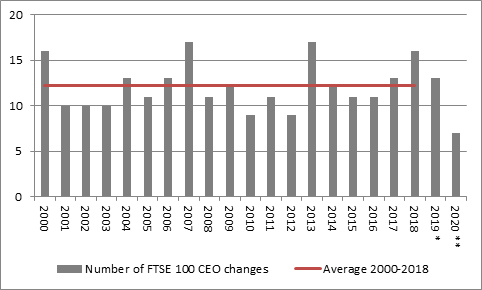

“The news that Clive Bannister is to retire down from the Chief Executive Officer’s job at Phoenix at the end of the years means that the bosses of 20 FTSE 100 firms have announced their departure in 2019, for one reason or another. Thirteen will leave this year and seven next, compared to a 20-year average of 12,” says Russ Mould, AJ Bell Investment Director. “Whether this is an attempt by some individuals to go out on a high remains to be seen, but in the USA CEO departures are running at a 17-year high, so this is a trend that investors need to watch, just in case company leaders are indeed looking to get out while the going is still good

Source: Company accounts. *2019 changes as already announced, planned or happened. **2020 changes as already announced in 2019

“Judging by the smooth nature of the handover to insurance industry heavyweight Andy Briggs, and the calm reaction of Phoenix’s share price, it is unlikely that anyone will read anything too sinister into the decision by the 60-year old Mr Bannister to retire and step aside after almost nine years at the helm.

“He took the top job at Phoenix in February 2011 and his stint means he is currently the fifteenth-longest serving boss in the FTSE 100. (See Appendix II below)

“There have been other, equally seamless transitions at Unilever, RBS, Ashtead and Reckitt Benckiser, for example, and BP, Auto Trader, Land Securities and Tesco are all co-ordinating smooth handovers for 2020.

“But in the case of Just Eat (when it was still a member of the FTSE 100), BT, HSBC and Kingfisher the change was sudden and there are several reasons why a CEO should go, voluntarily or otherwise.

• Share price performance has been poor, something has gone wrong or both and investors or the board felt it was time for a change. The rise and rise of activist investing continues to increase the pressure on CEOs to deliver.

• Companies where perhaps investors felt it was time for a change or the executive in question felt ready for a fresh challenge or a break

• There may be instances where the executive feels now is a good time to go, to ensure their legacy looks like a good one. (Vittorio Colao and Moya Greene, for example, could be said to have timed their 2018 departures from Vodafone and Royal Mail respectively with particular aplomb and some may be thinking the same about Rakesh Kapoor at Reckitt Benckiser this year).

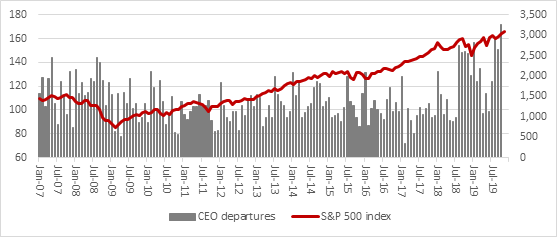

“In this context it is interesting to see so many CEOs step aside in the USA just as the S&P index sets new all-time highs (and executive selling of shareholdings hits levels not seen since 2006, despite rampant buyback activity).

“According to data from Chicago-headquartered outplacement, business and executive coaching specialist Challenger, Gray and Christmas, 172 US CEOs stepped down in October 2019, 15% higher than the same month a year ago.

“That takes the total number of changes in boss to 1,332 for 2019 to date, 13% higher than a year ago and the highest total for the first ten months of the year since Challenger, Gray and Christmas began to keep records in 2002.

“This rash of CEO departures could lead the more cynically-minded to wonder whether some are getting out while the going is still good, or at least consider whether trading is proving to be quite as strong as share prices would leave us to believe.

“Aggregate earnings estimates for the S&P 500 continue to leak lower and the previous peak in changes at the top came in 2008, just before the wheels fell off the global economy and stock market alike.

Source: Challenger, Gray & Christmas, Refinitiv data

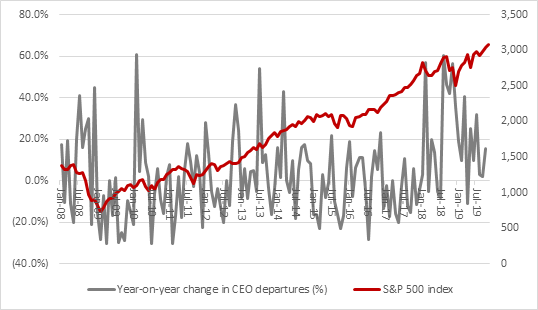

“It is possible to counter such dark thoughts. The rate of growth in changes of leader has slowed markedly over the past 12 months. It can be argued that economic data has started to stabilise in the US, after a sticky patch, and bulls will assert that the worst could be over, especially if Washington and Beijing can reach a trade accord and central banks can keep growth going with interest rate cuts.”

