“Bears will growl about an increase in office space vacancy rates in London to 4.6% from 4.3% during the half, according to CBRE analysis and construction projects that add 13.5 million square feet in new capacity and are only 49% pre-let.

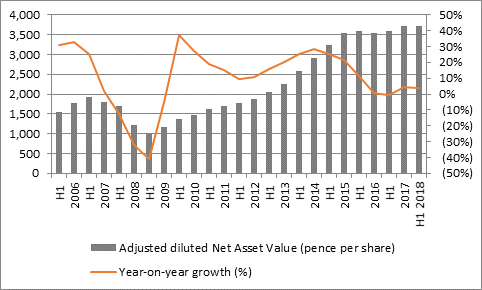

“They will also note with interest how the bulk of Derwent’s rent reviews and lease expiries fall in the second half of 2018, at a time when Brexit, economic and interest rate uncertainty persist, and how net asset value (NAV) per share was pretty much flat, coming in at £37.13 per share at the end of June compared to £37.16 in December (after payment of the interim dividend).

Source: Company accounts. Financial year to December.

“Bulls of Derwent London, and the real estate sector more generally, will point out how NAV still grew 4% year-on-year.

“In addition, new unlet property under construction work represents an increase in capacity in London offices of barely 3% and of West End space of barely 2%, so supply and demand remain tightly in balance, especially as Asian buyers returned in force to the London market in the first half, perhaps attracted by fresh falls in the pound.

“Derwent’s total property return for the half was still positive, at 3.3%, as rent reviews, rent renewals and lease regears all increased rental income. On-site projects in W2 and W1 are already 40% and 73% pre-let, while development work on projects in Soho, W1 and EC1 is underway, with consent received for two more mixed use schemes in W1, including one on Baker Street.

“The company is also looking forward to the new Elizabeth line on the London Underground starting operations, not least because 74% of its assets are located close to a station.

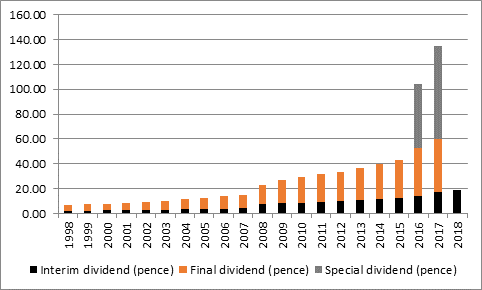

“This promising pipeline, added to strong demand for London property and a low loan-to-value ratio of just 15% persuaded management to increase the interim dividend by 10% to 19.1p.

“That is the third straight double-digit percentage increase in the interim dividend and means Derwent London is on course to add to its phenomenal record of increasing its annual distribution to shareholders every year for at least the last two decades (with special dividends added to the mix in 2016 and 2017 for good measure).

Source: Company accounts. Financial year to December.

“At £31.16, Derwent London’s shares are forecast by analysts to offer a yield of some 2% and they come at a discount to historic net asset value of some 13%.

“Neither figure stands out in the REITs sector, which may well be a tribute to the attractiveness of its London assets, low debts and careful expansion plans, as investors see it as a relatively safe stock in what is clearly perceived to be a risky sector, given its poor performance since June 2016.

“Yet the company’s long run record of organic portfolio development, with the 2006 all-share acquisition of London Merchant its last major piece of merger and acquisition activity, suggests that patient investors who do not fear Brexit might start to take another look at the company as the Elizabeth Line gets ready to roll.”

| 2018E Dividend Yield |

|

| Premium / (discount) to NAV |

Newriver | 7.9% |

| Safestore | 49.2% |

INTU | 8.0% |

| Big Yellow | 38.2% |

Hammerson | 5.2% |

| SEGRO | 20.8% |

Land Securities | 5.0% |

| Londonmetric Property | 11.7% |

British Land | 4.8% |

| TRITAX Big Box | 9.6% |

Hansteen | 4.4% |

| A & J Mucklow | 8.9% |

Londonmetric Property | 4.4% |

| Workspace | 3.7% |

TRITAX Big Box | 4.3% |

| Shaftesbury | (5.6%) |

A & J Mucklow | 4.2% |

| Newriver | (6.4%) |

Town Centre Securities | 4.2% |

| St. Modwen | (14.0%) |

Big Yellow | 3.4% |

| Derwent London | (13.0%) |

Workspace | 3.0% |

| Capital & Counties | (14.5%) |

Safestore | 2.9% |

| Great Portland Estates | (16.5%) |

CLS | 2.8% |

| Hansteen | (18.7%) |

SEGRO | 2.7% |

| CLS | (21.9%) |

Derwent London | 2.1% |

| Town Centre Securities | (22.9%) |

Shaftesbury | 1.8% |

| British Land | (31.5%) |

Great Portland Estates | 1.7% |

| Land Securities | (31.7%) |

St. Modwen | 1.7% |

| Hammerson | (33.0%) |

Capital & Counties | 0.6% |

| INTU | (56.1%) |

Source: Thomson Reuters Datastream, Digital Look, consensus analysts’ forecasts, Company accounts