“Endeavour Mining’s all-stock bid for Centamin is the third proposed deal in the gold mining industry in the space of a week. Investors may therefore need to ask themselves why gold mining executives seem to think there is value to be had in the gold business, even if equity markets still seem fairly indifferent,” says Russ Mould, AJ Bell Investment Director.

“Besides Endeavour’s offer for Centamin (which the FTSE 250 firm’s management team has already swiftly rejected), another Canadian-quoted gold producer, Kirkland Lake, has bid $3.7 billion in stock for countryman Detour Gold, while China’s Zinjing Mining has offered $1.3 billion in cash for Toronto-quoted Continental Gold, whose prime asset is in Colombia.

“These transactions follow Newmont’s $10 billion all-share purchase of Goldcorp, Barrick Gold swoops for both Randgold Resources and the shares it did not already own in Acacia Mining (formerly African Barrick Gold) and Canada’s Hunt Mining bid for AIM-quoted Patagonia Gold.

“Granted, investors’ faith in these deals would be higher if management were paying cash rather than stock, but the flurry of activity still suggest that those in the know feel that assets are going cheap.

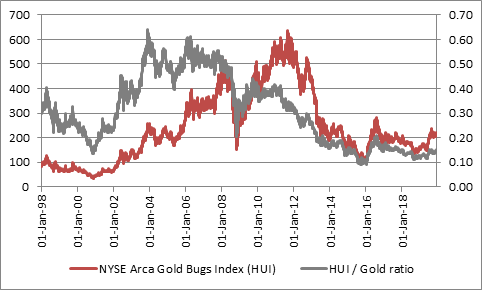

“The 19-stock HUI Index (known as the ‘gold bugs’ index) may be up by 39% this year – against a 15%, dollar-terms in gold – but it still trades very cheaply relative to the precious metal.

Source: Refinitiv data

“Taking just this alone into account may persuade investors in Centamin to follow management’s advice and take no action regarding the offer from Endeavour, let alone the list of objections offered by the board to the deal, even if Centamin’s recent operational and financial record at its Sukari mine in Egypt is frankly patchy.

“Shareholders will also note how Centamin’s share price trades above the value implied by Endeavour’s offer of 0.0846 of its shares for every one Centamin share.

|

How to calculate the value of the Endeavour offer |

|||

|

|

|||

|

Centamin |

Endeavour |

||

|

|

|

Share price |

C$24.89 |

|

|

|

Share offer |

0.0846 |

|

|

|

Share offer in C$ |

C$2.11 |

|

|

|

GBP/CAD |

$1.7335 |

|

|

|

|

|

|

Share price |

128.1p |

Offer value |

121.4p |

|

Number of shares |

1.156 billion |

Number of shares |

1.156 billion |

|

Market cap |

£1.48 billion |

Offer value |

£1.40 billion |

Source: Company accounts, Refinitiv data

“This suggests shareholders expect – or are at least holding out for – a higher bid, which is understandable given that Barrick Gold eventually raised its offer for Acacia Mining and the merger and acquisition wave which seems to be sweeping the gold mining industry.

“Given the bids for Acacia, Patagonia Gold and now Centamin, it will also be interesting to see whether any of the London market’s other leading gold producers draw a predator, especially if gold makes a sustained break above the $1,500-an-ounce mark.

London’s largest gold miners by production

|

|

2018 |

2018 |

|

|

|

Production (ounces) |

AISC ($/oz)* |

Operations |

|

Centamin |

472,418 |

884 |

Egypt, Burkina Faso, Cote d'Ivoire |

|

Petropavlovsk |

422,300 |

1,117 |

Russia |

|

Highland Gold |

269,500 |

682 |

Russia |

|

Avesoro Resources |

220,458 |

1,043 |

Liberia, Burkina Faso, |

|

Resolute Mining * |

129,199 |

1,050 |

Mali, Senegal, Australia, Ghana |

|

Shanta Gold |

81,872 |

730 |

Tanzania |

|

Anglo Asian Mining |

72,798 |

541 |

Azerbaijan |

|

Trans-Siberian Gold |

42,128 |

1,049 |

Russia |

|

Serabi Gold |

37,108 |

1,093 |

Brazil |

|

Ariana Resources |

27,110 |

n/a |

Turkey |

|

Griffin Mining ** |

16,206 |

n/a |

China |

Source: Company accounts. Covers six months July-Dec 2018. Targets for 2019 are 400,000 ounces at an AISC of $1,020. **Sales in concentrate.

World’s largest gold miners by production

|

|

2018 |

|

|

|

Production (ounces) |

AISC ($) |

|

Newmont Goldcorp |

5,100,000 |

909 |

|

Barrick Gold |

4,530,000 |

806 |

|

AngloGold Ashanti |

3,400,000 |

976 |

|

Kinross Gold |

2,450,000 |

965 |

|

Freeport McMoran |

2,440,000 |

n/a |

|

Newcrest Mining |

2,410,000 |

779 |

|

Polyus |

2,400,000 |

607 |

|

Gold Fields |

2,040,000 |

981 |

|

Agnico Eagle |

1,630,000 |

877 |

|

Harmony Gold |

1,438,231 |

1,207 |

|

B2Gold |

953,504 |

758 |

|

Yamana Gold |

920,000 |

835 |

|

Iamgold |

882,000 |

1,057 |

|

Endeavour Mining |

727,000 |

843 |

|

Kirkland Lake Gold |

723,701 |

685 |

Source: Company accounts