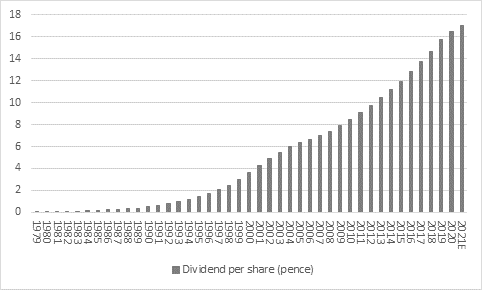

“You have to be an aficionado of 1980s pop to remember German band Freiheit and their one-hit wonder Keeping the Dream Alive but shareholders in Buckinghamshire-based Halma continue to benefit as the company keeps a long-running dividend growth streak alive,” says Russ Mould, AJ Bell Investment Director. “Halma can already point to 41 consecutive increases in its annual dividend of at least 5% and the interim results suggest the FTSE 100 firm is well on track to make it 42, despite the difficult overall backdrop, as management sanctions a 5% hike in the first-half payment to 6.87p per share.

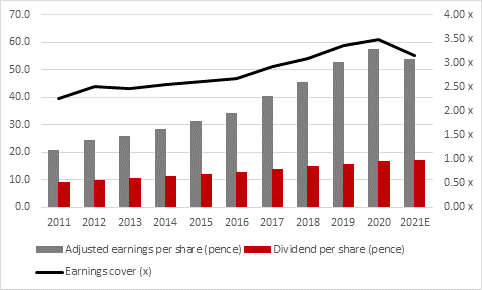

Source: Company accounts, Sharecast, consensus analysts’ forecasts for 2021E. Financial year to March.

“This increase comes despite a 6% drop in (adjusted) earnings per share (EPS) and a 9% slide in the statutory number and reflects management’s understandable confidence in the business, despite the prevailing economic environment.

“Halma is still making a 16% operating return on sales, a double-digit return on invested capital (ROIC) and generating plenty of free cash flow. In addition, net debt is low at £305 million given the cash flow and shareholders’ funds of £1.1 billion while earnings cover for the dividend payment is nearer three than it is the traditional comfort zone of two. Halma can afford to maintain its dividend growth streak, so long as management feels it is prudent to do so and it does not have a more pressing use for the cash elsewhere.

Source: Company accounts, Sharecast, consensus analysts’ forecasts for 2021E. Financial year to March.

“Although the actual forecast dividend yield of 0.7% is not going to set income investors’ pulses racing, the consistent increases in the total annual pay-out are helping to carry the share price higher. Halma’s share price was 1.9p at the start of 1979, when the dividend growth streak began, so this year’s forecast distribution of 17.04p a share looks pretty good against that.

“While this might seem like an extreme example, it does show how well-run, well-financed companies which build and hone their competitive position can reward truly patient investors, with the ideal combination of capital gains and income. Halma has been able to do this, and keep that dream alive, because management continues to get the fundamental basics right:

• The company continues to think on a long-term basis, with careful investment in new products and services and prudent capital allocation. Investment in organic growth comes first, select acquisitions second and capital returns to shareholders next, which is the correct way around. If the first two are done well then the third can almost take care of itself.

• There are strong regulatory drivers associated with Halma’s hazard detection and life protection products and the company’s ongoing investment means it continues to maintain and develop the competitive position of its core business. Both of these facets are reflected in the high-teens percentage operating margin and the robust strong cash flow which both funds the dividends and keeps debt reassuringly low.

• Management continues to use select, small acquisitions to supplement existing momentum within the business, not create or transform it with one knock-out, potentially high-risk deal.

“One challenge that shareholders do face now is Halma’s valuation. A forward price/earnings ratio of more than 40 times prices is an enormous amount of good news, even allowing for how the pandemic is depressing profits this year and the company’s long-term track record.

“The longer the pandemic goes on and the more sluggish the global economic outlook, the better Halma’s shares may do, as investors crowd into stocks that are seen as relatively safe or reliable. But any hint of a rapid upturn – due to a vaccine or some other factors – could see such expensive stocks start to lag cyclical names, which have the potential in the short term offer faster growth (if only because they are coming from a lower base) and do so from a much lower starting valuation.”