“America’s headline S&P 500 stock index continued to swing around as investors try to fathom what the coronavirus outbreak may (or may not mean) for the global economy and corporate profits and cash flows. In the meantime gold is making its latest concerted effort to crack the $1,650-an-ounce mark,” says Russ Mould, AJ Bell Investment Director. “After its recent stumble the S&P 500 is up by nearly 8% over the past year, while gold is up by more than a quarter and a leading index of sixteen gold miners is showing gains of 40%. Those figures are in dollars, so the capital gains for UK-based investors who will be looking at their returns in sterling are better, STILL thanks to the weakness in sterling relative to the dollar.

|

|

S&P 500 |

Gold |

HUI Gold Bugs Index |

FTSE 100 |

|

Change over past 12 months in $ |

7.5% |

27.4% |

40.3% |

(8.5%) |

|

Change over past 12 months in £ |

10.5% |

30.9% |

44.2% |

(5.8%) |

Source: Refinitiv data

“The reaction of the gold and the S&P 500 to Tuesday’s half-point Fed interest-rate cut was particularly interesting in this context. US stocks lost nearly 3% in value while gold rose by the same amount – the direct opposite of what the US central bank probably had in mind.

“Gold’s advance (and equities’ decline) may have reflected fears that central banks are not in control of the situation. Gold is often seen as a hedge against inflation or deflation but its history suggests that it is wider economic uncertainty and markets’ lack of confidence in policy response that really lead investors to favour a role for the precious metal in their portfolios.

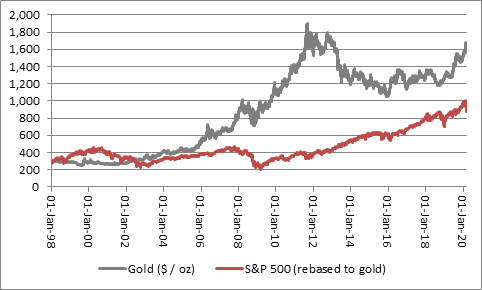

“The S&P has wiped the floor with gold over the last ten years, as investors have warmed to the view that central banks had their backs and would do ‘whatever it takes’ to keep the economic and stock market shows on the road. This view stretches back through multiple periods of market volatility, through last year’s repo market dislocation to 2015’s Chinese growth scare to the European debt crisis in 2011 to the Great Financial Crisis of 2007-09, the tech bust of 2000-03 and stretching all the way back to the collapse of the LTCM hedge fund after Russia’s debt default in 1998.

“But here lies the rub.

“Since the Greenspan-led Fed orchestrated the $3.6 billion bailout of Long-Term Capital Management twenty-two years ago, central banks have taken an increasingly active and interventionist role in supporting financial markets. And over that period, gold has left the S&P 500 for dead.

Source: Refinitiv data

“The US index has had three bull runs and two busts during that period and gold has massively outperformed it, to perhaps reflect the consistent trend lower in headline interest rates and increased use of one-unorthodox schemes such as quantitative easing, manipulation of the yield curve and provision of liquidity to interbank funding markets.

|

|

Capital return in $ |

|

|

|

S&P 500 |

Gold |

|

Since 1 Jan 1998 |

209.5% |

466.6% |

|

Last 20 years |

113.1% |

468.4% |

|

Last 15 years |

148.1% |

280.3% |

|

Last 10 years |

168.4% |

43.4% |

|

Last 5 years |

42.5% |

36.2% |

|

Last 1 year |

7.5% |

27.4% |

Source: Refinitiv data

“The need to intervene regularly and turn unorthodox monetary policy tools into everyday ones could lead some investors to think that central banks are not on top of everything after all – and the Fed has already cut rates to 1.25% before there is even a hint of a recession, while headline borrowing costs in the UK, EU and Japan are already just 0.75%, 0.0% and -0.1% respectively.

“That, on the face of it, leaves little ammunition for the when the next recession comes, whenever that is. Should the coronavirus be the trigger for a downturn, the prospect of central banks turning to negative interest rates and more QE cannot be dismissed out of hand. And while governments could turn to fiscal stimulus, that would only serve to increase already bloated annual and aggregate deficits in the West.

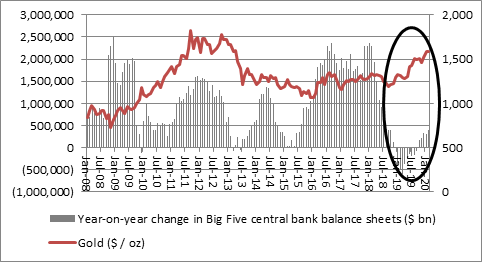

“Any of the these scenarios could conceivably be bullish for gold, as they have been traditionally in the past, a view point supported by how gold has performed during even recent periods of central bank’s expansion of their balance sheets, let alone the 1970s, when President Nixon took America off the gold standard so Uncle Sam could print dollars to fund welfare programmes and the Vietnam war.”

Source: Bank of England, Bank of Japan, European Central Bank, Swiss National Bank, US Federal Reserve and FRED - St. Louis US Federal Reserve database