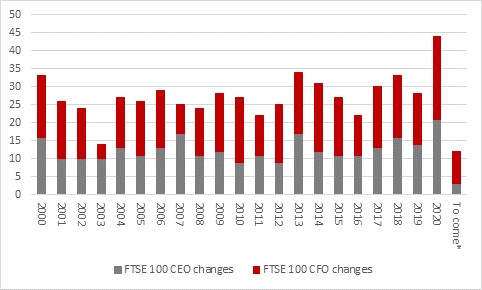

“You would have thought that investors would have wanted managerial stability in 2020 of all years, given the challenges which have been thrown at companies from all angles, but David Lamont’s arrival as the new chief financial officer at miner BHP Group today marked the forty-fourth change in either chief executive or head of finance at FTSE 100 firms this year,” says Russ Mould, AJ Bell Investment Director. “That is easily the highest number in two decades and there are three more changes in CEO and nine more in the CFO role that are pending.

Source: Company accounts. *Signifies changes already announced that become effective in 2021 or where a successor has yet to be appointed.

“A number of the changes had already been announced or come into effect before the pandemic swept around the world and ushered in a recession which blew many best-laid corporate plans off track. In some cases, managers did stay on for longer than originally planned, to help their charges through the crisis, including Willie Walsh at International Consolidated Airlines and Dave Lewis at Tesco, but the number of changes has piled up as the year has gone on.

“There is no single reason that explains all of these executive departures:

• It could simply be retirement, as in the case of the CFOs at DCC and WPP, Fergal O’Dwyer and Paul Richardson, who entered 2020 as the FTSE 100’s two longest serving finance bosses, having started in their posts in 1994 and 1996 respectively.

• It could be that the CEO has been forced out or decided to quit, amid shareholder and boardroom dissatisfaction with their performance and how their strategy has worked out in terms of financial, operational and share prices. Alison Cooper of Imperial Brands, Maurice Tulloch at Aviva, Iain Conn at Centrica (when it was still part of the FTSE 100) and John Fallon at Pearson could all fall into this category.

• It could be that there has been a change of CEO and the CFO either bagged the job (as in the case of Simon Carter at British Land) or, having failed to get the top post, decided to leave to chance their arm for the top position somewhere else (or were even elbowed out of the way by the successful candidate so they couldn’t make trouble).

• It could be that there is a change in CEO and the CFO feels that is the right time to go. This could well be the case with Bob Dudley at BP and Keith Skeoch at Standard Life Aberdeen in the CEO role and Alan Stewart, who started in the CFO role at Tesco in September 2014, just three weeks after Dave Lewis took over at CEO. He will step down in 2021, having helped to reduce both debt and the pension deficit and rebuilt momentum in the UK grocery operations both organically and through the acquisition of wholesaler Booker.

• In more extreme circumstances, it could have been that the CEO or CFO felt there was trouble ahead and it was time to get out while the going remains good. Willie Walsh announced his plans to step aside when the notoriously volatile airline industry was flying high. That said no executive, no matter how astute, has second sight and none could have foreseen the pandemic or its effects at the start of the year.

