FTSE 100 dividend yields are on the rise…

…but earnings cover is a source of concern

The FTSE 100 firms with the longest records of consecutive dividend increases

AJ Bell’s latest Dividend Dashboard report shows that the market wobbles during February and March have pushed forecast dividend yields higher because whilst share prices have fallen, dividend forecast have remained unchanged.

The FTSE 100 is now forecast to pay out a total of £87.5 billion in dividends this year, equating to a yield of 4.4%.

However, investors need to proceed with caution because some of the highest forecast dividend yields in the FTSE 100 this year are starting to look questionably high.

The ten FTSE 100 companies forecast to have the highest dividend yield this year:

| Forecast dividend yield 2018 | Forecast dividend cover 2018 |

Persimmon | 9.3% | 1.13x |

Centrica | 8.4% | 1.19x |

Barratt Developments | 8.2% | 1.50x |

Taylor Wimpey | 8.2% | 1.40x |

SSE | 8.0% | 1.27x |

Imperial Brands | 7.8% | 1.40x |

Direct Line | 7.7% | 1.08x |

Micro Focus | 7.5% | 2.04x |

BT | 7.0% | 1.76x |

Marks & Spencer | 6.8% | 1.46x |

Average | 7.9% | 1.42 x |

Source: Company accounts, Digital Look, analysts’ consensus forecasts

Russ Mould, investment director at AJ Bell, comments:

“With the exception of Persimmon, all of those firms have seen share price weakness over the past year. Centrica, SSE, Imperial Brands, BT and M&S have all fared particularly badly and the recent 50% fall in the share price of Micro Focus has catapulted it into the list of top ten yielders.

“The presence of three house builders in the top four highest yielders is testimony to the size of their capital return programmes, but it may also hint at investor scepticism that the industry can maintain its current lofty levels of profitability without the benefit of Government assistance, via the Help-to-Buy and Lifetime ISA schemes.

Earnings cover is still a source of concern

“The question now is whether these juicy looking yields are sustainable and the issue of skinny dividend cover refuses to go away.

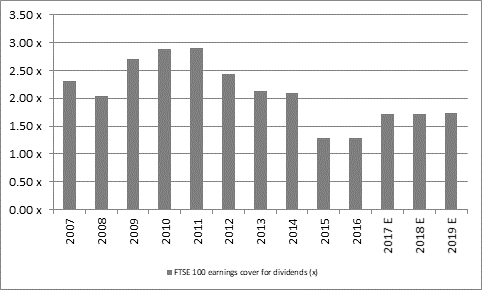

“Earnings cover for FTSE 100 dividends as a whole has improved slightly over the past quarter but it remains much thinner than ideal at 1.71 times for 2018 and has not reached the comfort zone of 2.0 times or more since 2014.

Source: Company accounts, Digital Look, analysts’ consensus forecasts

“Ideally earnings cover needs to be around that 2.0 times mark to offer a margin of safety to dividend payments, should there be a sudden and unexpected downturn in trading at a specific company, or indeed the UK and global economies as a whole.

“The picture for the highest yielding shares is significantly worse, with the average cover across the 10 highest yielding stocks in the FTSE 100 reaching 1.42 times.

“Investors therefore need to consider whether these juicy looking dividend yields are sustainable.

“None of them appear to be in immediate jeopardy but this is at a time when the economy is strong, interest rates on borrowings are low and underlying trading generally favourable, with the possible exceptions of BT, Centrica and now Micro Focus. March’s second profit warning of the year did not prompt analysts to revisit their dividend forecasts although investors will be looking for reassurance that the company has not bitten off more than it can chew with the acquisition of Hewlett Packard Enterprise’s software division.

The FTSE 100 firms with the longest records of consecutive dividend increases

There are 26 firms in the FTSE 100 that have grown their dividend every year for at least the past 10 years and nine of these have grown their dividend every year for the past two decades.

The average total return, including dividends reinvested, from these 26 firms is 569% over the past decade, compared to the FTSE 100 average of 87% over the same period. In fact, only two companies – SSE and Imperial Brands – have failed to do better than the FTSE 100 on a total returns basis.

Consecutive number of years of dividend increases | Company | Total return Mar 2008– Mar 2018 |

38 | Halma | 718% |

34 | Scottish Mortgage | 386% |

31 | Johnson Matthey | 121% |

29 | Vodafone | 129% |

26 | SSE | 54% |

24 | Bunzl | 285% |

22 | Sage | 378% |

21 | Imperial Brands | 80% |

20 | British American Tobacco | 216% |

19 | Croda | 834% |

19 | DCC | 660% |

19 | Diageo | 226% |

18 | Associated British Foods | 246% |

17 | Compass | 574% |

17 | Paddy Power Betfair | 413% |

15 | Intertek | 509% |

14 | BAE Systems | 97% |

14 | InterContinental Hotels | 700% |

14 | Whitbread | 322% |

13 | Ashtead | 4588% |

13 | Prudential | 317% |

13 | Shire | 212% |

12 | Micro Focus | 684% |

12 | St James’ Place | 546% |

10 | Hargreaves Lansdown | 1335% |

10 | Standard Life Aberdeen | 163% |

|

|

|

| Average of the 26 firms | 569% |

| FTSE 100 average | 87% |

Source: Thomson Reuters Datastream, Company accounts.

Russ Mould continues:

“Consistent dividend growth is a key trend to look out for as it can have a very positive effect on the total return delivered by a stock.

“These calculations run from March 2008, so the Great Financial Crisis was just starting to rip around the world a decade ago, demolishing share prices in the process, so that makes the returns generated by this grouping of names all the more noteworthy.

“25 of the 26 names are expected to increase their dividends in each of 2018 and 2019, to maintain their proud records, although in some cases the expected increments are pretty modest. The one exception is SSE where there are apparently some doubts over whether the dividend will rise in 2019.

“However, the share price plunge at Micro Focus in March shows that buying dividend compounders is not an infallible strategy. But even after the latest collapse the IT services expert has still beaten the FTSE 100 hands down over the past decade, with a 684% total return over the past decade.

“As a result, investors need to be on their guard that another firm does not join Tesco and Pearson as recent examples of 10-year growers who not only stopped increasing their payout but actually cut it, with subsequent damage to not only the yield but the share price. Diligent research on not just earnings cover but also balance sheets and cashflows is a must for anyone using an income-oriented investment strategy.

“In addition, only 13 of the 26 were actually in the FTSE 100 a decade ago, so investors may need to burrow through the FTSE 250 if they are looking for the next generation of dividend growth champions.”