Source: Challenger, Gray & Christmas, Refinitiv data

Appendix I: FTSE CEOs who have announced their departure in 2019

|

|

Company |

In |

Out |

Date |

|

|

|

|

|

|

|

Announced and already happened |

||||

|

1 |

Unilever |

Alan Jope |

Paul Polman |

01-Jan-19 |

|

2 |

Just Eat |

Peter Duffy (interim) |

Peter Plumb |

21-Jan-19 |

|

3 |

BT |

Philip Jansen |

Gavin Patterson |

01-Feb-19 |

|

4 |

Aviva |

Maurice Tulloch |

Sir Adrian Montague (interim) |

04-Mar-19 |

|

5 |

BAT |

Jack Bowles |

Nicandro Durante |

01-Apr-19 |

|

6 |

Ashtead |

Brendan Horgan |

Geoff Drabble |

01-May-19 |

|

7 |

Direct Line |

Penny James |

Paul Geddes |

09-May-19 |

|

8 |

Reckitt Benckiser |

Laxman Narasimhan |

Rakesh Kapoor |

01-Sep-19 |

|

9 |

HSBC |

Noel Quinn (interim) |

John Flint |

05-Aug-19 |

|

10 |

Kingfisher |

Thierry Garnier |

Veronique Laury |

25-Sep-19 |

|

11 |

Smith & Nephew |

Roland Diggelmann |

Namal Nawana |

31-Oct-19 |

|

12 |

RBS |

Alison Rose |

Ross McEwan |

01-Nov-19 |

|

|

|

|

|

|

|

Announced and will happen in 2019 |

||||

|

13 |

Ferguson |

Kevin Murphy |

John Martin |

19-Nov-19 |

|

|

|

|

|

|

|

Announced and will happen in 2020 |

||||

|

14 |

Phoenix Group |

Andy Briggs |

Clive Bannister |

01-Jan-20 |

|

15 |

BP |

Bernard Looney |

Bob Dudley |

04-Feb-20 |

|

16 |

Auto Trader |

TBC |

Trevor Mather |

31-Mar-20 |

|

17 |

Land Securities |

TBC |

Robert Noel |

2020 |

|

18 |

Centrica |

TBC |

Iain Conn |

AGM 2020 |

|

19 |

Tesco |

Ken Murphy |

Dave Lewis |

Summer 2020 |

|

20 |

Imperial Brands |

TBC |

Alison Cooper |

TBC |

Source: Company accounts

Appendix II: Fifteen-longest serving CEOs in FTSE 100

|

|

Company |

CEO |

Started |

|

|

1 |

Hiscox |

Bronek Masojada |

Jan-2000 |

19.9 |

|

2 |

Next |

Simon Wolfson |

May-2001 |

18.5 |

|

3 |

Ocado |

Tim Steiner |

Jan-2002 |

17.9 |

|

4 |

International Cons. Airlines |

Willie Walsh |

Jan-2005 |

14.9 |

|

5 |

Halma |

Andrew Williams |

Feb-2005 |

14.7 |

|

6 |

Associated British Foods |

George Weston |

Apr-2005 |

14.6 |

|

7 |

Taylor Wimpey |

Peter Redfern |

Jul-2006 |

13.4 |

|

8 |

British Land |

Chris Grigg |

Jan-2009 |

10.9 |

|

9 |

Berkeley |

Rob Perrins |

Sep-2009 |

10.2 |

|

10 |

RELX |

Erik Engstrom |

Nov-2009 |

10.0 |

|

11 |

Scottish Mortgage Inv. Trust |

John Scott (chair) |

Dec-2009 |

9.9 |

|

12 |

Imperial Brands |

Alison Cooper* |

May-2010 |

9.5 |

|

13 |

DS Smith |

Miles Roberts |

May-2010 |

9.5 |

|

14 |

BP |

Robert Dudley* |

Oct-2010 |

9.1 |

|

15 |

Phoenix Group |

Clive Bannister* |

Feb-2011 |

8.8 |

|

|

|

|

|

|

|

|

FTSE 100 average |

|

|

5.4 |

Source: Company accounts. *Have announced their departure.