“It is hardly the most ringing endorsement when a company announces the departure of its chief executive and the subsequent share price gain catapults the firm to the top of the day’s FTSE 100 leaderboard, but that is what is happening at Smith & Nephew after its parting of the ways with Roland Diggelmann,” says AJ Bell Investment Director Russ Mould. “The absence of any further bad news on earnings is also helping, after a couple of disappointing updates in 2021, and the orthopaedics-to wound care-to sports medicine specialist could even be a beneficiary of anything like a return to normality in hospitals as and when COVID-19 proves to be less of a problem.

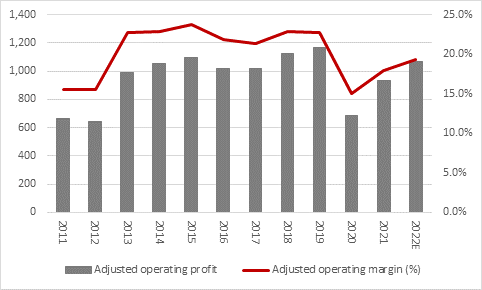

“Investors may also be still warming to Smith & Nephew’s new Strategy For Growth, as outlined by Mr Diggelmann last December. The FTSE 100 firm is now targeting compound organic revenue growth of between 4% and 6% a year out to 2024 and an operating margin of 21% by 2024, with further improvements in return on sales after that.

“The Board therefore seems happy with the strategy so it is now the job of the incoming boss, Dr Deepak Nath, to deliver on those targets, which are based partly upon the promising product pipeline in orthopaedics and strong growth in sports medicine and wound care, as well as manufacturing and cost efficiencies.

“At least the full-year results featured no further nasty surprises.

“Revenues of $5.2 billion equates to a 14% year-on-year increase on a stated basis and a 10% advance on an underlying basis. That is toward the bottom end of the 10% to 13% target laid down alongside November’s third-quarter trading update but still within it.

“An operating margin of 18% also came in at the bottom end of the targeted range of 18% to 19%. Analysts will now look to Dr Nath and his new colleagues to start delivering on the planned margin expansion, despite the challenges posed by higher input and logistics costs.

“Higher volumes would be a big help on this front. Hip and knee replacements and other surgical procedures have either been crowded out by the viral outbreak at busy hospitals and new variants have delayed the recovery in volumes. Smith & Nephew could therefore get a boost if, as and when the virus is finally beaten off.

“The FTSE 100 firm is targeting underlying revenue growth of 4% to 5% for 2022 and an increase in its operating margin of half a percentage point to 18.5%.

“This may be enough to satisfy bulls of the stock, although sceptics will note how the board expects sales growth to be back-end loaded toward the second half of the year, a forecast which does leave the company as a bit of a hostage to fortune. It also undershoots the current analysts’ consensus forecast for a margin north of 19% in 2022.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

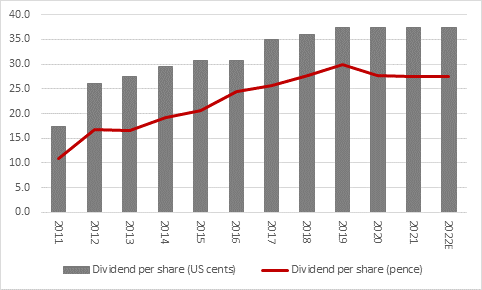

“However, investors seem enthused by the arrival of Dr Nath from Siemens Healthineers and also talk of enhanced cash returns from the company going forward. Smith & Nephew has declared an unchanged final dividend payment of 23.1 cents, making for an unchanged full year payment of $0.3750, but management has flagged what it calls a progressive dividend policy and plans for share buybacks.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

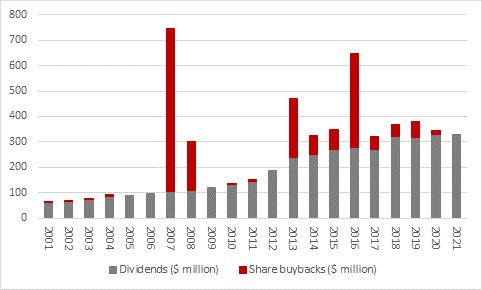

“Smith & Nephew has not usually been an enthusiastic purchaser of its own stock, although it did run share buybacks of some size in 2007, 2013 and 2016. Over the last 20 years, however, the firm has preferred to reward investors with dividends, where total distributions have come to $3.8 billion compared to $1.8 billion of buybacks.

Source: Company accounts

“As for Mr Diggelmann, his tenure at the top of Smith & Nephew will prove relatively short, at just two-and-a-half years, when he leaves at the end of March. He took over in October 2019 after the departure of Namal Nawana, who left amid claims he was underpaid and would do better for himself in the USA.

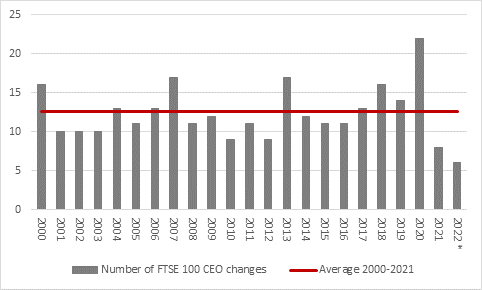

“Smith & Nephew is therefore the fifth current FTSE 100 firm to announce a change at the top for 2022. Prudential, Burberry, Anglo American and Taylor Wimpey are the other four (Johnson Matthey would have been a sixth as it announced Robert Macleod would be leaving when it was still in the index but it has since fallen into the FTSE 250. Liam Condon is scheduled to take the reins on 1 March).

|

Changes in FTSE 100 announced for 2022 |

|||

|

|

|

|

|

|

Company |

In |

Out |

Date |

|

Prudential |

Mark FitzPatrick (interim) |

Mike Wells |

31-Mar-22 |

|

Burberry |

Jonathan Akeroyd |

Marco Gobbetti |

01-Apr-22 |

|

Smith & Nephew |

Deepak Nath |

Roland Diggelmann |

01-Apr-22 |

|

Anglo American |

Duncan Wanblad |

Mark Cutifani |

19-Apr-22 |

|

Taylor Wimpey |

Jennie Daly |

Pete Redfern |

26-Apr-22 |

|

|

|

|

|

|

Johnson Matthey* |

Liam Condon |

Robert MacLeod |

01-Mar-22 |

Source: Company accounts. *Johnson Matthey change announced 11 November 2021 when company was still a FTSE 100 constituent. Changes at Burberry, Anglo American and Taylor Wimpey announced in 2021 but only effective in 2022.

“That compares to just eight in the whole of 2021, although that came after a wild year in 2020 when 22 bosses stepped aside, voluntarily or otherwise.

Source: Company accounts. *To date.