“The FTSE 100 and FTSE 250 are both up nicely in the early exchanges and sterling is holding on to the $1.35 and €1.10 marks, so markets seem to be welcoming the Brexit deal that was announced on Christmas Eve,” says Russ Mould, AJ Bell Investment Director. “However, the agreement struck between London and Brussels is yet to win universal acclaim, even if that is the inevitable result of the compromises that the Prime Minister had to make to get the deal over the line before the end of the transition period and confirmation of the UK’s departure from the economic bloc.

“That there are questions still be to answered can be seen in two ways.

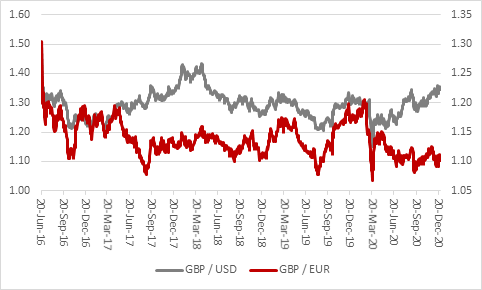

“The first is through the medium of the pound. Sterling may be closing out 2020 at pretty much its highest level against the dollar all year but it is trading much nearer to its 12-month lows than its highs against the euro. Moreover, the pound is still down by 9% against the buck and 15% against the single currency relative to where it stood in June 2016 before the Brexit referendum.

Source: Refinitiv data

“The second is through the identity of the immediate winners and losers in the stock market. Multinationals, who are the likeliest beneficiaries of frictionless, tariff-free trade and overseas currency earners are generally leading the charge in the FTSE 100, including Intertek and Diageo. Yet the laggards are nearly all banks and providers financial services, a trend which can also be seen in the FTSE 250 where asset managers and insurers such as Ninety One and Sabre are among the day’s losers.

“This suggests that nerves remain over what deal will be struck in 2021 when it comes to financial services and indeed services overall, which provides a far greater percentage of UK GDP (and the Government’s tax take) than fishing or manufacturing.

“The free trade agreements from Christmas Eve will be taken positively by the markets, in the view that they may help to unlock investment and employment decisions which have been on ice since June 2016. Manufacturers now know where they stand in terms of trade flows, customs declarations, logistics and the vexed issue of the level playing field and potential state-aid for overseas-based rivals. They could also benefit from a currency that remains depressed relative to where it was four-and-a-half years ago, as that could provide a competitive edge when it comes to pricing in international markets.

“Yet the lack of visibility on services could continue to nibble away at sentiment until a further agreement is reached, although this is not to say that Brexit will be the only factor at work when it comes to shaping near-term market sentiment.

“The presence of AstraZeneca at the top of the FTSE 100 leader board on news that its COVID-19 vaccine, developed with the University of Oxford, could be approved and rolled out within a matter of days, shows that the global pandemic will remain a key influence for some time to come, as it is either beaten back or proves frustratingly persistent.

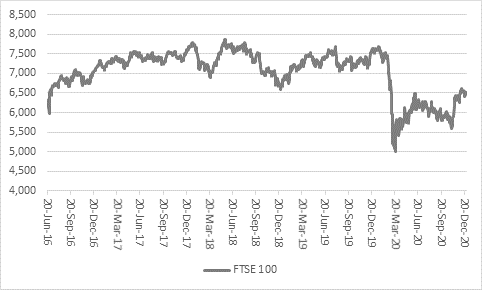

“A double-dip recession, thanks to new viral strains and perhaps more stringent lockdowns, could put equity investors on the back foot – even if the FTSE 100 is down by a sixth from its August 2018 and January 2020 highs, the index is up by 30% from its March 2020 nadir of 4,994, so some degree of recovery is already expected.

Source: Refinitiv data

“A successful vaccination programme could unleash animal spirits in the form of corporate investment and increased private consumption, leading to a rapid economic bounce back, especially now some of the Brexit uncertainty is lifting. Buoyed by news of mass inoculation on the UK and other countries, as well as ongoing fiscal and monetary support for economies from Governments and central banks, markets seem to be leaning toward this scenario right now, with some investors openly debating the return of inflation.”