View the Wealth and Assets Survey here.

Key pensions highlights:

Employer pensions viewed as the safest way to save for retirement (40%), followed by investing in property (29%) and paying into a personal pension scheme (13%)

Property jumps into first place for the self-employed, selected by 42% of respondents

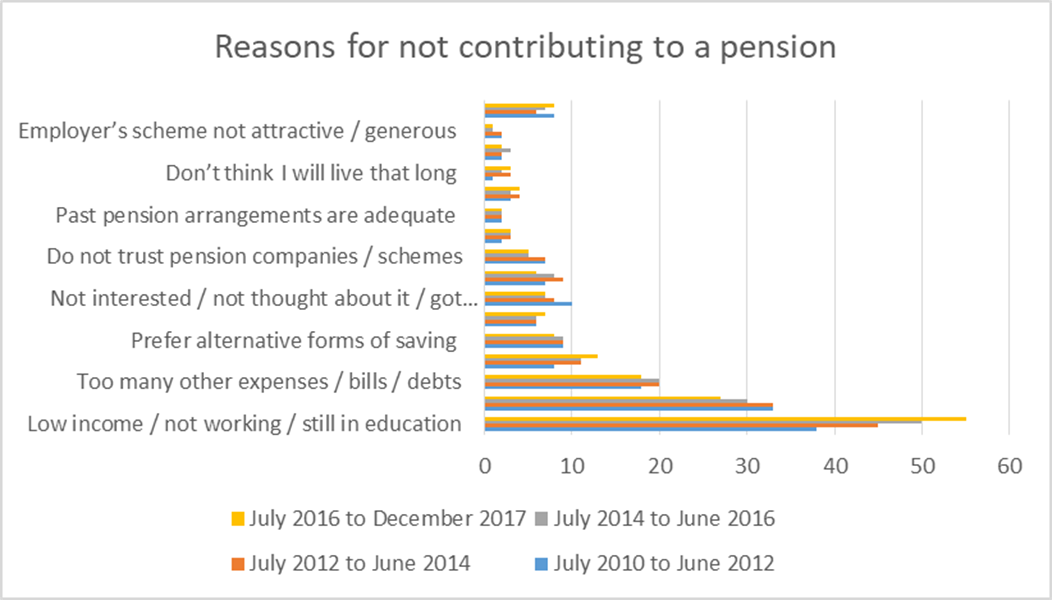

More savers citing low income as key reason for not paying into a pension

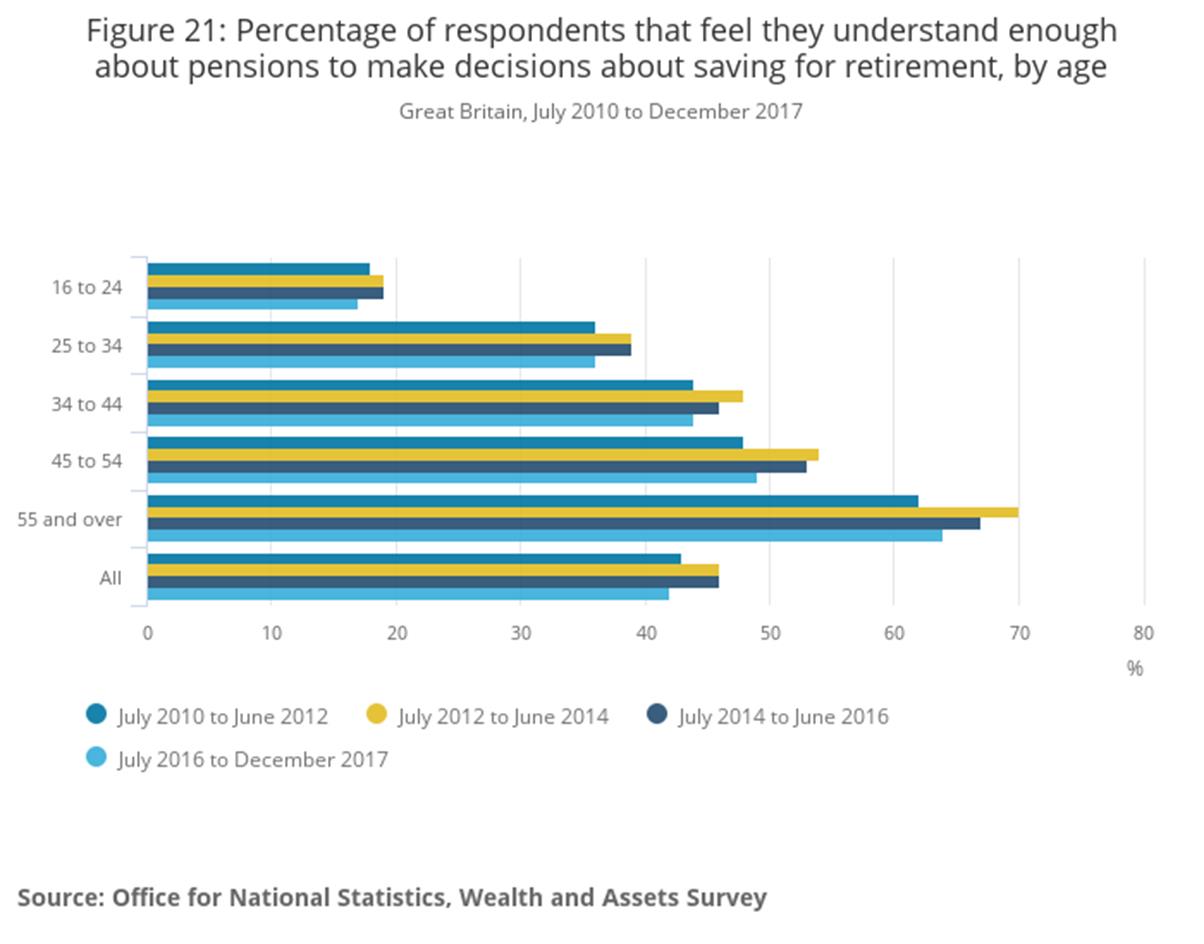

Worrying drop in those who feel they understand enough about pensions to make a decision about saving for retirement, down from 46% to 42%

Over two-thirds (36%) of eligible employees aren’t aware they have been automatically enrolled into a workplace pension scheme

Tom Selby, senior analyst at AJ Bell, comments:

“Despite a raging bull market driving up stock prices for the past eight years at the same time as automatic enrolment has been introduced for millions of workers, people’s perceptions about pensions have barely shifted.

“Although employer pensions continue to be viewed as the safest way to save for retirement, Britain’s love affair with property shows little sign of shifting.

“While property remains an important source of equity in retirement for many people, investors shouldn’t rely solely on this as a drop in values – such as that experienced ten years ago during the financial crisis – would be a serious kick in the teeth.

“Stagnant wage growth has clearly had an impact on behaviour, with a greater proportion of people citing this as a factor preventing them saving for old age.

“Perhaps more worrying is the rising number of people reporting a lack of understanding about pensions, particularly when you consider the retirement freedoms introduced in 2015 require decent levels of engagement.

“Poor engagement risks leading to poor decisions – or no decision at all – resulting in an increased likelihood of poor outcomes in retirement. Addressing this engagement gap now needs to become a central priority for policymakers across regulators and Government.

“The good news is that auto-enrolment is working well to-date, with over a third of eligible employees not even aware they have been nudged into saving for retirement.

“The real test is to come, however, with minimum contributions set to edge up to 8% of qualifying earnings next year. Ministers will be hoping that a combination of wage increases and inertia mean opt-outs stay relatively low, at which point reforms to increase the amount people are paying in will need to be considered.”

Source: ONS