“An 11% in Net Asset Value (NAV) per share, a slowdown in leasing activity and the well-flagged cancellation of the interim dividend at Shaftesbury will all feed into the narrative that real estate is an asset class that it destined to underperform in the future as a result of the long-term implications of the COVID-19 pandemic,” says Russ Mould, AJ Bell Investment Director. “Such concerns could prove accurate, depending upon how slowly workers return to offices (if at all), the pace at which consumers return to shops, bars and restaurants, and whether there is a shift away from living and working in big city centres and toward the suburbs or smaller communities, even once the outbreak is under control.

Source: Company accounts

“If the pace of recovery is very slow or a people begin to move away from commuting and toward working from home or living in the suburbs or more rural areas, then urban REITs like Shaftesbury could face further drops in asset values and rental income, which would in turn crimp the company’s ability to pay dividends to shareholders.

Source: Company accounts

“Yet there are no certainties here. The more rapidly the viral outbreak is reined in and the more reassurance Government and health authorities can offer on the percentage chances of someone recovering from the virus even if they are unlucky enough to catch it, by detailed study of different demographic groups, the more willing some may be to venture out, once they are permitted to do so and once they make their own personal risk assessment.

“In addition, a turn in the weather, boredom, the need to earn if furlough schemes are tapered, the mental health benefits of social contact and benefits for more junior members of staff of being able to work with and learn from senior colleagues in person could yet mean the fate of the office environment is far from sealed. It is quite possible that fewer people will work in offices but those that do will surely require or demand more space.

“The destiny of offices, retail and leisure spaces could all be different, too, and this leaves investors to measure the balance of probabilities as to what could happen, because ultimately no-one knows for certain how workers and consumers will behave in the future.

“This is where real estate stocks could become more interesting. Self-storage and logistics and e-commerce plays trade at tight discounts to NAV or even a premium, whereas those REITs with big exposure to retail, leisure and office sits trade at big discounts, to varying degrees. The question that investors need to ask themselves, therefore, do the big discounts price in some or all of the bad news and, if so, what needs to happen for perception to change and get those discounts to close?

“It does seem as if someone thinks there is value to be had. Capital & Counties has acquired

Samuel Tak Lee’s 26.3% stake in Shaftesbury and Brookfield has snapped up a 7.3% stake in British Land.

|

|

Share price (p) |

Historic NAV per share (p) |

Premium / (discount) |

|

Safestore |

714.8 |

452.0 |

58.1% |

|

Primary Health Properties |

148.2 |

101.0 |

46.7% |

|

Big Yellow |

1,018.0 |

770.4 |

32.1% |

|

Londonmetric Property |

213.6 |

174.9 |

22.1% |

|

SEGRO |

849.2 |

708.0 |

19.9% |

|

Unite |

937.0 |

853.0 |

9.8% |

|

TRITAX Big Box |

140.3 |

151.1 |

(7.2%) |

|

LXI |

112.2 |

124.3 |

(9.7%) |

|

Derwent London |

3,096.0 |

3,958.0 |

(21.8%) |

|

Great Portland Estates |

664.0 |

868.0 |

(23.5%) |

|

GCP Student Living |

131.0 |

171.6 |

(23.6%) |

|

Helical |

353.3 |

486.0 |

(27.3%) |

|

St. Modwen |

362.0 |

504.2 |

(28.2%) |

|

Shaftesbury |

627.3 |

878.0 |

(28.6%) |

|

Harworth |

104.0 |

155.6 |

(33.2%) |

|

Workspace |

716.0 |

1,115.0 |

(35.8%) |

|

Capital & Counties |

181.7 |

293.0 |

(38.0%) |

|

CLS |

203.0 |

329.2 |

(38.3%) |

|

Land Securities |

653.4 |

1,192.0 |

(45.2%) |

|

British Land |

438.5 |

856.0 |

(48.8%) |

|

RDI |

83.0 |

185.5 |

(55.3%) |

|

Newriver |

79.5 |

244.0 |

(67.4%) |

|

Town Centre Securities |

104.0 |

343.0 |

(69.7%) |

|

Hammerson |

122.0 |

601.0 |

(79.7%) |

|

INTU |

8.3 |

147.0 |

(94.3%) |

Source: Company accounts for last stated NAV per share figure, Refinitiv data

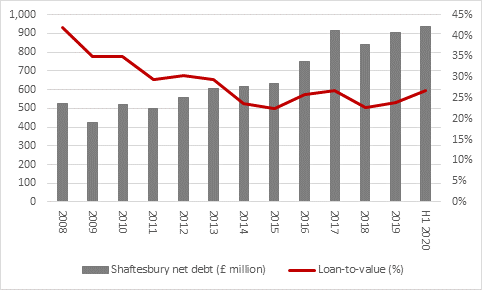

“Put another way – and not all of the REITS listed here are owners of offices – you can either buy 25 major REITs for pretty much the same price as you can buy Zoom Video Conferencing. The REITs’ borrowings do mean that this is not a straight apples-for-apples comparison and although Shaftesbury’s loan-to-value ratio is only 27% the firm has more debt now than it did a decade ago. The ratio is low because valuations have risen, not because debt has gone down, and a sustained fall in asset values would be a concern.

Source: Company accounts

“But the prevailing discounts to NAV already factor in some of that danger and the REITs still come with net assets, whereas Zoom Video Conferencing, for all of its impressive growth and $1.1 billion net cash pile, generated just $328 million in sales and $27 million in net profit in the first three months of the year.

|

REIT |

Market cap (£ million) |

|

SEGRO |

9,431 |

|

Land Securities |

4,852 |

|

British Land |

4,064 |

|

Derwent London |

3,452 |

|

Unite |

3,396 |

|

TRITAX Big Box |

2,395 |

|

Londonmetric Property |

1,947 |

|

Shaftesbury |

1,931 |

|

Primary Health Properties |

1,806 |

|

Big Yellow |

1,782 |

|

Great Portland Estates |

1,693 |

|

Capital & Counties |

1,521 |

|

Safestore |

1,497 |

|

Workspace |

1,299 |

|

Hammerson |

938 |

|

CLS |

844 |

|

St. Modwen |

796 |

|

GCP Student Living |

596 |

|

LXI |

585 |

|

Helical |

425 |

|

Harworth |

343 |

|

RDI |

315 |

|

Newriver |

243 |

|

INTU |

111 |

|

Town Centre Securities |

56 |

|

Aggregate market cap (£ m) |

46,318 |

|

|

|

|

Aggregate market cap ($ m) |

59,171 |

|

Zoom Video Conferencing market cap ($ m) |

57,950 |

Source: Refinitiv data