Source: Company accounts

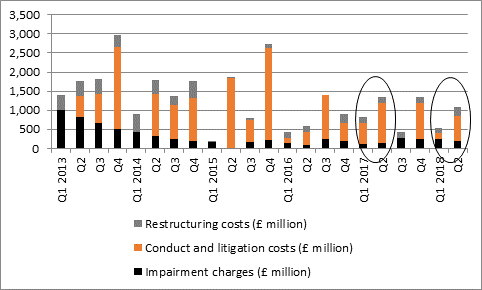

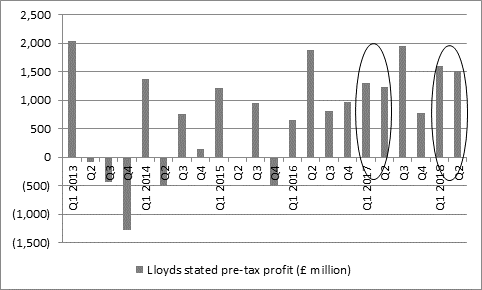

“Although Lloyds had to take a further £460 million in payment protection insurance (PPI) compensation provisions in the second quarter, taking the total cost of litigation and conduct issues to £23.6 billion since 2011, the bank’s pre-tax income rose to £3.1 billion from £2.5 billion in the first half.

“The enabled management to sanction a 7% increase in the interim dividend and run its £1 billion share buy-back programme, although recent share price performance suggests investors remain a little underwhelmed by the latter.

“This will boost hopes that Lloyds is on the way to becoming a safe, utility bank which pays them a reliable dividend, even as the company digests two acquisitions, namely the MBNA credit cards business and Zurich’s workplace pensions and savings operations as management looks to generate growth from selected target areas.

“The purchases slightly distort the comparisons but it is still early days when it comes to Lloyds’ growth plans as loans, customer deposits and risk-weighted assets are yet to show any real step-change in momentum.

“This may well partly reflect the modest rate of economic growth shown by the UK, as well as the mature, competitive and tightly-regulated nature of the British banking market, all features which suggest investors are more likely to be interest in Lloyds’ shares for their yield rather than their potential to offer capital growth.

“Investors will be hoping the bank can keep its nose clean, avoid further regulatory scrutiny, treat its customers well and manage its loan book in a sensible fashion. That should help to further reduce the costs which have weighed on the profit and loss account and boost the cash flow that funds dividend payments.

“Today’s hike in the interim dividend to 1.07p from 1.00p will therefore be particularly welcome and helps to explain why the shares are trading up at the London opening.

“Lloyds’ prospective 5.5% yield is the best figure for any of the Big Five FTSE 100 banks although the highest-yielding banks are the most expensive ones on a price-to-book-value basis, to suggest that a lot of the good news on their dividends may be at least partially priced in.”

|

| 2018E |

|

|

| P/E | Price/book | Dividend yield | Dividend cover |

Lloyds | 8.7 x | 1.20 x | 5.5% | 2.1 x |

HBSC | 13.2 x | 1.41 x | 5.3% | 1.4 x |

Barclays | 9.8 x | 0.77 x | 3.4% | 3.0 x |

Royal Bank of Scotland | 9.9 x | 0.93 x | 3.1% | 3.2 x |

Standard Chartered | 12.8 x | 0.75 x | 2.5% | 3.1 x |

Source: Digital Look, consensus analysts’ forecasts