“President Trump’s flurry of legal challenges to the US Election result of 3 November are yet to gain major traction and even if the Republicans continue to challenge the ballots of certain counties in Pennsylvania, the Electoral College’s 306-to-232 vote in favour of Joe Biden is the next step on the Democrat’s path to becoming America’s forty-sixth President,” says Russ Mould, AJ Bell investment director. “That will again leave investors wondering what policies the Biden-Harris team will implement, aided and abetted by a Democrat House of Representatives, even if further legal manoeuvrings from Trump cannot be entirely discounted.

“Georgia’s Senate run-off vote in January could have a say here, as a Democrat sweep would leave a tie in the Upper House, which Vice President Kamala Harris could then break, to her party’s benefit.

“In very crude terms, investors might expect the US stock market to prefer a Republican President to a Democrat one, with the Grand Old Party generally seen as being in favour of small(er) Government and less inclined to interfere in business matters and free markets than the Democrats.

“However, it generally has not worked out like that, at least not in modern times.

“Over 18 Presidencies since the election of Harry S. Truman in 1948, the Dow Jones Industrials has, on average, done better under Democratic Presidents than it has Republican ones. Even more intriguingly with 2021 in mind, the Dow has done much better in the first year of a Democratic term than it has a Republican one, with an average gain on 13.1% compared to 2% from their rival incumbents.

“In fact, of the eight post-war Democratic Presidential terms, only Jimmy Carter’s offered investors a loss in its first year, using the Dow Jones Industrials as a benchmark.

The Dow Jones has tended to perform better under Democratic Presidents than Republican ones, especially during the first year of a term

|

Inauguration |

President |

Party |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Term |

|

20-Jan-49 |

Harry S. Truman |

Democrat |

13.6% |

21.3% |

10.3% |

5.8% |

60.8% |

|

20-Jan-53 |

Dwight D. Eisenhower |

Republican |

0.4% |

35.9% |

18.2% |

2.8% |

65.8% |

|

20-Jan-57 |

Dwight D. Eisenhower |

Republican |

(6.3%) |

33.2% |

8.1% |

(1.4%) |

32.9% |

|

20-Jan-61 |

John F. Kennedy * |

Democrat |

10.5% |

(4.0%) |

14.9% |

15.8% |

41.1% |

|

20-Jan-65 |

Lyndon B. Johnson |

Democrat |

10.3% |

(14.2%) |

3.9% |

5.8% |

4.0% |

|

20-Jan-69 |

Richard M. Nixon |

Republican |

(16.5%) |

9.3% |

7.1% |

12.7% |

10.2% |

|

20-Jan-73 |

Richard M. Nixon ** |

Republican |

(16.6%) |

(24.3%) |

46.7% |

1.0% |

(6.5%) |

|

20-Jan-77 |

Jimmy Carter |

Democrat |

(19.0%) |

7.8% |

3.5% |

9.6% |

(0.9%) |

|

20-Jan-81 |

Ronald Reagan |

Republican |

(11.0%) |

26.6% |

17.6% |

(2.5%) |

29.1% |

|

20-Jan-85 |

Ronald Reagan |

Republican |

24.6% |

37.6% |

(10.7%) |

19.0% |

82.1% |

|

20-Jan-89 |

George H. W. Bush |

Republican |

19.8% |

(1.2%) |

22.9% |

(0.4%) |

45.0% |

|

20-Jan-93 |

Bill Clinton |

Democrat |

20.0% |

(0.6%) |

34.0% |

32.0% |

111.1% |

|

20-Jan-97 |

Bill Clinton |

Democrat |

15.0% |

18.6% |

21.6% |

(6.7%) |

54.7% |

|

20-Jan-01 |

George W. Bush |

Republican |

(7.7%) |

(12.1%) |

22.6% |

(0.5%) |

(1.1%) |

|

20-Jan-05 |

George W. Bush |

Republican |

1.9% |

17.8% |

(3.7%) |

(34.3%) |

(24.1%) |

|

20-Jan-09 |

Barack Obama |

Democrat |

33.4% |

11.5% |

7.6% |

7.3% |

71.7% |

|

20-Jan-13 |

Barack Obama |

Democrat |

20.6% |

6.4% |

(10.0%) |

25.8% |

45.3% |

|

20-Jan-17 |

Donald J. Trump *** |

Republican |

31.5% |

(5.2%) |

18.8% |

(5.1%) |

40.4% |

|

|

|

|

|

|

|

|

|

|

Average |

6.9% |

9.1% |

13.0% |

5.4% |

36.5% |

||

|

Average - Democrat |

13.1% |

5.8% |

10.7% |

11.9% |

48.5% |

||

|

Average - Republican |

2.0% |

11.8% |

14.8% |

(0.2%) |

28.4% |

||

Source: Refinitiv data. * John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson. ** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford. *** Data for Donald J. Trump as of 14 December 2020. Data taken from date of inauguration, not calendar year.

