“It is exactly one month since Elon Musk tweeted that he was considering taking Tesla private, and that the funding was in place. One month later, that plan has been abandoned, questions are being asked about Mr Musk’s leadership style, lawsuits are flying and perhaps most tellingly (and irritatingly for the entrepreneur), the electric vehicle company’s shares are bonds are firmly in reverse gear,” says Russ Mould, AJ Bell Investment Director.

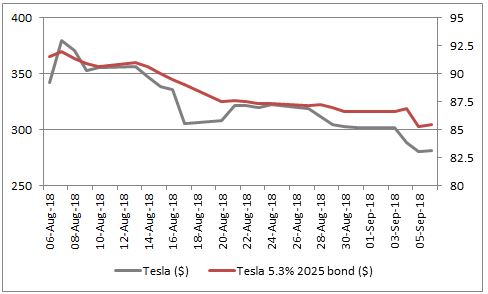

“Tesla’s shares closed at $380 on 7 August, just a fraction below their June 2017 all-time high, yet they ended trading yesterday at $280 for a fall of nearly 24% in just a month.

“Perhaps even more tellingly, the Tesla bond, which pays a 5.3% annual coupon and trades in Berlin on the Deutsche Boerse, has fallen too. Issued a year ago at $100 it has not once traded above par and as of yesterday’s close the traded debt was trading at 85.5 cents on the dollar, down 7% since that tweet.

Source: Thomson Reuters Datastream

“That leaves the sub-investment grade, or ‘junk’ rated, bonds offering a gross redemption yield of some 8.6% to reflect concerns among fixed-income investors over Tesla’s cash flow.

“Two convertible bonds are due to mature in the next nine months and if the shares do not reach a certain level then the bonds will not convert to equity and will instead have to be repaid. That would drain $1.1 billion from Tesla’s already dwindling $2.3 billion cash pile and places even more importance upon Mr Musk’s comment made alongside the Q2 results in early August that the company will turn a profit in the second half of 2018.

|

Maturity Date |

Coupon |

Amount |

Conversion price |

|

Nov-2018 |

2.75% |

$230m |

$560.5 |

|

Mar-2019 |

0.25% |

$920m |

$359.9 |

|

Nov-2019 |

1.625% |

$566m |

$759.4 |

|

Dec-2020 |

0.00% |

$113m |

$300.0 |

|

Mar-2021 |

1.25% |

$1,380m |

$359.9 |

|

Mar-2022 |

2.375% |

$977.5m |

$327.5 |

Source: Company accounts

“Besides the rumpus over Tesla’s corporate governance, the share price slide may also reflect renewed concerns over near-term production problems. Social media continue to report of shortages of key semiconductor components which could be hampering Tesla’s plans to ramp up output of the Model 3 car, something which the company does not appear to have denied, despite its CEO’s willingness to use Twitter as an outlet for communicating with investors.”