“With a 65% increase in the annual dividend translating into a barely 2% increase in the share price at the opening, Redrow chairman Steve Morgan must be wondering what he has to do to get his firm’s share price going again, as it tries to rally from levels last seen a year ago,” says Russ Mould, AJ Bell investment director.

“After all Redrow, like the house builders’ sector as a whole, comes with a net cash balance sheet, a decent yield and a low earnings multiple. All three suggest the stock – and the sector – looks cheap.

|

|

2018E |

2018E |

2018 E |

Historic |

|

|

PE (x) |

Dividend yield (%) |

Dividend cover (x) |

Price/NAV(x) |

|

Persimmon |

8.8 x |

9.7% |

1.18 x |

2.45 x |

|

Taylor Wimpey |

8.0 x |

9.2% |

1.37 x |

1.75 x |

|

Bovis |

11.9 x |

9.0% |

0.93 x |

1.44 x |

|

Crest Nicholson |

5.9 x |

8.7% |

1.95 x |

1.17 x |

|

Barratt Developments |

8.3 x |

8.0% |

1.51 x |

1.28 x |

|

Berkeley Homes |

9.6 x |

5.5% |

1.88 x |

1.86 x |

|

Redrow |

6.4 x |

5.3% |

2.92 x |

1.41 x |

|

Bellway |

7.0 x |

4.7% |

3.04 x |

1.64 x |

|

Countryside |

9.2 x |

3.3% |

3.29 x |

2.19 x |

|

AVERAGE |

8.3 x |

7.1% |

2.01 x |

1.69 x |

Source: Digital Look, consensus analysts' forecasts.

“But when an earnings multiple is low and the dividend yield is high, this is often a two-fold message from investors. First, they do not believe the earnings numbers and therefore are of the view that the shares are not as cheap as they look. Second, to compensate themselves for this perceived risk of earnings disappointment, they are demanding a high dividend yield.

“This scepticism is understandable at a time when UK mortgage approvals have fallen year-on-year for ten consecutive months, the unknown of Brexit is looming, consumer confidence remains soggy – and the builders are starting to press for another extension to the Government’s Help to Buy scheme, which is due to expire in 2021.

Source: Bank of England

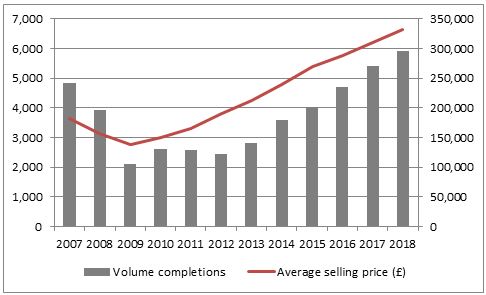

“Since demand does not appear to be the problem for the housing market, perhaps affordability is the issue. Redrow itself recorded another 7% increase in average selling prices to £332,200, a figure that exceeds the 2007 cyclical peak by some 80%, while volume completions were just 23% higher.

Source: Company accounts

“That helps to explain the gathering calls for a Help to Buy extension, although it remains debatable whether further boosting demand while supply remains relatively constrained is going to help or make matters worse. Still, it would not be the biggest shock in the world were the Government to further the life of the scheme, especially as it is currently due to expire in the year before the General Election that is scheduled for 2022.”