“It’s a bit of a nightmare for investors who put maximum store on environmental, social and governance (ESG) screens and factors at the top of their list when it comes to picking stocks, but over the last month Oil & Gas Producers, Automobiles and Parts and Oil Equipment & Services are the best three performers out of 39 industry groupings in the FTSE 350,” says Russ Mould, AJ Bell Investment Director. “Hopes for an economic recovery, boosted by vaccines, are helping to support the oil price and fuel this share price rebound, which now leaves investors in Big Oil (or those who wish to avoid it) looking ahead to next week’s OPEC meeting.

|

Best and worst performing sectors within FTSE since 24 October 2020 |

||||

|

Top10 |

Performance |

|

Bottom 10 |

Performance |

|

Oil & Gas Producers |

34.0% |

|

Pharmaceuticals & Biotechnology |

1.6% |

|

Automobiles & Parts |

32.9% |

|

Healthcare Equipment & Services |

0.4% |

|

Oil Equipment & Services |

32.8% |

|

Chemicals |

(1.5%) |

|

Banks |

23.4% |

|

Gas, Water & Multi-Utilities |

(1.9%) |

|

Aerospace & Defence |

22.0% |

|

General Retailers |

(2.0%) |

|

Life Insurance |

19.9% |

|

Electronic & Electrical Equipment |

(3.6%) |

|

Travel & Leisure |

19.5% |

|

Personal Goods |

(5.4%) |

|

Nonlife Insurance |

18.2% |

|

Software & Computer Services |

(7.7%) |

|

Fixed Line Telecoms |

14.4% |

|

Leisure Goods |

(10.3%) |

|

Food Producers |

10.7% |

|

Technology Hardware & Equipment |

(11.4%) |

Source: Refinitiv data

“The Organization for the Petroleum Exporting Companies turned 60 this year and few of the 13-nation grouping’s previous 179 meetings will have been as important as this one, even if it will take place remotely rather than in the usual location of Vienna.

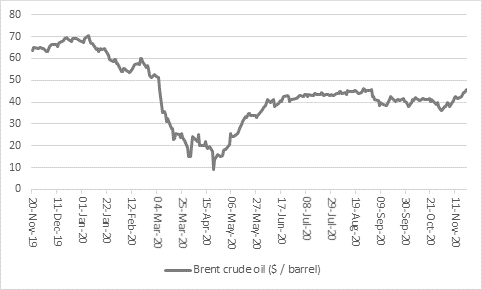

“Oil, as benchmarked by Europe’s Brent Crude, has bounced back from the chaos of spring when the price of a barrel briefly went negative, as demand collapsed due to the pandemic and there was so much of the stuff sloshing around that no-one knew where to put or store it.

Source: Refinitiv data

“Since then, some degree of calm has returned to the market and Brent crude has climbed steadily through the summer and autumn to $46 a barrel, although that it still a quarter below where it was a year ago.

“This recovery is being fuelled by

• hopes for a vaccine and a return to more normal levels of economic activity in 2021

• a drop in US shale output as producers there falter in the face of weak oil and gas prices

• capital investment discipline among major oil groups

• and the production cut agreement brokered by OPEC and Russia back in April, which cut output by some 9.7 million barrels per day, or almost 10% of global daily supply

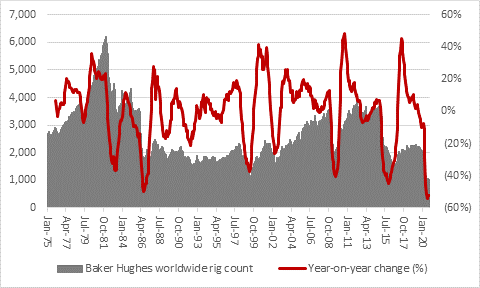

“The industry-wide cuts in spending and production can be seen in the number of rigs that are at work worldwide, which is down 52% year-on-year and stands at the lowest level recorded by Baker Hughes, whose records go back to 1975.

Source: Baker Hughes

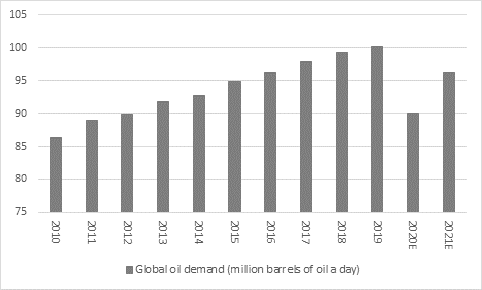

“That is why the latest OPEC meeting is so important. According to OPEC’s 2020 World Oil Outlook document, global oil demand will rebound by some 6 million barrels in 2021 to 96.3 million barrels a day, while demand in 2022 is seen exceeding the pre-pandemic peak of 2019 – assuming that the pandemic is under control by then.

