“The saying ‘the trend is your friend’ is one that has well served investors who use either fundamental analysis or technical analysis, or a combination of the two and once a narrative or asset class gathers steam it can often go a lot further than many think,” says Russ Mould, AJ Bell Investment Director. “As 2020 ends and 2021 begins, there are three trends that are particularly worth watching, especially as they are interlinked. Spotting whether they will continue or reverse could have a huge influence on portfolio performance in the coming 12 months and beyond, as they could shape asset allocation, fund selection and – for those intrepid enough to try – individual stock picks.”

1. Will the US dollar keep falling?

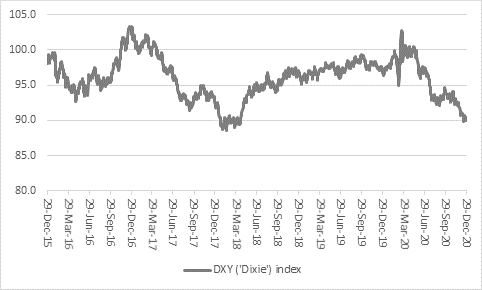

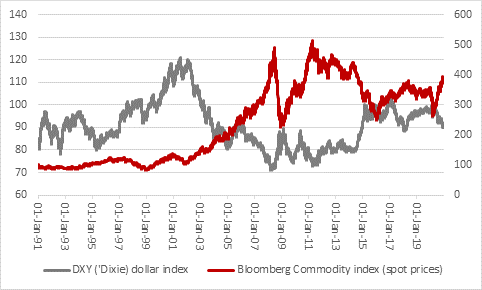

• As benchmarked by the trade-weighted DXY (‘Dixie’) index, the US dollar is trading at almost three-year lows as it battles to hang on to the 90 mark.

Source: Refinitiv data

• There are several possible reasons for this:

o Investors feel less need to own a perceived haven asset such as the greenback, amid hopes that vaccination programmes will beat off the pandemic and help economic activity start to return to normal in 2021

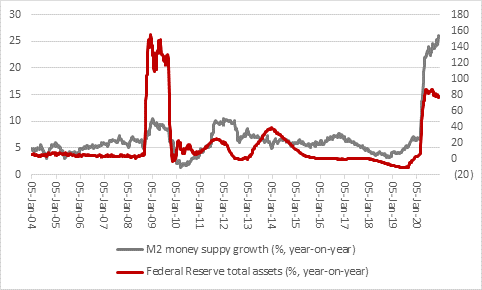

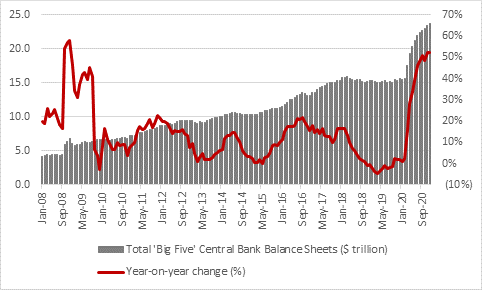

o The US Federal Reserve continues to run ultra-loose monetary policy and it is even starting to grow its balance sheet again as the central bank buys more bonds under its Quantitative Easing scheme. This suggests that one solution offered in response to the pandemic and any further economic stumbles will simply be more money printing and increased supply of dollars. M2 money supply growth in the US is now running at 26% year-on-year, while the Fed’s is growing again, as total assets reach $7.4 trillion (77% higher than a year ago).

Source: FRED – St. Louis Federal Reserve database

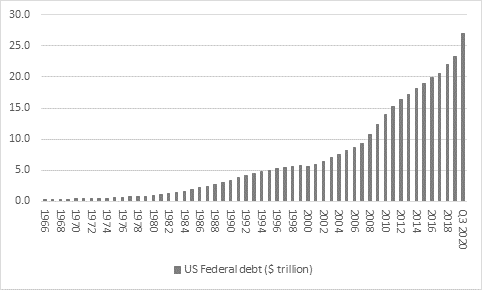

o The $900 billion stimulus bill, passed by Congress and then reluctantly by President Donald Trump, also shows that increased Government spending will be one result of the fight against COVID-19 – the only debate is over how much will be spent. The President is calling for higher distributions to American citizens and the House of Representatives’ Speaker, the Democrats’ Nancy Pelosi, has already flagged her desire for a further stimulus bill early in 2021. No indications are yet being given how this is to be funded and as such it is no little wonder that America has doubled its national debt in the last ten years to $27 trillion, having taken from 1776 to 2010 to rack up the first $13.5 trillion.

