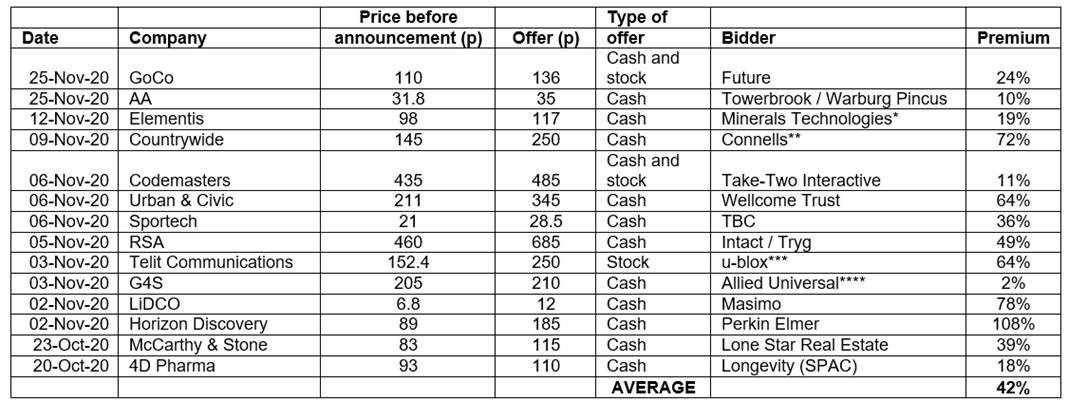

“The confirmation of a bid for AA, an approach to GoCo and a raised offer for Elementis make it 14 takeover deals in just over a month, to suggest that someone, somewhere thinks there are some UK-listed companies going cheap,” says Russ Mould, AJ Bell Investment Director. “The average premium offered for the targets is 46% so any investors who owned some of them will be feeling pretty happy with themselves. They may even start to wonder who could be next on the block, given that the FTSE All-Share still trades 15% below its May 2018 peak.

Source: Company accounts. *Bid raised from initial offer of 107p. ** Countrywide had already received offer of refinancing at 180p per share from Alchemy. *** u-blox' preliminary offer made public on 20 November when the shares were 168p ****G4S had already received 190p-per-share bid from Garda World

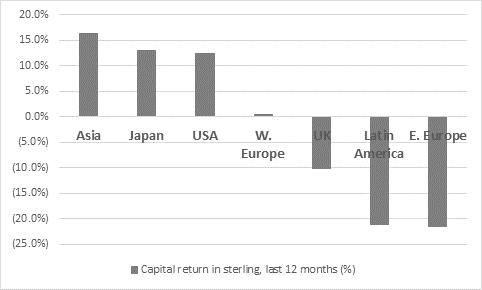

“Given how unpopular UK equities have been, relative to the other geographic options available, it is perhaps no wonder that some nuggets of value are emerging. Sentiment toward the UK stock market has been relentlessly negative, for reasons that stretch from perceptions of how it has handled the pandemic, to the predominance of sectors such as oils and banks, the absence of a major weighting toward technology and an apparent lack of progress in the Brexit talks. In sterling terms, over the past year, the UK has managed to outperform Latin America and Eastern Europe but it has lagged Asia and the other major developed arenas.

Source: Refinitiv data

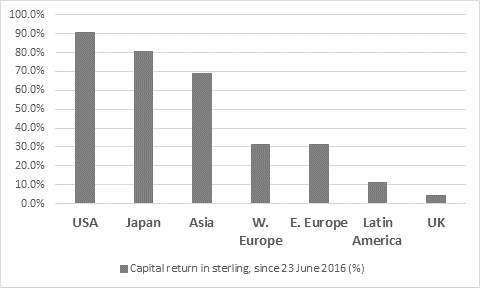

“Nor is this is new trend. The UK has been a dog since the Brexit vote in June 2016, thanks to the uncertainty it has seemingly helped to create, politically (until December 2019 at least) and economically. Since the referendum on membership of the EU economic bloc, the UK has been the single worst performer of the seven major options available to investors in sterling terms – with the pound’s post-poll plunge a contributor to that poor showing in relative and absolute terms.

Source: Refinitiv data

“But that rotten effort may mean that UK stocks are unloved and therefore potentially undervalued and since the idea behind investing is to buy low (and ultimately sell high) buying at a time of pervading pessimism is the correct thing to do. As the writer Joseph Campbell noted, ‘The cave you fear to enter holds the treasure you seek.’

“The would-be buyers of these 14 firms are perhaps therefore leading the way by showing some nerve and backing their views with cash (although in two cases, stock is being used as a currency, too). They think they are getting value, and perhaps good news on three potential COVID vaccines is helping them to take the plunge, and perhaps investors should take heed. If they wait for definitive proof the vaccines work, the economy is firing on cylinders and that corporate profits and dividends are booming once more the chances are they’ll have missed a good chunk of the upward move – although those who are sceptical that the vaccines will have such a transformational effect, fear the virus will linger and that economic activity by will dampened by both COVID-19 and horrendous levels of global debt may still prefer to take a more cautious view.”