Source: OPEC

“That may give OPEC and Russia some leeway to coax production higher, although they may want to do so carefully, to support oil prices, given uncertainties over the pandemic and the global economy as well as the ongoing drive away from hydrocarbons and toward more renewable sources of power.

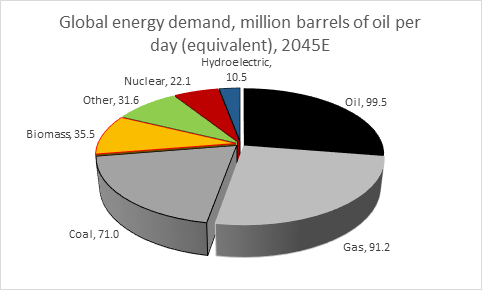

“If correct – and it must be noted that OPEC’s forecast for 2045 demand is less optimistic than it once was – that means oil would still be the world’s leading source of energy in 25 years’ time, closely followed by gas and coal.

Source: OPEC World Oil Outlook, October 2020

“Investors must consider the sources of these forecasts – as OPEC is unlikely to willingly condemn itself to irrelevance. Nor are such estimates are not guaranteed to be right, especially as initiatives such as the Paris Climate Agreement of 2016 are doing their best to make sure they are not.

“But they make some investors wonder whether oil assets are not quite as badly stranded as 2020’s share price action would lead us to believe. That could have interesting implications for the cash flows and therefore the valuations of quoted oil producers, who may already be attracting the attentions of hard-nosed contrarian investors, who will note Exxon Mobil’s ejection from the Dow Jones Industrials index and Tesla’s imminent promotion to the S&P 500 benchmark, but only as a sign to consider going against the prevailing flow.

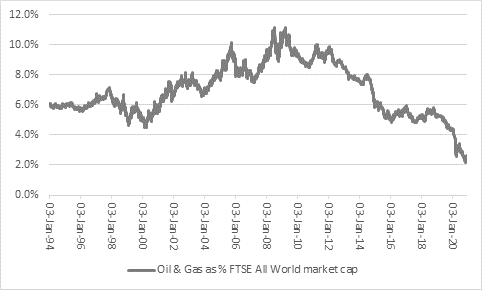

“Oil firms’ market capitalisation as a percentage of the global value of stock markets stands near to modern all-time lows, using the FTSE All-World indices as a benchmark.

Source: Refinitiv data

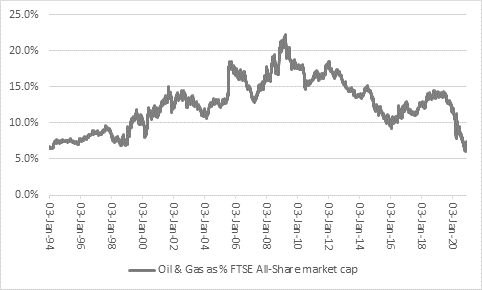

“The same trend can be seen in the UK, where the FTSE All-Share Oil & Gas Producers’ sector hit a new all-time low as a percentage of the FTSE All-Share’s market cap in late October.

Source: Refinitiv data

“This set-up of washed-out market sentiment, collapsing investment and the possibility of higher demand in 2021 may intrigue contrarian value seekers although investors who run strict ethical, social and governance (or ESG) screens over their portfolios will be cheering this decline in the valuation and relative stock market importance of oil firms - and wanting it to continue.

“They will see the latest rally in oil as no more than one of the last flicks of the industry’s tail and nothing about which they can get excited.

“ESG investors are not going to be wooed away from their firm stance on the production and use of hydrocarbons, looking to alternatives such as renewables instead – and that view looks set to receive further support from the Conservative Government here in the UK, after the announcement of a ten-point Green Industrial Revolution by Prime Minister Boris Johnson earlier in November.

“This policy package suggests that Cantillon’s Law may yet work to the advantage of ESG investors over Big Oil. The eighteenth-century economist Richard Cantillon asserted that those closest to the source of money would do best and renewables look set to receive a lot more love and financial support from Government than hydrocarbons.”