• Half of investors say the Coronavirus-induced market crash in March and subsequent recovery had a positive impact on their investment portfolio, a survey* of AJ Bell Youinvest customers reveals

o Just over a fifth (22%) report taking an investment hit as a result of market volatility, while 28% say it had “little impact”

o Overall, almost three-quarters (73%) of investors enjoyed gains in 2020, while 23% have worn losses

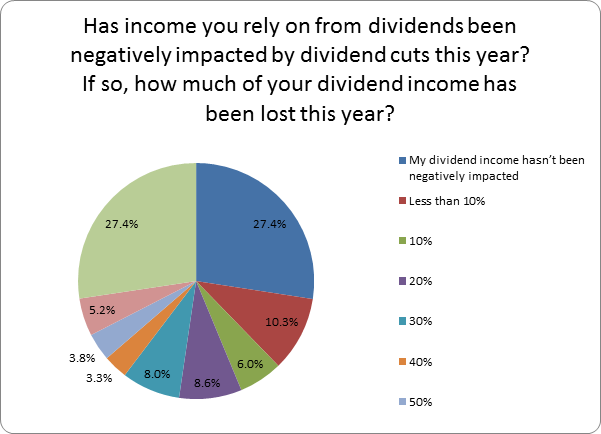

• Companies slashing dividends has particularly hurt investors, with the majority of those relying on such income (73%) saying they have taken a hit during the year

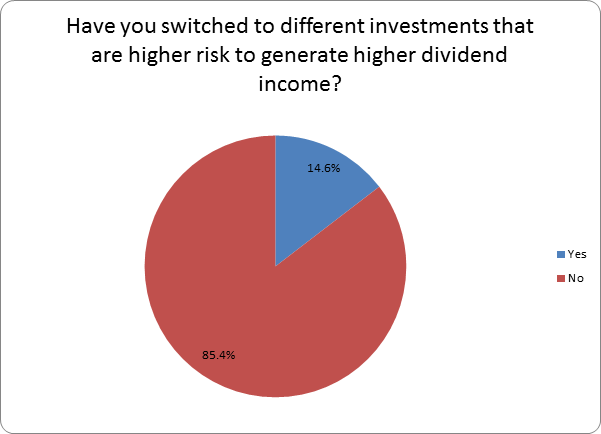

o A significant minority (15%) have switched to higher risk investments in an attempt to boost their dividend income

Tom Selby, senior analyst at AJ Bell, comments:

“The past 12 months have undoubtedly been rocky for UK investors, with millions facing up to double-digit losses in March and April as economies around the world were shut down in a bid to slow the spread of Coronavirus.

“However, since those lows markets have bounced back - first in the summer as restrictions were eased and Government support rolled out to paralysed businesses, then towards the end of the year as positive vaccine news boosted hopes of a return to ‘normal’ life in 2021.

“In amongst the turmoil canny investors have been cashing in, with half of AJ Bell Youinvest customers saying the events of 2020 have actually boosted their portfolio and three-quarters reporting a gain in the value of their investments.

“This may be as a result of people ‘buying on the dip’ in anticipation of a rapid recovery in share prices, or simply the smoothing effect of drip-feeding investments over the year.

“Either way, given where we were just nine months ago, the fact most people’s hard-earned savings pots have either grown or at least remain intact is testament to the value of holding your nerve when volatility hits.”

Dividend doldrums

“With many companies facing enormous financial pressure just to keep the lights on in 2020, dividend payments inevitably collapsed.

“At the last count, companies had cut £47 billion worth of dividends this year, hurting retirement income investors in particular who often rely on such incomes, with less than £4 billion of those cuts restored so far.

“Just over a third (35%) of people relying on dividends reported taking a hit of 10% or more to these payments in 2020, while a further 1-in-10 said the impact was below 10%. Around a quarter (27%) said they had seen no hit to their dividend income during the year, with a similar proportion saying they were unsure.

“This is why it is so important for investors not to solely rely on dividends to deliver their retirement income. Although a ‘natural income’ strategy can be extremely effective when dividends are plentiful, when they dry up you need to have a Plan B ready to go.

“This might involve using other easily realisable investments, such as ISAs, or selling some of your underlying pension capital. If you take the latter option, keeping an eye on the sustainability of your withdrawals is absolutely crucial.”

Income chasers

“Perhaps unsurprisingly, around 1-in-7 (15%) admit to chasing dividends by increasing the amount of investment risk they are taking.

“This approach comes with a health warning because while it may pay off, there is absolutely no guarantee.

“Furthermore, shifting investments too often risks layering on unnecessary costs and causing a drift away from an investment strategy based on your long-term goals and appetite for risk.”

*Survey of 1,780 AJ Bell Youinvest customers between 5th and 7th December 2020

Survey questions and responses