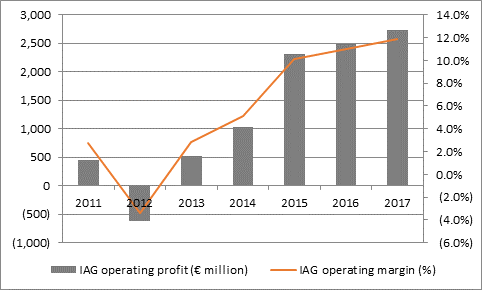

“The airline business is undeniably in better health than it has been for many years, as high-profile failures and capacity discipline have helped to boost load factors and therefore profits. IAG’s 2017 results show the benefits, too, with higher sales and earnings, a decrease in net debt and an increased dividend – and a third share buyback programme since summer 2015.

Source: Company accounts

“However, share buybacks can be an acquired taste. Yes, they quickly return cash to investors, who may be happier to receive the money than to see IAG invest it in fresh capacity across its routes at a time when consumer confidence is still pretty depressed, at least in the UK, owing to weak wage growth relative to inflation.

“But buybacks tend to work best when a company has ample funds to take care of the operational liquidity and needs of its business, when the balance sheet is rock solid and the stock is selling at a material discount to the company's intrinsic business value.

“Helped by the trio of buyback announcements, and strong operational performance, IAG’s shares are trading near all-time highs, the company still has net liabilities of €7.8 billion (once aircraft leases are included) and industry-wide confidence seems to be growing – Doug Parker, the chief executive of American Airlines was quoted in late 2017 as saying ‘I don’t think we’re ever going to lose money again .... We have an industry that’s going to be profitable in good and bad times.’

“For an industry with a notorious reputation for being volatile and capable of plunging from profit to loss at great speed, owing to industry supply-side indiscipline, an economic downturn or rising oil and fuel costs, this was a remarkably bold statement.

“It is therefore to be hoped that the IAG share buyback is evidence of further capital discipline and not the sort of top-of-the-cycle (over)confidence which over time leads to a return to the sort of capital destruction which has characterised the airline business for most of its 100-year-plus history.”