|

Changes in FTSE 100 CEOs in 2020 |

||||

|

|

Company |

In |

Out |

|

|

1 |

BHP Group |

Mike Henry |

Andrew Mackenzie |

01-Jan-20 |

|

2 |

Just Eat Takeaway.com |

Jitse Groen |

Peter Duffy (interim) |

31-Jan-20 |

|

3 |

Imperial Brands |

Brisby / Biebernick (interim) |

Alison Cooper |

03-Feb-20 |

|

4 |

BP |

Bernard Looney |

Bob Dudley |

04-Feb-20 |

|

5 |

Phoenix Group |

Andy Briggs |

Clive Bannister |

11-Feb-20 |

|

6 |

NMC Health |

Michael Davis (interim) |

Prasanth Manghat |

27-Feb-20 |

|

7 |

Auto Trader |

Nathan Coe |

Trevor Mather |

01-Mar-20 |

|

8 |

Centrica |

Chris O'Shea |

Iain Conn |

17-Mar-20 |

|

9 |

Mondi |

Andrew King |

Peter Oswald |

01-Apr-20 |

|

10 |

Land Securities |

Mark Allan |

Robert Noel |

14-Apr-20 |

|

11 |

Sainsbury |

Simon Roberts |

Mike Coupe |

01-Jun-20 |

|

12 |

Imperial Brands |

Stefan Bomhard |

Brisby / Biebernick (interim) |

01-Jul-20 |

|

13 |

Aviva |

Amanda Blanc |

Maurice Tulloch |

06-Jul-20 |

|

14 |

GVC |

Shay Segev |

Kenneth Alexander |

16-Jul-20 |

|

15 |

Pennon |

Susan Davy |

Christopher Loughlin |

31-Jul-20 |

|

16 |

Standard Life Aberdeen |

Stephen Bird |

Keith Skeoch |

01-Sep-20 |

|

17 |

International Cons. Airlines |

Luis Gallego |

Willie Walsh |

08-Sep-20 |

|

18 |

Persimmon |

Dean Finch |

David Jenkinson |

28-Sep-20 |

|

19 |

Tesco |

Ken Murphy |

Dave Lewis |

01-Oct-20 |

|

20 |

Pearson |

Andy Bird |

John Fallon |

19-Oct-20 |

|

21 |

British Land |

Simon Carter |

Chris Grigg |

18-Nov-20 |

|

|

|

|

|

|

|

|

Announced but yet to become effective |

|||

|

1 |

Rio Tinto |

TBC |

Jean-Sebastian Jacques |

31-Mar-21 |

|

2 |

Admiral |

Milena Mondini de Focatiis |

David Stevens |

Mar-21 |

|

3 |

Lloyds |

Charlie Nunn |

Antonio Horta-Osorio |

01-Apr-21 |

Source: Company accounts

|

Changes in FTSE 100 CFOs in 2020 |

||||

|

|

Company |

In |

Out |

|

|

1 |

Bunzl |

Richard Howes |

Brian May |

01-Jan-20 |

|

2 |

Morrisons |

Michael Gleeson |

Trevor Strain |

04-Feb-19 |

|

3 |

Auto Trader |

Jamie Warner |

Nathan Coe |

01-Mar-20 |

|

4 |

NMC Health |

Prasanth Shenoy (sick leave) |

n/a |

27-Feb-20 |

|

5 |

Antofagasta |

Mauricio Ortiz |

Alfredo Atucha |

01-Apr-20 |

|

6 |

Reckitt Benckiser |

Jeff Carr |

Adrian Hennah |

09-Apr-20 |

|

7 |

Pearson |

Sally Johnson |

Coram Williams |

24-Apr-20 |

|

8 |

WPP |

John Rogers |

Paul Richardson |

01-May-20 |

|

9 |

BP |

Murray Auchinloss |

Brian Gilvary |

01-Jul-20 |

|

10 |

DCC |

Kevin Lucey |

Fergal O'Dwyer |

17-Jul-20 |

|

11 |

United Utilities |

Phil Aspin |

Russ Houlden |

24-Jul-20 |

|

12 |

Spirax-Sarco Engineering |

Nimesh Patel |

Kevin Boyd |

28-Jul-20 |

|

13 |

Pennon |

Paul Boote |

Susan Davy |

31-Jul-20 |

|

14 |

Smith & Nephew |

Anne-Francoise Nesmes |

Graham Baker |

03-Aug-20 |

|

15 |

Rentokil |

Stuart Ingall-Tombs |

Jeremy Townsend |

14-Aug-20 |

|

16 |

Rightmove |

Alison Dolan |

Robyn Perriss |

07-Sep-20 |

|

17 |

B & M European Value |

Alex Russo |

Paul McDonald |

05-Oct-20 |

|

18 |

Ferguson |

Bill Brundage |

Mike Powell |

01-Nov-20 |

|

19 |

British Land |

TBC |

Simon Carter |

18-Nov-20 |

|

20 |

Johnson Matthey |

Karen-Hayzen Smith (interim) |

Anna Manz |

20-Nov-20 |

|

21 |

London Stock Exchange |

Anna Manz |

David Warren |

21-Nov-20 |

|

22 |

Ocado |

Stephen Daintith |

Duncan Tatton-Brown |

22-Nov-20 |

|

23 |

BHP Group |

David Lamont |

Peter Beaven |

01-Dec-20 |

|

|

|

|||

|

|

Announced but yet to become effective |

|||

|

1 |

Coca-Cola HBC |

Ben Almanzar |

Michalis Imellos |

1-Apr-21 |

|

2 |

Intertek |

Jonathan Timmis |

Ross McCluskey |

01-Apr-21 |

|

3 |

Tesco |

Imran Nawaz |

Alan Stewart |

01-Apr-21 |

|

4 |

easyJet |

Kenton Jarvis |

Andrew Findlay |

By May-2021 |

|

5 |

Land Securities |

Vanessa Simms |

Martin Greenslade |

01-Jun-21 |

|

6 |

CRH |

TBC |

Senan Murphy |

2021 |

|

7 |

Mondi |

Mike Powell |

Andrew King |

TBC |

|

8 |

Imperial Brands |

TBC |

Oliver Tant |

TBC |

|

9 |

Rolls-Royce |

TBC |

Stephen Daintith |

TBC |

Source: Company accounts

“Whatever the reasons, the rash of changes means that the average FTSE 100 CEO’s tenure is now 5.2 years while the average CFO stays in the job for 4.7 years.

|

Days |

Months |

Years |

|

|

|

|

|

|

|

FTSE 100 CEO |

1,897 |

62 |

5.2 |

|

FTSE 100 CFO |

1,699 |

142 |

4.7 |

|

|

|

|

|

|

|

Football managers in English Leagues |

||

|

Premier League |

925 |

30.4 |

2.5 |

|

Championship |

574 |

18.9 |

1.6 |

|

League One |

600 |

19.7 |

1.6 |

|

League Two |

568 |

18.7 |

1.6 |

|

AVERAGE |

661 |

21.7 |

1.8 |

Source: Company accounts, club websites, BBC

“Intriguingly, that is in keeping with football legend Jack Charlton’s dictum that no club manager should hang around for more than five years, on that grounds that the boss and players would both go stale beyond that, leading to a deterioration of results on the pitch.

