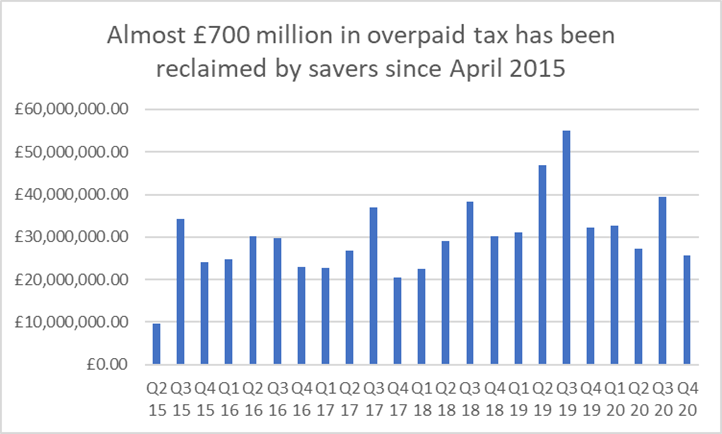

• Savers have reclaimed £693 million in overpaid pension tax since the pension freedoms were introduced in April 2015, AJ Bell analysis of HMRC data shows

• Just 8,019 pension tax reclaim forms were processed in Q4 2020, the third lowest figure since records began (https://www.gov.uk/government/publications/pension-schemes-newsletter-127-february-2021/pension-schemes-newsletter-127-february-2021)

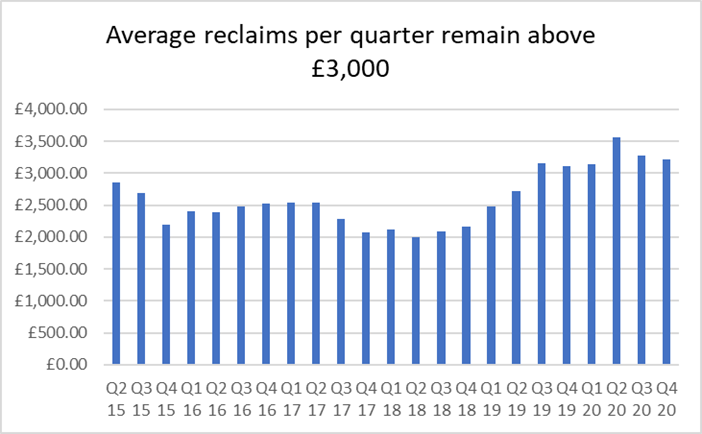

• Over £25 million was repaid during the quarter, with an average reclaim of £3,213

• Overtaxation occurs because HMRC taxes savers’ first flexible pension withdrawal on a Month 1 basis

Tom Selby, senior analyst at AJ Bell, comments:

“There remains a serious flaw in the pension tax system which in all likelihood has left hundreds of thousands of people lumbered with a shock overtaxation bill since April 2015.

“This approach was painful before the pandemic hit but now risks adding extra financial hardship to those who are forced to dip into their retirement pot to make ends meet.

“This overtaxation occurs because when someone accesses their retirement pot ‘flexibly’ for the first time in a tax year, HMRC applies an emergency ‘Month 1’ tax code to the withdrawal. Flexibly accessing your pension includes taking income via drawdown or withdrawing ad-hoc lump sums.

“HMRC’s insistence on using a Month 1 tax code means your usual tax allowances will be divided by 12 and then applied to your withdrawal. In many cases this will lead to tax bill thousands of pounds higher than expected.

“Only those who fill out the official reclaim form will be repaid within 30 days by the Revenue. Those who don’t will likely have to wait at least until the end of the tax year for HMRC to sort out their affairs.

“To give an idea of the scale, in 2020 around 38,000 official reclaim forms were processed by HMRC. In the same year, over 600,000 people flexibly accessed their retirement pot for the first time.

“While those who took a regular income should have had their tax code adjusted automatically, anyone who didn’t will have been overtaxed.”

Source: HMRC Pension Schemes Newsletters

Source: HMRC Pension Schemes Newsletters

Pensions overtaxation – how it works

Take someone who has no other taxable income and takes a £5,000 taxable withdrawal from their pension. Given the personal allowance for 2020/21 is £12,500, they might expect to pay 0% tax on the withdrawal.

However, because a Month 1 tax code is used this allowance is divided by 12 and then applied to the withdrawal (meaning only the first £1,042 will be taxed at 0%).

The basic-rate tax band of £37,500 is then also divided by 12 (giving a band of £3,125) and this part of the withdrawal is taxed at 20%. Finally, the remaining £833 will be taxed at 40%.

The net result is that, rather than paying £0 in tax, they will initially pay around £958.

Getting the money back

If you are taking a steady stream of income via drawdown then you shouldn’t need to take any action, as HMRC will adjust your tax code to ensure that over the course of the year you are taxed the correct amount.

However, if you make a single withdrawal then you will either need to take action by filling out one of three forms, or rely on HMRC putting you in the correct position at the end of the tax year.

Which form you need to fill out will depend on how you have accessed your retirement pot:

• If you’ve emptied your pot by flexibly accessing your pension and are still working or receiving benefits, you should fill out form P53Z

• If you’ve emptied your pot by flexibly accessing your pension and aren’t working or receiving benefits, you should fill out form P50Z

• If you’ve only flexibly accessed part of your pension pot then use form P55.

Provided you fill out the correct form HMRC says you should receive a refund of any overpaid tax within 30 days.