• AJ Bell FTSE 100 forecast for the end of 2021: 7,500

• Four stock picks for 2021

o Cautious: SSE

o Balanced: Grafton

o Adventurous: Tekmar Group

o Income: Imperial Brands

• Tale of the tape from last year*

o FTSE 100 forecast: 8,000 (reached 7,675 but -13% overall)

o Cautious: Severn Trent (-7.6% with a total return of -3.6%)

o Balanced: TI Fluid Systems (-0.3% with a total return of -0.3%)

o Adventurous: IP Group (+29.9% with a total return of +29.9%)

o Income: Imperial Brands (-15.9% with a total return of -6.6%)

*From publication on 16 December 2019 to 8 December 2020. Over the same period the FTSE All-Share was -11.7% and provided a total return of -9.1%

Russ Mould, investment director at AJ Bell, comments:

The FTSE 100 is back where it was in summer 2016, and still languishes below the peaks of 2007 and 1999, while the pound trades near five-year lows against the dollar and close to a ten-year trough against the euro. It is therefore deceptively easy for value-seeking contrarians to make a case for a UK stock market which has underperformed and feels unloved. This is particularly the case when merger and acquisition activity suggests that someone already thinks there is value to be had on these shores and the FTSE 100’s earnings mix means it is a good recovery play, in the event the COVID vaccines do the business and global economic activity starts to pick up in 2021.

“That said, there are more than enough variables to make second-guessing the markets even harder than usual. Enthusiasm for UK equities is still tempered to some degree by Brexit, simply owing to the uncertainty of how this will look come 1 January, although anything is probably better than the fog with which investors have to contend at the moment.

“A persistent COVID-19 virus and a double-dip recession are both major threats to any recovery scenario and some investors will fight shy of the FTSE 100 because of the weighty influence of both oil and banking stocks, either for ethical reasons (in the case of the oils) or excessive global debts (in the case of banks) or simply in the view that both industries are simply a busted flush, as technological developments condemn them to the dustbin of history.

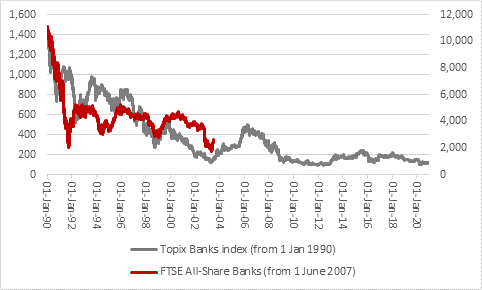

“Banks are indeed hemmed in on several fronts, notably record levels of global borrowing, the margin-crushing powers of central banks’ Quantitative Easing (QE) and Zero Interest Rate Policies (ZIRP) and the rise and rise of fintech rivals which could ultimately disintermediate the lenders as dissatisfied customers go elsewhere for their financial services (usually starting with their mobile phones).

“They are cheap, trading at sizeable discounts to book, or net asset, value, and probably deserve to be. But even Japanese banks managed some huge rallies even during the thirty-year pasting they have received at the hands of Japan’s equity and property market collapse and then the Bank of Japan’s QE and ZIRP policies and if the markets sniff an economic recovery, any steepening of the yield curve in the UK or inflation, then the FTSE 100’s big five banks could have a (potentially rare) good year.

Source: Refinitiv data

“Oils may be beyond the pale for many investors, but the chances of the Earth weaning itself off the black stuff in the next five to ten year are pretty limited, so oil and gas fields may not quite prove to be the stranded assets that many think – at least, not yet anyway.

“Under normal circumstances, oils would be primed for a run. Sentiment is dead set against them, they have performed badly, capex and exploration work are being cut and production is being reined in, even as demand could be set for a near-term rebound in 2021, should the vaccines do the business and global economic activity start to pick up.

“Again, those investors who run strict ethical, social and governance (ESG) screens will not care less, but those who still argue that capital should be allocated where the risk-reward balance may be more tempting from a purely financial view may take a closer look.

“Besides oils and financials, in the form of insurers and banks, the other big swing factor in 2021 earnings and dividend forecasts are the miners. This also shows how geared the FTSE 100 is into a global economic recovery and how its fortunes are likely to be determined by global events rather than domestic ones. With ultra-loose monetary policy and further fiscal stimulus both on the cards for 2021, this may not be the bad thing that it at first seems.

|

Percentage by sector for total FTSE 100 growth, 2021E consensus forecasts |

||||

|

|

Profits growth |

|

|

Dividend growth |

|

Oil & Gas |

29% |

|

Financials |

52% |

|

Mining |

20% |

|

Mining |

18% |

|

Financials |

16% |

|

Consumer Discretionary |

12% |

|

Consumer Discretionary |

12% |

|

Industrials |

9% |

|

Industrials |

12% |

|

Consumer Staples |

8% |

|

Consumer Staples |

4% |

|

Telecoms |

7% |

|

Healthcare |

4% |

|

Real Estate |

1% |

|

Telecoms |

1% |

|

Healthcare |

1% |

|

Utilities |

1% |

|

Technology |

1% |

|

Technology |

1% |

|

Utilities |

1% |

|

Real Estate |

0% |

|

Oil & Gas |

(11%) |

Source: Sharecast, consensus analysts’ forecasts

“The UK market may be unloved, judging by how it has resolutely underperformed since the Brexit vote in June 2016 (and frankly before that).

|

Performance since UK Brexit vote, 23 June 2016 |

||

|

Country |

Index |

Capital return* |

|

USA |

NASDAQ Composite |

155% |

|

Brazil |

Bovespa |

120% |

|

USA |

S&P 500 |

75% |

|

Japan |

Nikkei 225 |

63% |

|

India |

Sensex |

61% |

|

Russia |

RTS |

46% |

|

Switzerland |

SMI |

30% |

|

Germany |

DAX |

30% |

|

Hong Kong |

Hang Seng |

26% |

|

France |

CAC-40 |

25% |

|

China |

Shanghai Composite |

18% |

|

UK |

FTSE All-Share |

6% |

Source: Refinitiv data. *Local currency terms

“But periods of poor performance can mean there is contrarian value to be had, especially with the weak pound an additional lure to overseas buyers. In the past couple of months,

“The average premium offered has been 47% across the 15 takeovers announced on the Main Market and junior AIM platform of the London Stock Exchange since late October. If buyers feel they can still justify their purchase at that sort of premium, then they clearly think they are getting some kind of value, both financially and strategically.

