“October’s trading update had already hinted that these interim figures from cybersecurity specialist GB Group (GBG:AIM) would be strong and they have not disappointed,” says Russ Mould, AJ Bell Investment Director. “The company is well placed in what remains a rapidly-growing industry as identity and location detection and fraud protection become ever more important as more and more of the world’s commercial and financial transactions take place online.

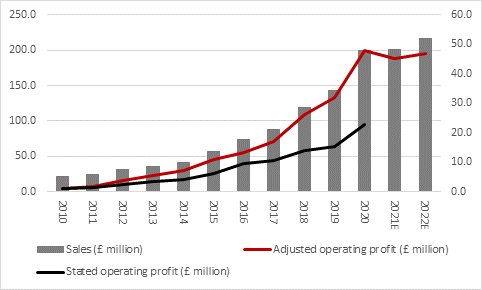

“First-half sales rose by 10% on a headline basis and the underlying rate of progress was slightly faster than that, once currency movements were taken into account. To increase sales at all in the current environment is hard enough so this substantial step upward confirms the value that GB’s products and services bring to the Chester-headquartered company’s customers worldwide.

“That first-half increase in the top-line continues a streak of double-digit percentage growth in sales, on an underlying basis, that dates back to 2014.

Source: Company accounts. Financial year to March.

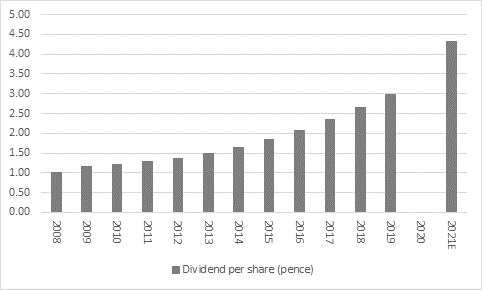

“Cash flow remains robust and net debt has rattled lower by some £32 million since the end of the last financial year. That is helping GB Group get back on the dividend list and the decision by chief executive Chris Clark and the board to sanction a 3p-per-share interim dividend speaks highly of confidence in future trading.

“The £1.8 billion cap company has not previously offered a first-half distribution, only a final one and in the fiscal year to March 2020 it passed on the year-end payment too, so the return to the dividend list looks like a further positive sign.

Source: Company accounts, consensus analysts’ forecasts. Financial year to March.

“However, investors must resist the temptation to get too carried away. A big, one-off contract in the USA helped first-half performance and it will not be much of a factor in the second six months of the financial year to March 2021, so underlying revenues are expected to increase only marginally for the full-year, ending that streak of double-digit percentage rates of progress. Analysts are still pencilling in a small dip in underlying operating profits for the full year, despite a 25% surge in the first half.

Source: Company accounts, consensus analysts’ forecasts. Financial year to March.

“That is still eminently forgivable in a world where corporations continue to husband their resources and manage their cash very carefully, although GB Group will need to pick up the pace at some stage or otherwise the very lofty valuation could start to weigh on the share price.

“Contrarians and value-hunters alike will balk when confronted by a forward price earnings (PE) ratio that exceeds 50.

“But if GB Group keeps developing at its usual pace then that prospective multiple will fall quickly and look far less intimidating, especially as the company has frequently demonstrated its knack of supplementing rapid organic growth with shrewd acquisitions.”