“The FTSE 250 firm noted that all of its new lettings, rent review and new letting offers were struck at levels above the estimated rental value (ERV) attributed to the properties in the full-year results to March.

“This will help to calm fears that commercial property valuations are coming under pressure owing to the number of high-profile retailers and restaurateurs who are in difficulty and concerns that uncertainty over Brexit may deter potential tenants from signing on the dotted line.

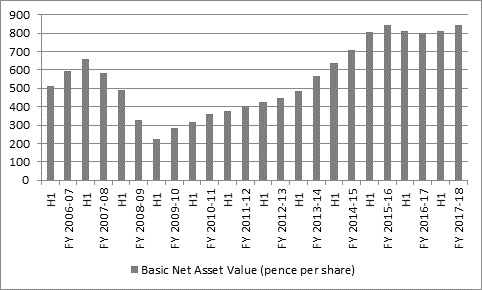

Source: Company accounts

“However, bears of the stock – and the sector – will continue to growl that Great Portland’s NAV per share has not grown for two years, even as it has sold assets and developed new ones across its portfolio of prime London properties that stretch from Oxford Street in the West End to Old Street in the City and from St. Thomas Street on Southbank to Gray’s Inn Road.

“The question then becomes one of whether valuation prices in a lot of bad news already or not.

“In Great Portland’s case, the shares trade at a discount to historic net asset value of 17%. This compares to the premium ratings afforded to warehousing, logistics and perceived e-commerce plays such as SEGRO and the 30% to 50% discount valuations slapped on those Real Estate Investment Trusts which has big exposure to retail, offices in the City or both, such as British Land, Land Securities, Hammerson and INTU.

“This mid-range valuation reflects the quality of Great Portland’s assets and also its low debt levels, with a loan-to-value ratio of just 13%, as well as the company’s relative modest yield.

“Besides the largest discounts to NAV the highest dividend yields can generally be found at those REITs with retail, City or new development exposure, to reflect investors’ fears over the perceived risks involved.

| Premium / (discount) to historic NAV |

|

| 2018E Dividend yield |

Safestore | 49.2% |

| Newriver Retail | 8.0% |

Big Yellow | 38.2% |

| INTU | 7.7% |

SEGRO | 20.8% |

| Hammerson | 5.0% |

Londonmetric Property | 11.7% |

| Land Securities | 4.9% |

TRITAX Big Box | 9.6% |

| British Land | 4.7% |

A & J Mucklow | 8.9% |

| Hansteen | 4.5% |

Workspace | 3.7% |

| Londonmetric Property | 4.4% |

Shaftesbury | (5.6%) |

| TRITAX Big Box | 4.3% |

Newriver | (6.4%) |

| A & J Mucklow | 4.1% |

St. Modwen | (14.0%) |

| Town Centre Securities | 4.0% |

Derwent London | (14.5%) |

| Big Yellow | 3.6% |

Capital & Counties | (14.5%) |

| Workspace | 3.0% |

Great Portland Estates | (16.5%) |

| Safestore | 3.0% |

Hansteen | (18.7%) |

| CLS | 2.9% |

CLS | (21.9%) |

| SEGRO | 2.7% |

Town Centre Securities | (22.9%) |

| Derwent London | 2.1% |

British Land | (31.5%) |

| Shaftesbury | 1.8% |

Land Securities | (31.7%) |

| Great Portland Estates | 1.7% |

Hammerson | (33.0%) |

| St. Modwen | 1.7% |

INTU | (56.1%) |

| Capital & Counties | 0.5% |

Source: Thomson Reuters Datastream, Company accounts, Consensus analysts’ forecasts, Digital Look

“For the moment, asset values are still rising, to confound the bears.

“But there are few catalysts to support the bull case that the big discounts to NAV and fat yields mean there is value to be had, especially as a weak pound mean British real estate assets will look even cheaper to overseas buyers, who will also warm to the UK’s rule of law and independent central bank.

“The failure of Klepierre’s bid for Hammerson, of Hammerson’s bid for Klepierre and the lack of action of Shaftesbury, despite the presence of two big shareholders in the form of Norges and Samuel Tak Lee, mean there has been no event to help persuade non-believers that value is there. Perhaps it will take a bid – or some clarity on the Brexit negotiations – to overcome the doubts that investors clearly have and it seems as if patience may be required on both fronts.”