Russ Mould, investment director at AJ Bell, explains:

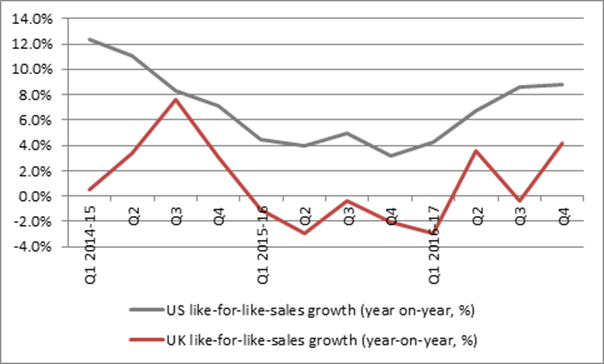

“First, trading conditions in the UK remain patchy, which begs the question of whether the British business may be put on the block for sale like its Nordic equivalent (a move which could be well received)?

Source: Company accounts

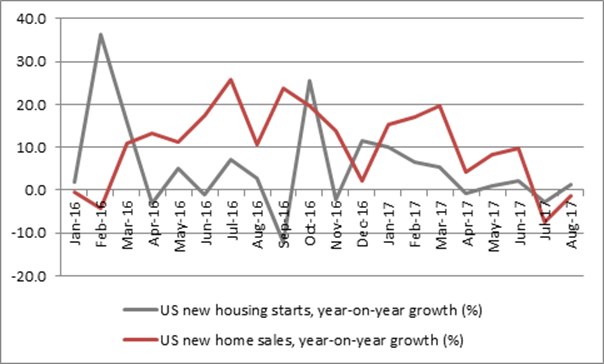

“Second, while it is encouraging to see the US show improved momentum in the second half of the year, it is of some concern to see a marked slowdown in US new housing starts and US new homes sales, even if Ferguson’s business across the Pond has a broad spread between residential, commercial and industrial buildings.

Source: FRED, St. Louis Federal Reserve database

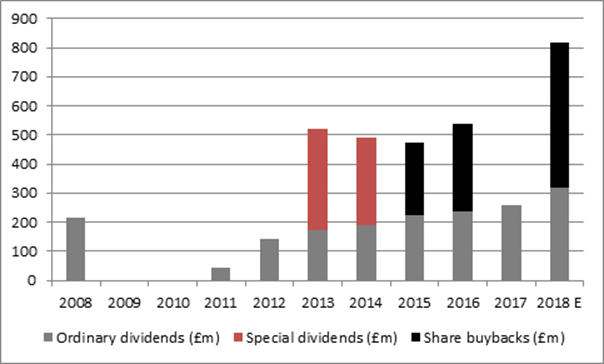

“Finally, it is intriguing that the company is buying back more shares now when they are trading at what is basically an all-time high. A forward price/earnings multiple of 15 to 16 times also represents a premium to the wider UK market and the prospective 2.5% yield represents a discount. The buyback may signal confidence in the future, net debt is low and the company currently seems to be able to comfortably fund itself but buybacks only create value for shareholders if the stock is acquired at a level that represents a clear discount to a conservative valuation of the company’s intrinsic business value – and it is not clear that Ferguson’s buyback policy fulfils this final, vital criterion.

“Bulls of the stock will shrug aside such concerns, pointing to fresh optimism that President Trump’s tax reform programme will galvanise both US economic growth and the dollar, to the benefit of Ferguson, which draws nearly 90% of its profits from America.

“Holders of the stock will also point out how a combination of dividends, special dividends and share buybacks means the company will have returned nearly £2.6 billion in cash to investors over a five-year span by the end of its new financial year.”

“That is a fifth of its current £12.8 billion market cap and the prospects of future cash returns could keep income and growth seekers alike, assuming it can be maintained.

“Those with long memories will however remember that Ferguson cut its dividend to zero in the wake of the Great Financial Crisis and the last US housing downturn.”

Source: Company accounts