and gas.

“Perhaps Big Oil could be more capable of providing an upside surprise in the event of an inflationary recovery than the miners, to the benefit of UK equities – although investors cannot discount the possibility that BP and Shell’s hefty investments to pivot away from oil and gas help them politically and benefit wider society without bringing either the companies or their shareholders much by way of financial benefit, owing to the (rising) costs involved.”