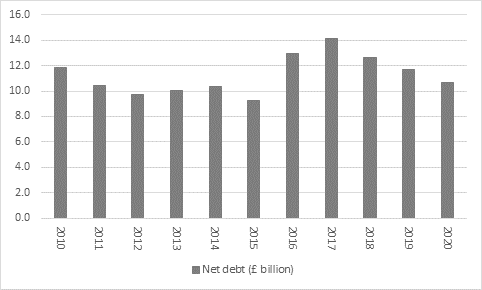

“The absence of any further profit warning, a dividend that meets (lowered) expectations and improved cash flow all offer hopes of a better times ahead at Imperial Brands under new CEO Stefan Bomhard and his revamped management team, especially as debt is coming down and the results of a strategic review are due in January,” says Russ Mould, AJ Bell Investment Director. “Less debt means less risk, less risk can mean a higher rating for the stock and if nothing else it means lower interest payments and more cash available for investment in the core business proposition or dividends.

|

£ million |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Operating profit |

2,229 |

2,278 |

2,407 |

2,197 |

2,731 |

|

Depreciation & amortisation |

1,244 |

1,364 |

1,266 |

1,316 |

910 |

|

Net working capital |

138 |

67 |

(11) |

50 |

1,042 |

|

Capital expenditure |

(217) |

(235) |

(327) |

(409) |

(302) |

|

Operating Cash Flow |

3,394 |

3,474 |

3,335 |

3,154 |

4,381 |

|

|

|

|

|

|

|

|

Tax |

(401) |

(570) |

(407) |

(522) |

(568) |

|

Interest |

(540) |

(537) |

(491) |

(473) |

(420) |

|

Pension contribution |

(111) |

(157) |

(60) |

(72) |

(88) |

|

Leases paid |

0 |

0 |

0 |

0 |

(72) |

|

Free Cash Flow |

2,342 |

2,210 |

2,377 |

2,087 |

3,233 |

|

|

|

|

|

|

|

|

Dividend |

1,386 |

1,528 |

1,676 |

1,844 |

1,753 |

|

Free Cash Flow Cover |

1.69 x |

1.45 x |

1.42 x |

1.13 x |

1.84 x |

Source: Company accounts. Financial year to September.

“Income seekers will note the improved cash flow and although they may wonder whether the inflow from net working capital and the reduction in capital investment are both truly sustainable it is clear that free cash flow cover for the dividend is higher – especially as this year’s accounts features last year’s final payment and this year’s interim, so the run-rate for the dividend payment is nearer to £1.25 billion.

“Even that lowered number, which equates to 137.7p per share and is the result of the first cut in Imperial’s history since it was spun out of the old Hanson conglomerate in 1996, translates into a 9.6% dividend yield.

Source: Company accounts. Financial year to September.

“That is enough to make Imperial Brands the second-highest yielding stock in the FTSE 100, even if its proposed cash payment is only the eleventh-highest.

|

|

|

2020E |

|

|

|

Dividend yield (%) |

Dividend cover (x) |

Pay-out ratio (%) |

|

M & G |

9.9% |

2.09 x |

48% |

|

Imperial Brands |

9.5% |

1.85 x |

54% |

|

Aviva |

8.9% |

1.80 x |

56% |

|

BP |

8.5% |

(0.62 x) |

-161% |

|

British American Tobacco |

7.7% |

1.53 x |

65% |

|

Legal and General |

7.1% |

1.59 x |

63% |

|

Vodafone |

6.7% |

0.78 x |

129% |

|

Rio Tinto |

6.5% |

1.55 x |

65% |

|

Evraz |

6.4% |

1.50 x |

67% |

|

Phoenix Group |

6.3% |

1.67 x |

60% |

Source: Company accounts, Sharecast, consensus analysts’ forecasts, Refinitiv data

“Confidence will also be boosted by the decline in net debt, which should drop further once the cash comes in from the £1 billion sale of the cigars business in October, after the company’s financial year end.

Source: Company accounts, financial year end to September

“This is not to say that Mr Bomhard’s in-tray is empty. Far from it, as he wouldn’t have been called in to replace Alison Cooper otherwise.

“Imperial has partly boosted its profit by reining back investment in, and losses on next generation products (NGPs), amid greater regulatory scrutiny of vaping and e-cigarettes. This may lessen the growth potential of what was once hailed an exciting new area.

“In addition, the core tobacco business still faces fierce regulatory push-back as well, after prior clampdowns on indoor smoking, packaging and advertising, and ever-growing public awareness of health issues.

“Near-term issues such as a plunge in duty-free sales in the wake of the pandemic and collapse in international passenger travel also complicate the immediate outlook and taken at face value, the full-year results are not great, with underlying, or like-for-like drops in operating profit and earnings per share of 5% and 6% respectively.

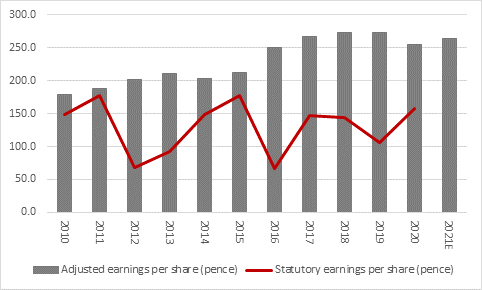

“The pressure is still on – adjusted earnings per share in the year to September 2021 are expected to be no higher than in 2017 - and that is one reason why Imperial’s shares trade at £14 rather than £40 as they did five year ago.

Source: Company accounts, Sharecast, analysts’ consensus forecasts for 2021E. Financial year to September.

“The grinding share price decline leaves the stock on a forward price/earnings (PE) ratio of barely 5.5 times for 2021, based on consensus analysts’ forecasts. Add that to the 9%-plus dividend yield and some investors may think they are getting a bargain. Others may think Imperial is just a value trap.

“They will assert that the combination of low earnings multiple and high yield certainly suggests that investors remain very sceptical of the tobacco giant’s ability to maintain its profitability and cash flow, and thus dividend-paying potential, over the long term, thanks to issues such regulatory pushback on smoking and increased public health awareness. In addition, tobacco stocks will fail to pass any ethical screens which investors care to run.

“It will take more than October’s trading statement and this set of full-year results to convince a sceptical market that Imperial really is on the road to recovery, especially dividend yields that looked to be around 10% (or higher) on paper eventually proved to be nothing of the sort in reality once pay-outs were cut at firms like Vodafone, Shell, BP, Royal Mail and Centrica.”