HMRC has today published the latest statistics on pension freedom withdrawals showing:

• Savers flexibly withdrew just under £2 billion from their pensions in the third quarter of 2018

• £21.7 billion has now been withdrawn since the freedoms were launched in April 2015

• 258,000 people made a withdrawal in Q3 2018, down slightly on the record set in Q2 2018 of 264,000

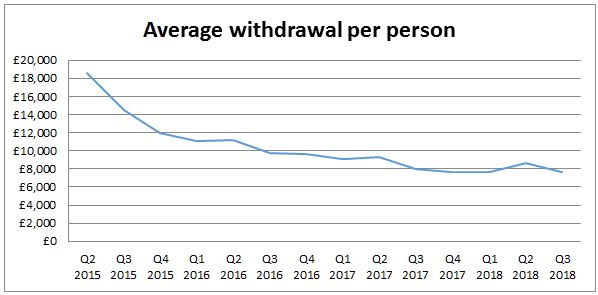

• Average withdrawals per person were £7,597 during Q3, down from £8,595 in Q2 2018 and back down to the lowest level since the pension freedoms were introduced

• Number of savers being hit with emergency tax bills also on the rise, with separate figures published by HMRC showing a record £38 million was reclaimed during Q3

Tom Selby, senior analyst at AJ Bell, comments:

“The Government recently upgraded its estimate for the tax take from pension freedoms withdrawal this year by a whopping £400m and now we can see why. The UK public has latched on to the flexibility the new rules give them and as more people hit age 55 we can expect these figures to keep rising.

“Importantly though, it looks like most people are taking a pragmatic and controlled approach to how they manage their pension savings with the average withdrawal per person generally on a downwards trajectory. There was an initial rush for cash when the new rules came into effect in 2015 but since then the average withdrawal has plunged from £18,571 to £7,597 in Q3 this year.

“One of the real thorns in the new rules is the tax treatment applied to people making their first pension freedoms withdrawal. In most cases an emergency tax rate will be applied to these withdrawals meaning people pay more tax than they should do. This can be reclaimed but it is a hassle and doesn’t help the fact that the withdrawal will be lower than the individual expected. Earlier this week HMRC reported that a record £38 million of this overpaid tax was reclaimed by investors in Q3, yet it seems to have no intention of changing the rules.”