“The valuation you pay is the ultimate arbiter of any investment you make, whether you are a trade buyer, financial buyer (such as a private equity firm), institutional pension fund manager or a private investor, so the less you pay, the more downside protection you have and the more upside potential there may be.

“FTSE 100 member RSA is one of the firms to have received an overseas bid but so have plenty of FTE 250 and small-cap firms, to imply there is value to be had beyond the confines of the FTSE 100’s multinationals, too, so investors looking to build a portfolio of UK firms could delve down into the FTSE 250 (or below) as well.

Four stock picks for 2021

Cautious – SSE (SSE) £14.20

A targeted dividend of at least 80p per share plus retail price index (RPI) inflation for this year underpins a 5.6% yield at SSE, with increases in line with RPI planned for 2021 and 2022 for good measure. That seems a good starting point for an investment case at the FTSE 100 firm, but it could offer more than just the relative dependability of the power utility.

SSE’s existing renewables portfolio and growth plans leave it well placed to be in the vanguard of the drive in the UK toward alternative sources of energy, a drive given fresh impetus by the Government’s announcement in November of a multi-billion-pound Green Industrial Revolution.

While the Prime Minister’s propensity to talk a good game and then falter when it comes to anything resembling details must be taken into account, SSE is already proving the value of its renewable assets. Italian oil major ENI has swooped for a stake in the Dogger Bank wind power project at a price that generates a tasty capital gain for the seller. That seemed to confirm the clear upward trend in the market value of renewable assets and with oil majors potentially wading in at almost any price given their determination – and need – to reinvent themselves – SSE’s shares could yet offer greater potential for capital appreciation than many investors realise.

Balanced – Grafton (GFTU) 851.5p

Even if Grafton is currently getting a lift from the rash of home improvement work carried out during lockdowns, a return to some degree of economic normality next year would surely help the builders’ merchant.

Consensus profit and dividend forecasts have consistently increased since the summer and analysts expect a return to profits growth in 2021 for good measure, although earnings are still not expected to return to the pre-pandemic peak.

A cyclical, post-pandemic upturn should help on that front but Grafton offers a strong internal dynamic too. Selco continues to take market share, investment in the IT system at Buildbase should bring long-term benefits and the company continues to make bolt-on acquisitions, the latest of which is a £44 million swoop for Stairbox, an industry leading UK manufacturer and distributor of bespoke wooden staircases, as announced in early December.

Adventurous – Tekmar (TGP:AIM) 71p

Micro-cap stocks are suitable only for patient, risk-tolerant investors who can withstand a few setbacks and the road to recovery at Tekmar could yet offer a few lumps and bumps. Yet the balance sheet is net cash and the market cap of £36 million compares to the net asset value of £46 million shown in the last set of accounts. Both of those facets at least give some degree of downside protection. Meanwhile, the company’s leading position in the niche of protection systems for subsea cables and pipes offers plenty of scope for upside. There are surely few markets as packed with potential as this one, as the UK prepares to launch its Green Industrial Revolution and throw money at wind power, an area where Tekmar’s skills are likely to be in high demand.

The shares have foundered, thanks in part to October’s acknowledgement of contract delays, a classic problem for project-driven businesses like this one and also smaller companies more generally. That business is still out there and Tekmar’s launch of a new, tenth-generation product in early 2021 should serve to cement its competitive position.

New chief executive Alistair MacDonald has launched a review designed to cut costs, increase efficiencies and boost profits, and given the modest market cap there has to be a chance that a trade buyer turns up for the business at some stage, given the global momentum in the offshore renewable energy industry.

Income seekers - Imperial Brands (IMB) £15.94

The Bible’s Book of Proverbs notes that “As a dog returns to his vomit, so a fool repeats his folly.” In that context flagging Imperial Brands as an income option for investors to consider may seem foolhardy, especially as the FTSE 100 firm actually cut its dividend for the first time ever in 2020.

Earnings would have still covered an unchanged dividend by 1.2 times and the new 137.7p-a-share payment was covered 1.8 time by earnings and, as it turns out, by free cash flow to the same degree for good measure. That distribution equates to an 8.6% dividend yield for a stock that trades on a forward price/earnings (PE) ratio of barely six.

Such a combination of fat yield and low PE usually signals investor scepticism about the accuracy of the forecasts, or at least the long-term sustainability of the profits, cash flow and dividend. Such a rating may also reflect understandable concerns about the ethical issues that come with smoking and this stock may simply be beyond the pale for some.

But the valuation may just ignore how tobacco remains a highly profitable and cash generative business (whether we like or not) while the sale of the cigar business further reduces the debt pile. It will be interesting to see what comes of the strategic review that is due in January from new CEO Stefan Bomhard and his revamped management team and after a dreadful eighteen-month run of profit warnings, boardroom shuffles and dividend disappointment is may not take much for Imperial Brands to surprise on the upside.