• Savers pumped £12.3 billion into cash deposit accounts in October, according to the latest Bank of England data

• The Bank says this might in part be down to rate cuts turning savers off NS&I products, which saw a £0.5 billion outflow in October

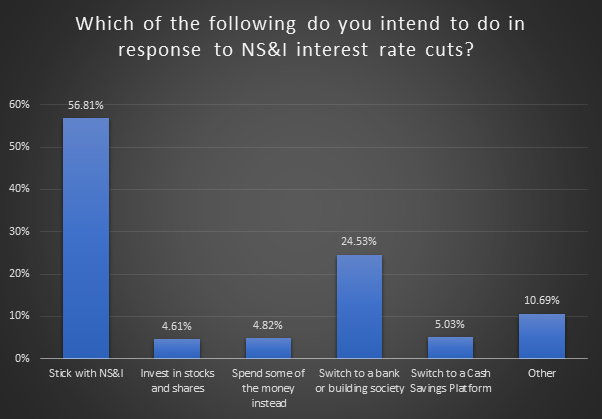

• More NS&I outflows could soon follow: consumer research conducted on behalf of AJ Bell suggests 43% of NS&I savers intended to move their cash elsewhere*

• £101 billion has now been saved into cash accounts since March, despite record low interest rates

(*Survey conducted by findoutnow on behalf of AJ Bell on 17 November 2020, with 500 respondents who are NS&I savers).

Laith Khalaf, financial analyst at AJ Bell:

‘It looks like NS&I rate cuts are hitting their intended target, by encouraging investors to find a different home for their money. NS&I reduced its rates on 24th November, but even in October it appears there was an early effect on the cash market, with £0.5 million leaving NS&I and £12.3 billion finding its way into deposit accounts in the banking sector.

This could be the thin end of the wedge, seeing as the NS&I cuts have only just come into effect, so data from October is only going to show the activity of early movers. Indeed our consumer research suggests over 40% of NS&I customers intended to move their money elsewhere as a result of the dramatic reduction in rates on some of their most popular products. This could mean even more cash flowing into bank and building society accounts paying miserable rates of interest.

The reason there is so much money sloshing around the banking system is of course the restraining effect COVID restrictions are having on consumer spending. Those who are lucky enough to have maintained their jobs and income find themselves with cash to spare, thanks to fewer opportunities to spend it on clothes, holidays, and nights out. Households have now saved over £100 billion into cash accounts since March.

The rotten irony is this bumper flow of cash is going into deposit accounts just when interest rates sit at record lows. In such uncertain times it makes sense for savers to build up an emergency cash buffer, though the risk is that inflation eats away at the value of their nest egg. Instant access accounts are now paying just 0.12% interest on average, below CPI inflation, which currently sits at 0.7%, and is expected to rise throughout next year.

Savers should therefore try to make the most of their cash by seeking out the best rates on the market, and considering locking some cash away for a bit longer in fixed term accounts, to bump up the interest they are receiving. Letting cash simply build up in a bog standard current account is likely to mean that money is losing its value once inflation is taken into account.

Looking forward there doesn’t appear to be much chance of cash rates moving significantly upwards for the foreseeable future. Indeed a negative base rate has been brandished as a potential tool by the Bank of England, though the emergence of successful vaccines has pared back the chances of the central bank having to resort to such a drastic measure.

For those who can tuck their money away for a bit longer, investing in the stock market is far more likely to generate inflation-busting returns over the long term than cash. Investors can even temper the volatility of the market by setting up a regular savings plan which drip feeds the money in monthly, providing a smoother journey. If you’re saving for retirement or any other long term goals, it’s going to be an uphill slog if you’re relying solely on cash interest to grow your nest egg.’

Source: findoutnow survey for AJ Bell 17 November 2020. Numbers do not add to 100% as respondents were asked to tick all that apply.