“Cult, US-listed stock NVIDIA, a firm often bracketed with the better-known FAANG stocks, has blown a massive fuse overnight and left growth-seeking momentum investors in an invidious position,” says Russ Mould, AJ Bell Investment Director.

“The leading manufacturer of silicon chips has issued a big profit warning for the final quarter of its financial year (the three months to the end of January), citing indigestion in the video consoles market and also a slowdown in demand from makers of Bitcoin mining equipment.

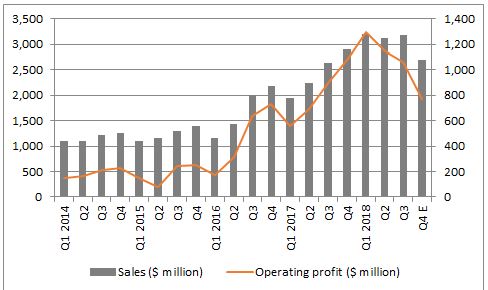

“As a result, a stunning run of increases in quarterly sales and profits is about to come to a crashing end, with founder and chief executive Jensen Huang forecasting a 7% year-on-year drop in sales and a 28% year-on-year plunge in operating profit for the fourth quarter.

Source: NVIDIA accounts, Q4 estimate based on management guidance issued on 15 November 2018

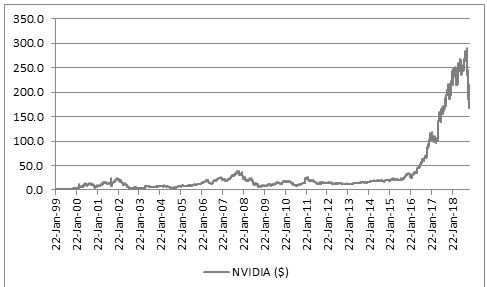

“That’s nowhere near good enough for a stock sporting a $123 billion market cap and a forward price/earnings of 43 times, based on consensus estimates before last night’s shocker. As a result NVIDIA’s shares fell 17% in after-hours trading, to take the stock back to where it had been last September.

“As the chart shows, after NVIDIA’s meteoric rise, this one was never going to plateau – it was either going to keep on going up like a rocket or come down like the stick. At the moment, gravity is starting to win.”

Source: Refinitiv data

“NVIDIA’s profit warning therefore means investors must now mull over three issues.

• Is it time to keep buying on the dips? A bull run that is nearly ten years old has conditioned investors to use any share price weakness as a chance to pile back in but like all investment strategies this one works well - until it doesn’t. It may not be obvious from the long-term share price chart but NVIDIA’s shares fell by more than 80% in both of the 2001-03 and 2007-09 bear markets. A repeat this time would take NVIDIA back to barely $60 – still miles below the $167.5 indicative price in after-hours trading.

• Is this a stock-specific situation or indicative of wider problems for end-demand for silicon chips? It is tempting to say this is a situation that lies solely with NVIDIA, given the damage done by relative niche markets such as bitcoin mining equipment. But NVIDIA has not been alone in warning of softer end markets. A string of Apple suppliers have coughed up disappointing results, including Japan Display, Lumentum and AMS, while Texas Instruments, Infineon and STMicroelectronics have all issued cautionary outlooks. This feels like it could be broader-based and investors must now keep an eye on NVIDIA’s quarterly balance sheets. A second-quarter jump in inventories and trade receivables warned of a possible slowdown and now it has come to pass, with inventories and receivables rising must faster than sales yet again. Tech-stock bulls will want to see this bulge of finished parts start to diminish to suggest this is just a blip and not an end-of-cycle downturn.

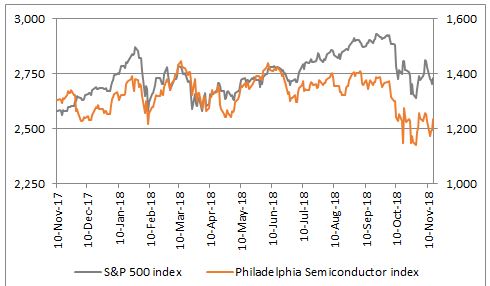

• What, if anything, does this mean for stock markets more generally? NVIDIA is a leading member of the Philadelphia Semiconductor Index, or SOX index. This benchmark has traditionally been a good indicator of wider stock market momentum and risk appetite since its launch in summer 1994. The index peaked before the wider US stock market in both 2000 and 2007 and bottomed before headline indices such as the S&P 500 began to find its footing in 2002 and 2009.

Source: Refinitiv data

This is because silicon chips – semiconductors – are everywhere, from cars and computers, from smartphones and tablets, from video games to robotics and from display screens to data centres so they are good proxy for economic growth and broader end-market demand. In addition, chip stocks are traded as momentum and growth stocks, doing well when earnings estimates are going up and badly when they are going down

As a result, the SOX can be a good guide to financial market sentiment more generally. The SOX had rallied by 3% this week so it will be interesting to see how it treats the NVIDIA news as a fresh retreat could suggest that wider indices such as the S&P 500 may find it hard to recapture their momentum too.”

Source: Refinitiv data