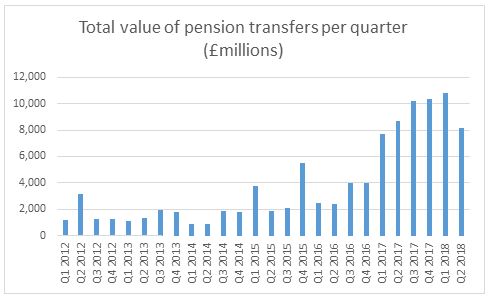

• Total value of pension transfers drops from £10.6billion in Q1 2018 to £8.2billion in Q2 2018 (Source: Office for National Statistics)

• First drop in value of pension transfers since Q2 2016

• Almost £80billion of pension transfers recorded by the ONS since launch of the pension freedoms in April 2015

• Transfer activity post-pension freedoms driven by savers quitting defined benefit (DB) schemes

Tom Selby, senior analyst at AJ Bell, comments:

“Savers have been rushing to the defined benefit exit door in their droves since the pension freedoms were introduced, attracted by a combination of alluring transfer values and the flexibility on offer in defined contribution schemes.

“Negative headlines surrounding the failure of some DB sponsors, most notably BHS and Carillion, have added to this heady cocktail.

“While there are circumstances where a DB transfer can be in a saver’s best interests – for example if they are in ill health or want to prioritise leaving money to loved ones after they die – the FCA has been turning up the heat on advisers acting in this market. There have also been reports of insurers jacking up premiums where advisers are carrying out this work – a pincer movement which has unsurprisingly seen many advisers pull out of the market.

“With DB transfers requiring advice to be taken where the pension is valued at £30,000 or more, this supply constraint could well be pushing down activity in the market.

“You would also expect the number of people with significant funds that are eligible for a transfer slowly edge downwards over time, and we may now be seeing the start of that process.

“For anyone considering quitting their DB scheme – or who has done so already – it is crucial they understand the risks associated, take an active role in planning their retirement and, ideally, seek ongoing help from a regulated financial adviser.”

Source: Office for National Statistics - Investment by insurance companies, pension funds and trusts (MQ5)

https://www.ons.gov.uk/economy/investmentspensionsandtrusts/datasets/mq5investmentbyinsurancecompaniespensionfundsandtrusts

Note: Figures quoted are from section 4.3 – self-administered pension funds income and expenditure - Row 62 (‘Transfers to other pension schemes’).