“The situation is a complex one. Venezuelan production is down owing to economic turmoil, Iran may be about to be excluded from world markets again by US sanctions, American shale production is rising and President Trump is complaining to Saudi Arabia about price fixing - though the Saudis won’t want to see oil go down too much, as they need the revenues to balance their budget and Riyadh is still looking to float its national oil firm, Aramco, on a stock exchange somewhere in the non-too-distant future.

“Nevertheless, Brent crude oil has pulled back a little from north of $80 a barrel to $76.50 amid talk that Saudi Arabia and Russia will begin to increase production again.

“Even so, Brent crude prices are still up by nearly 60% year-on-year. While history is by no means any guide for the future, past experiences suggest that a sustained period of 50%-plus year-on-year increases in oil prices can start to weigh on sectors which rely on discretionary consumer spending, as wallets and purses are squeezed by higher prices on the petrol station forecourts.

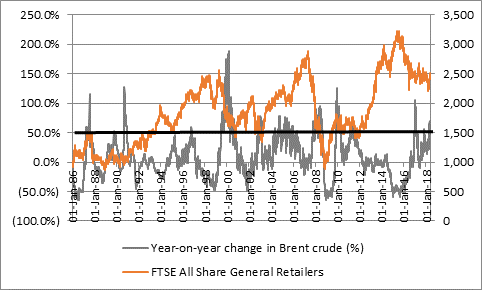

General retailers

“Since 1986, there have been a dozen prior instances of a 50% year-on-year jump in oil and with the only real exception of 1995, the FTSE All-Share General Retailers sector has come under pressure each time.

Source: Thomson Reuters Datastream

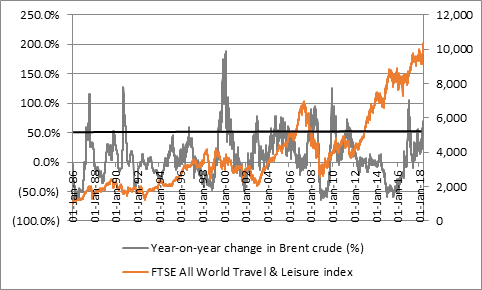

Travel & Leisure

“Travel & Leisure stocks have tended to be more resilient in the face of higher oil prices, but restaurateurs and hoteliers (as well as their shareholders) will be hoping the current bout of crude weakness continues. Even if the sector has held up well during the latest oil price increase, this looks like a bit of an outlier among the prior dozen 50% price hikes, along with 1995, 1996, 2003 and 2005.

Source: Thomson Reuters Datastream

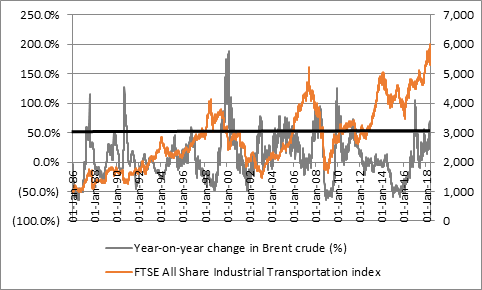

Industrial Transportation

“Intriguingly, the Industrial Transportation sector has not always stalled in the face of more expensive fuel. Plane, train, shipping and trucking firms have sailed through the last couple of oil 50% price increases, including the latest one, just as they did in 1987, 1989, 1997, 2005 and 2010.

Source: Thomson Reuters Datastream

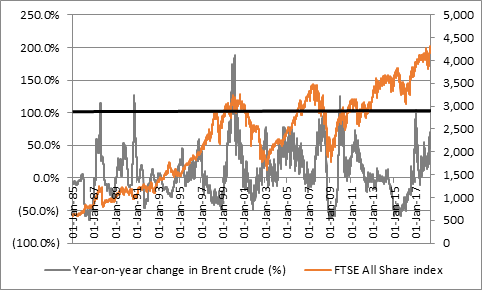

Global markets

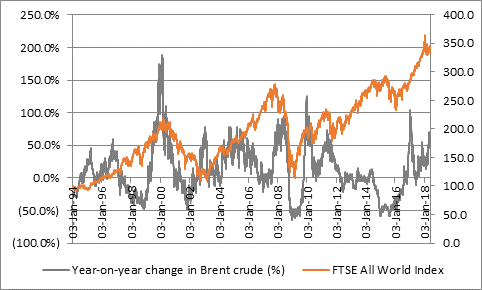

“Investors may also be pleased to see that it usually takes a lot more than a 50% increase in energy and fuel bills to derail stock markets and the global economy on a wider basis. Data since the launch of the FTSE All-Share in 1984 and the FTSE All-World benchmarks in 1994 would suggest that it needs a sustained increase of 100% year-on-year to signal real trouble ahead.

Source: Thomson Reuters Datastream

Source: Thomson Reuters Datastream

“That would need oil to reach $92 a barrel in double-quick time. The latest slippage in oil back below $80 may ease some investors’ fears on this front and even give encouragement to investors in consumer discretionary plays like retail and leisure stocks.”