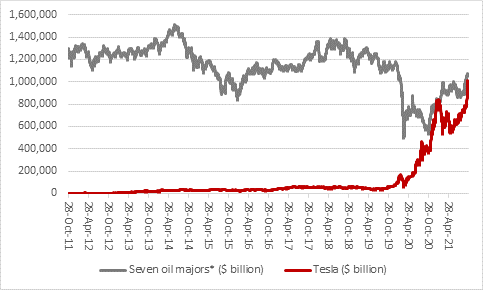

“Daniel Loeb prefers his Third Point fund to be described as an event-driven fund rather than an activist one, although there does seem to be an uncanny correlation between his arrival on companies’ share registers and the development of events which are designed to unlock value in the shares,” says AJ Bell Investment Director Russ Mould. “And given that seven of the world’s biggest oil producing firms – including Shell – are valued in aggregate no more highly than Tesla on its own, at $1 trillion, there may well be some value to be had in Big Oil, despite public and political pushback against the industry.

Source: Refinitiv data. *BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Royal Dutch Shell and TotalEnergies

“Those seven oil majors are the UK’s BP and Shell, Europe’s Total Energies and ENI and America’s ConocoPhillips, Chevron and ExxonMobil. Between them in 2021 they are expected to generate $1.1 trillion in sales and $133 billion in pre-tax profit, compared to Tesla’s $51 billion and $5.6 billion respectively.

|

2021 revenues ($ billion) |

|||

|

ExxonMobil |

270.9 |

Tesla |

51.0 |

|

Royal Dutch Shell |

278.1 |

|

|

|

TotalEnergies |

180.7 |

|

|

|

BP |

170.7 |

|

|

|

Chevron |

150.5 |

|

|

|

ConocoPhillips |

40.6 |

|

|

|

ENI |

60.9 |

|

|

|

Aggregate |

1,152.4 |

|

|

|

|

|

|

|

|

2021 pre-tax profits ($ billion) |

|||

|

ExxonMobil |

28.0 |

Tesla |

5.6 |

|

Royal Dutch Shell |

26.0 |

|

|

|

TotalEnergies |

21.1 |

|

|

|

BP |

21.1 |

|

|

|

Chevron |

18.7 |

|

|

|

ConocoPhillips |

10.9 |

|

|

|

ENI |

6.7 |

|

|

|

Aggregate |

132.5 |

|

|

Source: Marketscreener, consensus analysts’ forecasts

“Investors therefore seem to be of the view that Big Oil is in grave danger of being left sat on stranded assets as the globe moves away from oil and gas to more renewable, and less carbon-intensives, sources of energy. At the very least they seem more interested in Tesla’s growth potential and profit momentum and less concerned by its valuation, while in contrast they are implicitly saying Big Oil’s current sales and profits and not sustainable and it is a sunset industry.

“Yet oil and gas prices are currently buoyant as demand continues to rise and supply is constrained by political and public pressure, the reluctance of banks and investment institutions and insurance to provide funding or cover for new drilling projects, and oil firms’ own reticence as they redirect cashflow to other sources of energy in their bid to reinvent themselves and – ultimately – maintain their licence to operate.

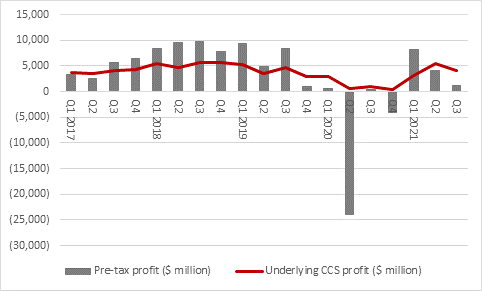

“Investors in Shell will therefore be intrigued to see Mr Loeb build a stake in the oil major, even if the share price is down in the wake of a messy set of third-quarter results, which were marred by more than $5 billion of mark-to-market, paper losses on derivative positions used to hedge oil and gas prices. Despite surging oil and gas prices, stated pre-tax profit fell from $4.1 billion in Q2 to $1.2 billion in Q3. Underlying profit, on a current cost of supplies basis (CCS) was hampered by output losses in the Gulf of Mexico in the wake of Hurricane Ida.

Source: Company accounts

“A break-up of Shell, as per Mr Loeb’s proposal, would indeed by a seismic event at the company and just the sort of event on which the Third Point fund thrives. It is also part of the classic list of strategies which ‘activist’ investors use in what they portray as attempts to unlock value in firms that are underperforming their potential, either operationally, financially or in terms of their share price (See appendix below).

“It is unlikely to be a proposal that will have favour in Shell’s boardroom, especially as the cash flow currently being generated by the oil and gas operations will be a useful source of funding for the firm’s investments in alternative and renewable energy sources.

Source: Company accounts

“That cash flow also funds the dividends, growing once more, and the reinstated share buyback programme. Shell returned $2.7 billion to shareholders in the third quarter alone via these mechanisms and the $0.24-a-share dividend payment for Q3 leaves the company on track to be the third-highest dividend payer in cash terms within the FTSE 100 in 2021, behind only Rio Tinto and BAT.

“In the event of a break-up, income seekers would presumably feel obliged to follow the money and hold the legacy oil and gas assets. Those investors who are prepared to put profit over their ethical and environmental principles may not find this too hard a choice, if they ever have to make it, and they (and Mr Loeb) may point to the example of Thungela Resources when it was spun out of Anglo American this summer.

“Shares in the thermal coal business, also seen as a problematic, legacy operation with limited long-term value and reputational stigma, have more than trebled since they listed back in June, not least as they came out on such a lowly valuation relative to both its cash flow and the stated book value of its assets.”

APPENDIX: Activist investor checklist

Strategic options: spin or sell

• Asset disposals or spin-offs to recognise value

• Break-up

• Put the company in play for a bid

Financial options: more effective capital allocation

• Share buybacks

• Special dividends

• Dividend initiation or increases

Operational angles: improve performance

• Change the management

• Sale and leaseback of assets

• Close or restructure poorly performing units

Governance: improve reputation and lower risk

• Rein in excessive executive remuneration

• Ensure board has right balance, executive and non-executive