“It therefore is not as simple as ‘Republicans good, Democrats bad’, when American politics is assessed through the very narrow prism of the US stock market. This is particularly the case now when the Republicans are running up the sort of budget deficits that would make even the most ardently pro-spending Democrat blush, even allowing for the effects of the pandemic and the emergency fiscal response it provoked.

“Moreover, if investors cast their minds back four years ago, the Democrats’ Hillary Clinton was then seen as a bit of a shoo-on for the 2016 election, as the Republican’s Trump had surprised everyone by winning the Grand Old Party’s nomination. Trump was also widely perceived as a potentially negative result for markets, thanks to his sabre-rattling on issues such as diplomatic relations with China, Iran and Mexico and desire to rip-up several trade agreement, including the North America Free Trade Agreement (NAFTA).

“But that isn’t how it turned out.

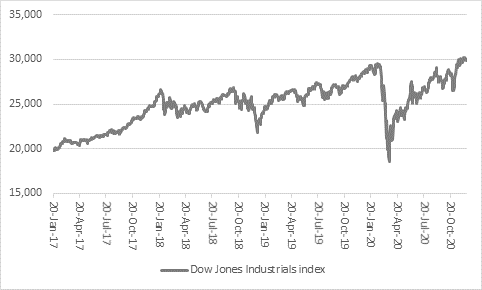

“The Dow Jones Industrials index is up by some 40% since Trump’s inauguration on 20 January 2017, thanks to what had been a steady economic expansion, tax cuts and an accommodative US Federal Reserve, which had pretty quickly backed away from raising interest rates and sterilising Quantitative Easing, even before COVID-19 swept around the globe.

Source: Refinitiv data

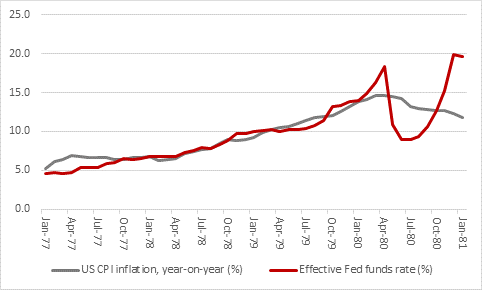

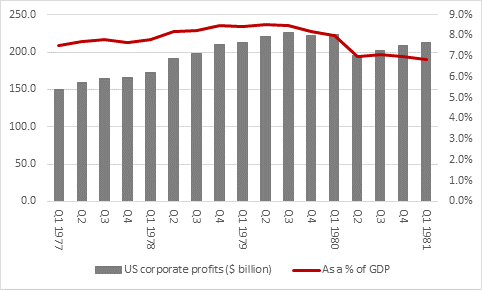

“This suggests that there is more than just politics at play when it comes to how a stock market performs, with monetary policy, economic performance and the possibility of exogenous shocks (such as a pandemic) all factors to be considered, among others, even before we get to the vexed issue of valuation. The Carter Presidency was, after all, vexed by rampant inflation, soaring interest rates, sluggish economic growth, an energy crisis and an eventual recession in 1980, not to mention the Iran hostage crisis and a heightening of geopolitical tensions following the Soviet invasion of Afghanistan in 1979.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“The Carter administration may therefore offer a warning to those who are craving inflation and welcoming the US Federal Reserve’s apparently willingness to let the economy and inflation run hot (assuming it can manage the feat at all, after over a decade of mixed results at best).

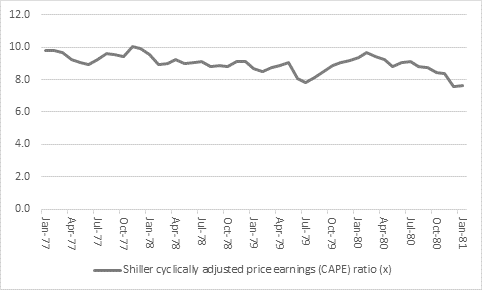

“Equities struggled to make progress during Carter’s Presidency, while gold and silver boomed in response to the inflationary backdrop. Note how US equities derated in the face of inflation, using Professor Robert Shiller’s cyclically adjusted price earnings (CAPE) ratio as a benchmark, trading on a CAPE multiple of between seven and ten times, miles below the 33 times multiple which may be about to welcome Joseph R. Biden to the White House.”

Source: http://www.econ.yale.edu/~shiller/data.htm