“The announcement of new, stringent lockdowns in England and Scotland may provide a gloomy backdrop to its results announcement but Next’s fourth profit upgrade for its current fiscal year goes a long way to explaining why the retailer’s shares are higher than where they were a year ago, despite everything that has happened in the meantime,” says Russ Mould, AJ Bell Investment Director. “Granted, the upgrade is relatively minor this time, at just £5 million to £370 million but the forecast of a £670 million profit for the financial year to January 2022 is 5% higher than the current analysts’ consensus forecast for good measure.

|

|

Next management forecasts for fiscal year to January 2021 |

||||

|

|

Apr-20 |

Jul-20 |

Sep-20 |

Oct-20 |

Jan-21 |

|

Change in full-price sales (year-on-year) |

(35%) |

(26%) |

(20%) |

(17%) |

(16%) |

|

Pre-tax profit (£ million) |

0 |

195 |

300 |

365 |

370 |

Source: Company accounts. Based on mid-point of guidance given at the time.: Company accounts. Based on mid-point of guidance given at the time.

“November’s lockdown has slowed the pace of both the upgrades and the recovery in Next’s share price, but the company continues to surprise on the upside thanks to the combination of better-than-expected full price sales, especially online, lower-than-expected returns and good cost control, where store closures and rent renegotiations have both been key features.

“The outlook for the new financial year contains even more variables than normal, including Brexit, the new lockdowns and the ongoing chaos in the global container shipping market which is impacting the availability of stock.

“Assuming that all physical stores remain closed through to the end of March, Next puts the cost of the new lockdowns at £40 million of profit (with online sales picking up around half of the slack), although management offers reassurance about Brexit, noting its new systems are up and running and no additional customs duties are expected to affect margins or pricing.

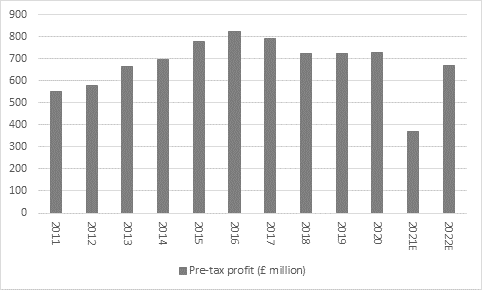

“The forecast of £670 million in profit represents a big recovery from the year to January 2022, although it would still mean earnings come in below the pre-pandemic year to January 2020, when pre-tax income reached £729 million.

Source: Company accounts, management guidance for 2021E and 2022E

“Shareholders will also be pleased to see Next reaffirm its forecast for debt reduction.

“The higher-than-expected profit, the scrapping of a share buyback programme, cancellation of dividend payments, asset sales and cuts in capital investment all mean that debt has fallen faster than expected. If the mid-point of management’s profit forecast proves correct then group net debt will drop by £487 million to £625 million, well within Next’s banking facility limits.

“This may give Next scope for strategic moves to capitalise upon the weakness of others and enhance its competitive position. The company has already agreed to take a controlling stake in Victoria’s Secret’s UK business, and it is thought to be running the rule over certain assets from Sir Philip Green’s fallen Arcadia group, notably Topshop and Topman.

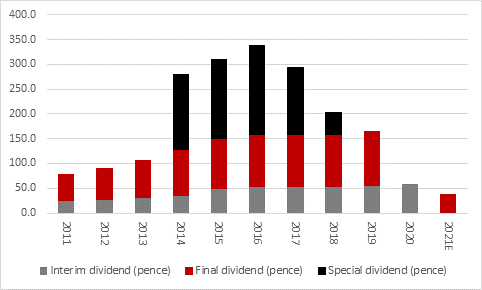

“The company’s financial strength will also raise hopes for a return to the dividend list, following the scrapping of fiscal 2020’s final and fiscal 2021’s interim payments.

Source: Company accounts, Sharecast, analysts’ consensus forecasts

“Analysts have tentatively pencilled in a distribution of 37.2p a share for the financial year that is about to end before a big hike to 149p in fiscal 2022, although again that figure remains below pre-pandemic peaks.”