• Savers withdrew £6.2 billion from NS&I accounts in November, according to Bank of England data released this morning

• Based on these figures, NS&I is now BELOW its funding target for the year, raising concern it may have overegged the pudding with its rate cuts

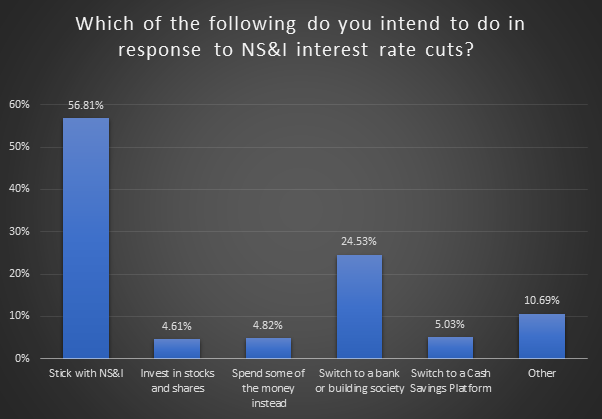

• Consumer research* conducted by AJ Bell in November found that 43% of NS&I savers intended to move their cash elsewhere

• Outside NS&I, in banks and building societies, households saved £17.6 billion in cash accounts in November 2020, up from £12.7 billion in October

(*Survey conducted by findoutnow on behalf of AJ Bell on 17.11.2020, with 500 respondents who are NS&I savers).

Laith Khalaf, financial analyst at AJ Bell:

“There’s been a consumer exodus from NS&I, after it slashed interest rates on some of its most popular products. Data from the Bank of England shows savers voted with their feet, and withdrew £6.2 billion from NS&I in November alone.

“NS&I’s rate cuts happened at the back end of the month, on 24th November, so more cash may well have leaked out since. Indeed a survey conducted by AJ Bell found that 43% of NS&I savers were planning to move their cash out as a result of the rate cuts.

“The size of the outflows will be concerning for NS&I, as it has gone from being flush with cash to now finding itself below its £35 billion funding target for the year. NS&I saw inflows of £38.3 billion in the first six months of the financial year, from April to the end of September. But Bank of England data has shown withdrawals of £0.5 billion, and £6.2 billion in October and November respectively, which look like they leave around £31.6 billion in the tank.

“That’s below NS&I’s £35 billion target, though there is £5 billion leeway either side, and NS&I still has until the end of March to make good any shortfall. In that time there will be some inflows through regular savings, which may help to offset withdrawals. ISA season is also just around the corner, when the end of tax year deadline serves to motivate savers to stick money in their tax shelters. However NS&I no longer offers an attractive rate of interest on its cash ISA, and with cash rates across the board so low, ISA savers may prefer stocks this year in any case.

“The scale of the withdrawals does raise the question whether NS&I has overegged the pudding with its rate cuts. It’s never an easy job deciding what rate will attract the right amount of money, but that’s been made even harder by the distortive effect of the pandemic on people’s savings habits. Over £150 billion was saved into cash accounts in 2020, as options to spend money dried up with widespread social restrictions. That money was stashed away in cash despite interest rates falling to record low, and NS&I took in a load of it.

“The nature of NS&I’s customer base may also have shifted during 2020. Its savings accounts unusually found themselves near the top of the best buy tables after the pandemic hit, and banks and building societies slashed their rates. That kind of exposure attracts customers who shop around for the very best rates, and when things change, these savers can understandably be ruthless about moving on to the next best thing.

“It doesn’t look like it’s going to be a good year for cash savers, with markets pricing in base rate staying put, or even falling by the end of 2021, and inflation expected to rise. However, if NS&I continues to see such large withdrawals, it may yet raise rates before the end of the tax year. But even if it does, it probably won’t be back to the market leading levels we saw last year.”

NS&I rate cuts

Premium Bonds now look like the only NS&I variable rate product offering a competitive rate of interest, though of course that is not shared equally, and savers may get more or less depending how lucky they are. Prizes are tax-free, which is an extra boost compared to normal savings accounts for anyone who pays tax on their savings.

While 1% of interest here and there might not seem like a lot, on £50,000 of cash it adds up to hundreds of pounds a year, and much more when that’s compounded over time. So it’s always worth spending a bit of time to make sure your savings are working as hard as they can for you.

|

Old NS&I AER |

New NS&I AER |

Moneyfacts best buy |

Extra annual interest switching to best buy on £50k |

|

|

Direct Saver |

1% |

0.15% |

0.75% |

£300 |

|

Investment Account |

0.80% |

0.01% |

0.75% |

£370 |

|

Income Bonds |

1.16% |

0.01% |

0.75% |

£370 |

|

Direct ISA |

0.90% |

0.10% |

0.6% |

£250 |

|

Premium Bonds* |

1.40% |

1% |

0.75% |

-£125 |

Sources: NS&I, Moneyfacts best buy as at 04/01/202. Old NS&I rates are before 24th Nov 2020, new rates are those available since.

What should savers do?

Overall the best course of action if you’re an NS&I saver depends on which kinds of product you’ve got and how much you value the security of having your money backed by the Treasury. In terms of security, it’s worth bearing in mind that the Financial Services Compensation Scheme covers up to £85,000 of losses per person in the unlikely event of their bank going bust.

Savers can improve their lot by shopping around for the best rate, and considering locking away some of their cash in fixed term bonds to harvest slightly higher rates of interest, if they don’t need instant access to their money. For longer term savings, five to ten years, investing in the stock market becomes a consideration.

Our consumer survey shows that a significant portion of NS&I savers intended to move away from NS&I, with banks and building societies being the main beneficiaries. Today’s figures from the Bank of England corroborate that conclusion, with £17.6 billion being saved into bank and building society accounts, up from £12.7 billion in October, with a £6.2 billion withdrawal from NS&I looking like a fairly likely source of much of that extra funding.

Source: findoutnow survey for AJ Bell 17/11/2020. Numbers do not add to 100% as respondents were asked to tick all that apply.