• Savers withdrew £9.4 billion flexibly from their retirement pots during 2020, new HMRC data reveals (https://www.gov.uk/government/statistics/flexible-payments-from-pensions#history)

• Some 360,000 people accessed their pension in the final three months of 2020, up 10% year-on-year and 4% versus the previous quarter

• This quarter-on-quarter rise is counter to previous trends and may reflect savers dipping into pensions as a result of Coronavirus

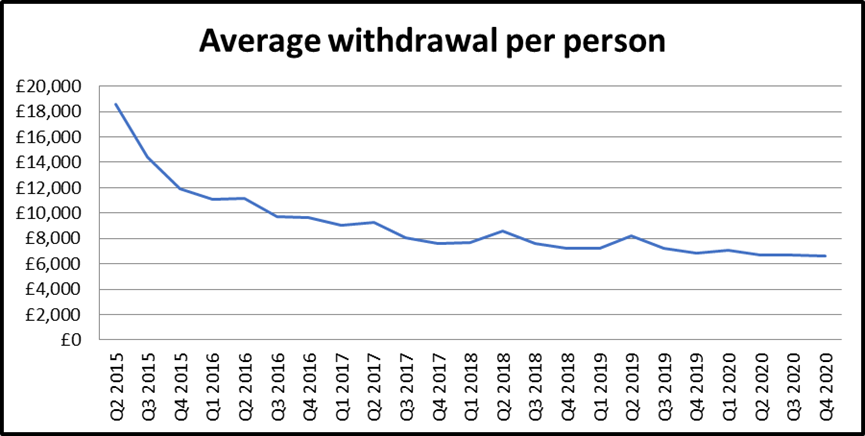

• Average per person withdrawals continue to fall, dropping from £6,715 in Q3 2020 to £6,583 in Q4

• Treasury urged to reinstate £10,000 money purchase annual allowance (MPAA) so savers aren’t unfairly punished for accessing their own money

Tom Selby, senior analyst at AJ Bell, comments:

“In a year like no other, retirement income investors faced their first major economic challenge since the pension freedoms were introduced in April 2015.

“As lockdown gripped the economy and markets went south in March and April 2020, the risk of ‘pound cost ravaging’ – where large pension withdrawals come at the same time as big investment losses – loomed large for those accessing their retirement pot.

“The fact year-on-year withdrawals dropped 17% during this torrid period suggests many savers were sensible, choosing to either delay accessing their pension, pause withdrawals or reduce the amount they were taking as income.

“Since then we have seen the number of people accessing their pensions and total withdrawals rise, which is unsurprising given markets have recovered and so investors will feel more comfortable returning to ‘normal’ retirement income behaviour. There is also likely to be some pent-up demand in the system following the drop in withdrawals we saw in the second quarter of 2020.

“However, there will inevitably be those who have had to access taxable income from their pension during this period as a result of Coronavirus. Given the exceptional circumstances that people have faced in the last 12 months, Chancellor Rishi Sunak should urgently review the money purchase annual allowance (MPAA) these savers are currently subjected to.”

Source: AJ Bell analysis of HMRC data

The case for reviewing the MPAA

“Anyone over 55 who flexibly accesses taxable income from their pension is subject to the ‘money purchase annual allowance’, reducing the amount they can save for retirement from £40,000 a year to just £4,000. When someone triggers the MPAA they also lose the ability to carry forward up to three years of unused allowances in the current tax year.

“The reasons for taking taxable income from your pension could vary from replacing lost salary from employment to helping a younger relative pay their bills or older relative cover care costs. But regardless of the circumstances, the MPAA is applied indiscriminately and permanently.

“This enormous annual allowance cut felt unfair during normal times, but at a time when many savers and their families are facing extreme financial hardship it seems particularly cruel.

“Given the impact Coronavirus will continue to have on people’s finances in 2021, there is a strong case for halting the application of the MPAA so people who access taxable income from their pension are not hampered in their ability to rebuild their retirement pot once this crisis is over.

“At the very least, the Treasury should consider raising the MPAA back to £10,000 - the level it was set at when first introduced in April 2015.”

Three ways to take money out of your pension without triggering the MPAA

1: consider only taking your 25% tax-free cash

“While taking taxable income from your pension risks triggering the MPAA, just taking your 25% tax-free cash won’t. In order to access your tax-free cash you’ll need to ‘crystallise’ some or all of your pension – this just means choosing a retirement income route such as drawdown or buying an annuity.

“It is possible to crystallise part of your pension in order to access your tax-free cash, leaving the remaining fund – including any further tax-free cash element – untouched.

“Take, for example, someone with a total pension pot worth £100,000. If they wanted to take out £5,000 to help a relative struggling during lockdown, one option would be to crystallise £20,000 of their pension, with £15,000 going into drawdown and £5,000 available as tax-free cash.”

2: take advantage of little-known ‘small pots’ rules if you can

“While flexibly accessing taxable income from your pension will see your annual allowance reduced by the MPAA, there are ‘small pots’ rules which allow you to make taxable withdrawals while retaining your full annual allowance.

“A small pot in this case is defined as a pension arrangement worth £10,000 or less. In order to class as a small pots withdrawal (and thus avoid triggering the MPAA), you must extinguish the entire pension pot you are accessing.

“You can make unlimited small pots withdrawals from any occupational defined contribution pension plans worth £10,000 or less. These are simply any pensions you may have which were set-up by an employer.

“For non-occupational DC plans such as SIPPs, you can close up to three pension pots by making a maximum of three small pots withdrawals.”

3: if you’re in ‘capped’ drawdown, don’t exceed your maximum income

“If you entered ‘capped drawdown’ before 6th April 2015 and stay within your income limits you will not trigger the MPAA.

“Savers in capped drawdown have their fund invested and take withdrawals from their fund in the same way as regular drawdown. However, the key difference – as the name suggests – is withdrawals are capped at 150% of the equivalent Government Actuary’s Department (GAD) annuity rate.

“Although this might sound complicated, it just means you can withdraw up to 150% of the income a healthy person at your age could receive from a lifetime annuity. If you breach this limit then you will have been deemed to have flexibly accessed your pension and so will trigger the MPAA.”