“Intriguingly, only five of the current 92 managers across the Premier League and Football League have managed to last that long, and 34 clubs have seen a change at the top in 2020 with a month still to go. It can at least be argued that shareholders and boardrooms are more patient than fans and football club chairman when it comes to pulling the trigger.

|

Ten longest-serving FTSE 100 CEOs and CFOs |

||||||

|

Company |

CEO |

Years |

|

Company |

CFO |

Years |

|

Next |

Simon Wolfson |

19.6 |

|

Persimmon |

Mike Killoran |

21.7 |

|

Ocado |

Tim Steiner |

18.9 |

|

AB Foods |

John Bason |

21.6 |

|

Homeserve |

Richard Harpin |

16.7 |

|

SSE |

Gregor Alexander |

18.2 |

|

B&M European |

Simon Arora |

15.9 |

|

Glencore |

Steve Kalmin |

15.4 |

|

Halma |

Andrew Williams |

15.8 |

|

Melrose Industries |

Geoffrey Martin |

15.4 |

|

AB Foods |

George Weston |

15.7 |

|

Land Securities |

Martin Greenslade |

15.3 |

|

Taylor Wimpey |

Peter Redfern |

14.4 |

|

Fresnillo |

Mario Arreguin |

12.6 |

|

Berkeley |

Rob Perrins |

11.2 |

|

Mondi |

Andrew King |

12.1 |

|

RELX |

Erik Engstrom |

11.1 |

|

3i |

Julia Wilson |

12.0 |

|

DS Smith |

Miles Roberts |

10.6 |

|

AVEVA |

James Kidd |

9.9 |

Source: Company accounts

|

Ten longest serving football managers in English Leagues |

||

|

Club |

Manager |

Tenure (years) |

|

Harrogate Town |

Simon Weaver |

11.5 |

|

Burnley |

Sean Dyche |

8.1 |

|

Wycombe Wanderers |

Gareth Ainsworth |

8.1 |

|

Accrington Stanley |

John Coleman |

6.2 |

|

Liverpool |

Juergen Klopp |

5.2 |

|

Forest Green Rovers |

Mark Cooper |

4.6 |

|

Sheffield United |

Chris Wilder |

4.6 |

|

Manchester City |

Pep Guardiola |

4.4 |

|

Crewe Alexandra |

David Artell |

3.9 |

|

Blackburn |

Tony Mowbray |

3.8 |

Source: Club websites, BBC

“Contrary to Charlton’s view, it can be argued that five years really is not long enough for a FTSE CEO, at least from a shareholders’ perspective. The best investments provide the magic combination of consistent dividend growth and capital returns, with dividend reinvestment then allowing the shareholder to benefit from the power of compounding.

“Yet even the maths of compounding only really begin to make a notable difference after seven to eight years and the danger of a five-year term is that managers focus on their incentive schemes and bonus plans which may help them conjure near-term performance from their firm and its assets but in a manner which does not benefit shareholders or stakeholders (be they employees or customers) to anything like the same degree.

“In a week when Arcadia is becoming the second firm under the control of Sir Philip Green to go into administration, after BHS in 2016, and the third high-profile failure of his career if you include Amber Day in the early 1990s, management pay and the relationship between shareholders and stakeholders and bosses will again be under scrutiny, especially in the context of the riches which the Green family has accrued for itself.

“Shareholders will again have to look at how executive pay is structured and succession planning is managed, to ensure that the long-term interests of staff and customers and investors are not sacrificed to satisfy the shorter-term temptations offered by management bonus, option and incentive programmes.

“Ultimately, one way to promote more long-term strategic planning would be to defer a portion of managers’ bonus, options or incentive package for a fixed period after their departure. They then share the same risk as the shareholder and employees should something go wrong, or a strategic move prove ineffective or the choice of successor be inappropriate.

“As Warren Buffett’s business partner Charlie Munger once noted: ‘Show me the incentive and I will show you the outcome’ and money talks very loudly in most cases.”

|

English League clubs to change manager in 2020 |

|

|

Month |

Clubs |

|

January |

Macclesfield*, Cambridge United, Scunthorpe United |

|

February |

Bradford City, Blackpool, Stevenage |

|

March |

|

|

April |

Luton Town |

|

May |

Burton Albion |

|

June |

Bolton Wanderers, Middlesbrough, Southend United |

|

July |

Barrow, Bristol City, Tranmere Rovers, Birmingham City, Colchester United, Huddersfield Town, Watford |

|

August |

Wigan Athletic, Bournemouth, Reading, Oldham Athletic |

|

September |

|

|

October |

Barnsley, Nottingham Forest, Salford City, Mansfield, Tranmere Rovers |

|

November |

Swindon Town, Sheffield Wednesday, Wigan Athletic, Derby County, Bristol Rovers, Shrewsbury Town, Sunderland |

Source: Club websites, BBC. *Macclesfield relegated into the National League in August following a court appeal over a points deduction.