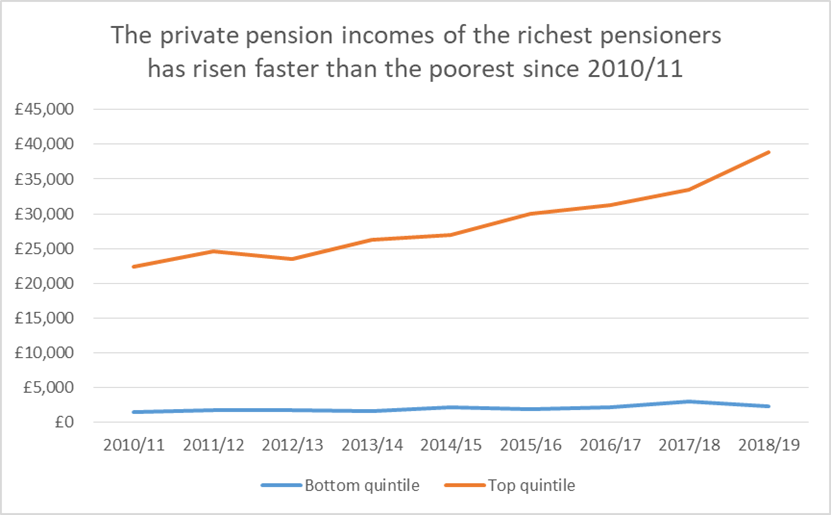

- The gap in private pension income between the richest and poorest pensioner households has widened significantly since 2010, AJ Bell analysis of official data reveals

- In 2010/11, the bottom fifth of retired households had an average private pension income of £1,472, while the top fifth was £22,422

- While the incomes of the poorest pensioners get from private pensions has increased 154% since then to £2,260 in 2018/19, the richest fifth have seen their incomes rise by a whopping 174% to £38,940

- In £s terms, the pension income gap between the richest and poorest retired households has risen from £20,950 to £36,680 in less than a decade

Tom Selby, senior analyst at AJ Bell, comments:

“It has become increasingly clear in recent years, and particularly in the aftermath of the EU referendum, that the UK is a divided nation, with the better off getting even better off as large sections of the population struggle to make ends meet.

“Addressing inequality and ‘levelling up’ regions that have been left behind is therefore likely to be a key priority for Boris Johnson’s new administration.

“While much attention has been paid to income inequality in the workplace, less has been said about those who are drawing a retirement income.

“Although average private pension incomes have risen substantially since 2010 – from £8,134 to £14,756 – this masks a widening gap between those at the top and those at the bottom. In fact, the disparity between the bottom fifth of savers and the top fifth has almost doubled, from £20,950 to £36,680.

“Or to put it another way, the pension incomes of the richest retirees are now 17x higher than those of the poorest. We truly live in a nation of pension ‘haves’ and pension ‘have nots’.

“While automatic enrolment should help future retirees avoid penury in their later years, for most people it will only serve to provide a basic level of income in retirement. And with no guarantees of how much the state pension will be or when it will be received in the coming decades, anyone wanting to avoid becoming a pension ‘have not’ needs to take responsibility by saving as much as they can afford today.”

Source: Office for National Statistics annual data