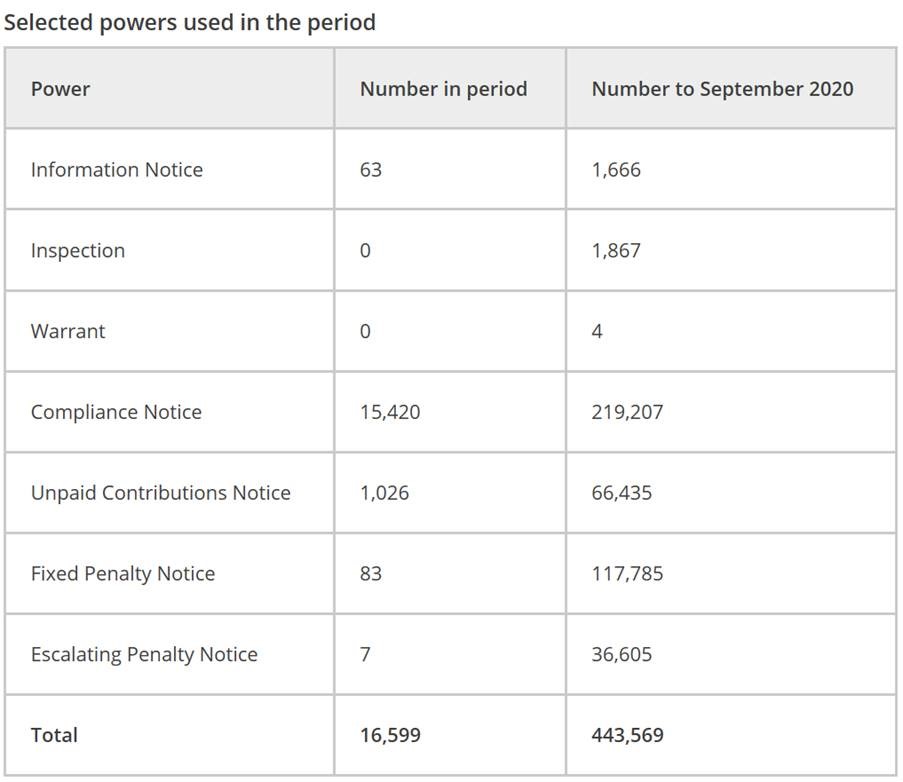

• The number of warnings issued to employers for failing to pay pensions to staff increased by almost 200% between July and September, data published today by the Pensions Regulator reveals (https://www.thepensionsregulator.gov.uk/en/document-library/enforcement-activity/enforcement-bulletins/compliance-and-enforcement-quarterly-bulletin-july-to-september-2020)

• Some 1,026 ‘unpaid contributions notices’ were issued during the three-month period, compared to just 352 between April and June

• The number of ‘compliance notices’ issued during the period also increased 17%, from 13,185 to 15,420

• Regulator warns employers who fail to meet their auto-enrolment duties risk facing legal action

Tom Selby, senior analyst at AJ Bell, comments: “COVID-19 and the subsequent nationwide lockdown has placed unprecedented strain on the balance sheets and day-to-day operations of thousands of businesses.

“This strain appears to have resulted in a surge in automatic enrolment non-compliance, with an almost 200% increase in employers being formally warned for failing to pay the right pension contributions to workers.

“The latest quarter also saw a significant rise in companies being issued ‘compliance notices’ for failing to meet their auto-enrolment duties, such as re-enrolling workers three years after they have opted out.

“Some of this non-compliance will simply be down to administrative error or oversight, and the regulator has been clear that it will take a pragmatic approach where genuine mistakes have been made.

“But it is also firing a warning shot across the bows of UK employers that it will not stand for companies flouting the rules, and retains the power to issue huge fines and pursue legal action if non-compliance persists.

“Although times are clearly tough, nobody would stand for not being paid for the hours they have worked during lockdown, and so the same must be true of auto-enrolment pension contributions.”

Source: The Pensions Regulator

Background

What is a ‘compliance notice’?

This is the notice employers receive if they’ve breached their auto-enrolment duties. This will outline how The Pensions Regulator thinks an employer has breached their duties, what steps they need to take – or stop taking – to be compliant and gives a timeframe showing when any actions need to be completed.

What is an ‘unpaid contributions notice’?

If The Pensions Regulator believes an employer hasn’t paid contributions into its workplace pensions scheme, they will issue this notice. The employer will be given a date by which they need to back pay missed contributions.