“While markets seem to think that President-Elect Joe Biden’s four years in the White House are already set in stone, two events this week could keep things interesting and investors on edge. The first is the Senate run-off in Georgia on Tuesday 5th and then Congress meets to certify the November ballot result and December’s subsequent vote by the Electoral College,” says Russ Mould, AJ Bell Investment Director. “If Georgia gives a two-seat sweep to the Democrats then the Senate will be split 50-50, giving Vice President-Elect Kamala Harris the casting vote and the Democrats an edge. Meanwhile current Vice President Mike Pence starts the vote-counting process in Congress and he could – in theory – exclude those states where President Trump is arguing that the ballots were rigged and cause all sorts of confusion, although he has thus far distanced himself from those allegations.

“The polls in Georgia suggest that the race for both seats, between Republican Senators David Perdue and Kelly Loeffler and their respective Democrat challengers, Jon Ossoff and Reverend Raphael Warnock, are too close to call.

“A Democrat victory in both would give the party control of the White House, House of Representatives and the Senate. That could open the way to further fiscal stimulus and sweep aside Republican opposition, spearheaded by Senate majority leader Mitch McConnell, to an increase in the latest round of welfare payments to $2,000 a head from $600, for those earning less than $75,000 a year.

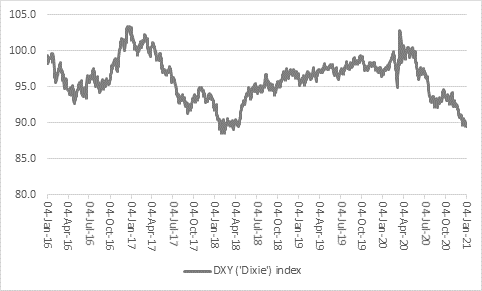

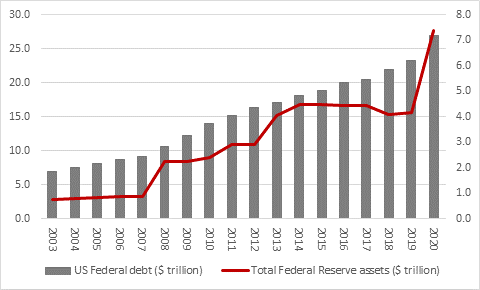

“The prospect of more Government spending may already be weighing on the dollar, which trades near three-year lows, based on the DXY (or ‘Dixie’) trade-weighted index, as the US deficit continues to balloon and the US Federal Reserve begins to expand its balance sheet once more.

Source: Refinitiv data

Source: FRED – St. Louis Federal Reserve database

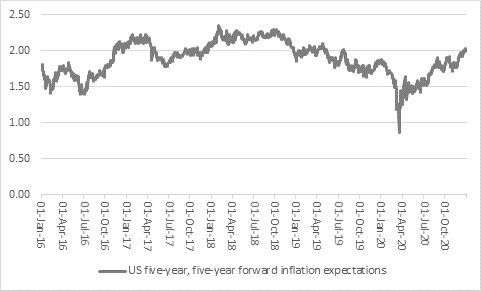

“It may also be raising the spectre of inflation. Five-year forward inflation expectations in the USA stand above 2% for the first time in nearly two years, as investors ponder the possible combination of a successful vaccination programme, ongoing fiscal and monetary stimulus and a post-virus economic upturn.

Source: FRED – St. Louis Federal Reserve database

“These considerations are also helping US equities power ahead, especially since investors will look back to the precedent set by previous Democrat administrations. In the eight Democratic Presidential terms since 1945, the average gain in the first year has been 13.1% and the only decline came during the 12 months after Jimmy Carter’s inauguration.

|

Inauguration |

President |

Party |

Dow Jones in Year 1 |

House of Reps |

Senate |

|

1949 |

Truman |

Democrat |

13.6% |

Democrat |

Democrat |

|

1961 |

Kennedy |

Democrat |

10.5% |

Democrat |

Democrat |

|

1965 |

Johnson |

Democrat |

10.3% |

Democrat |

Democrat |

|

1977 |

Carter |

Democrat |

(19.0%) |

Democrat |

Democrat |

|

1993 |

Clinton |

Democrat |

20.0% |

Democrat |

Democrat |

|

1997 |

Clinton |

Democrat |

15.0% |

Republican |

Republican |

|

2009 |

Obama |

Democrat |

33.4% |

Democrat |

Democrat |

|

2013 |

Obama |

Democrat |

20.6% |

Republican |

Democrat |

|

Average |

|

|

13.1% |

|

|

Based on first 12 months after inauguration, not calendar year.

“And, for all of the debate over what the Georgia result may or may not mean, the Dow Jones has not historically been concerned whether a Democrat President enjoys the full support of Capitol Hill or not. The first year of Bill Clinton’s second term still produced a double-digit percentage gain in the Dow, even though the Republicans controlled both the House and the Senate, and the index gained during the first 12 month of Barack Obama’s second year in office, even as he was confronted by a Republican House of Representatives.

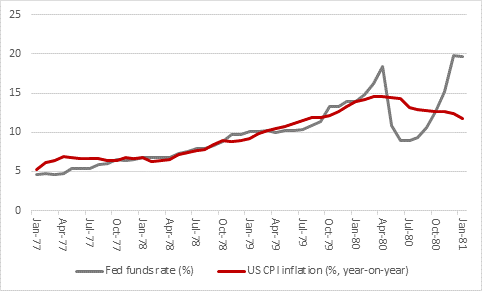

“The past is no guarantee for the future but this does suggest that economics, corporate earnings and cash flows mean more than politics when it comes to stock market returns, although the scope for Mr Pence to put a spanner in the works on 6 January must not be entirely discounted. Moreover, the one bad year under the first term of a Democrat President, that of Jimmy Carter, was characterised by an acceleration in US inflation that eventually drove the Federal Reserve’s headline interest rate to nearly 20% in late 1980, just after Carter had been defeated by Ronald Reagan.

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

“No-one is expecting that right now, so markets may need to at least be careful what they wish for when it comes to hoping for a rip-roaring, inflationary recovery. A little bit of what you fancy may be good for you, but over-indulgence rarely comes without a penalty at some stage.”