Source: FRED – St. Louis Federal Reserve

“In the dollar’s defence, the US is hardly on its own here, and that may be one reason why the dollar is not falling further. The public finances of the UK, EU and Japan all look very tatty to varying degrees and each of their central banks continues to run Quantitative Easing schemes which now equate to record highs in absolute money terms, and as a percentage of GDP. Not one of the ECB, Bank of Japan, Fed or Bank of England is now pretending that QE is a temporary or emergency measure and not one of them is talking about sterilising or withdrawing QE. The only game in town, at the moment, seems to be how far they will go.

“That may also explain why asset prices remain so elevated across the board and why some commentators think that markets will remain bubbly for some time to come, given the old adage that financial bubbles only burst when the money runs out – and there’s little sign of that right now.”

2. Will commodity prices keep rising?

“President Trump could never quite work out whether we wanted a strong or a weak dollar – even though a robust buck would have been a sign of relative economic strength – but two asset classes do seem happier when the US currency is on the slide, at least if their historic inverse relationship with the buck is any guide.

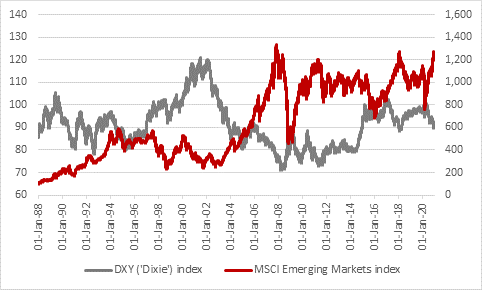

“The first is emerging market equities (EMs). This may be because a weak dollar means financial markets feel no need to own haven assets because the global economy is healthy, so emerging markets are benefiting from that rising tide. That would in turn also foster global risk appetite, something that could fuel buying of EM assets. In addition, a weaker greenback makes it easier for EM nations to fund their overseas, often dollar-denominated debts, freeing up cash that can be used more productively on investment rather than interest payments.

Source: Refinitiv data

“The second is commodities. They can benefit from a declines in the greenback as most of them are priced in dollars, so a decline there makes them cheaper to buy for nations whose own currencies are not linked in some way to the American one, boosting demand. Commodity strength may also coincide with dollar weakness as a reflection of robust global economic health (at least markets’ anticipation of it and thus their lesser need for haven assets like the buck).

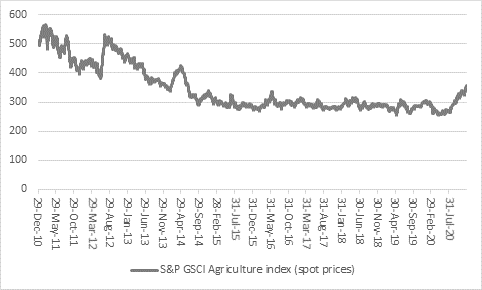

Source: Refinitiv data

“What is particularly interesting at the moment is how the broad Bloomberg Commodity index, which covers more than 20 raw materials, appears to be breaking higher after nearly a decade in the doldrums. Specific commodities are too, notably copper, platinum and also agricultural products and crops.

Source: Refinitiv data

“If food prices do suddenly take off, history suggests that the headline inflation rate could catch light on both sides of the Atlantic, a development which neither central banks nor financial markets seem to be expecting.

“Periods such as the last decade, where low inflation, low growth and low interest rates have dominated, have historically favoured long-duration assets, bonds and technology or growth stocks. Periods of inflation have tended to favour short-duration assets such as cyclical (or value) stocks, emerging markets and commodities, so if we do get inflation, for whatever reason, then asset allocation strategies in the 2020s may have to look very different from the ones which served investors so well in the 2010s.”

3. Will bitcoin (and gold) keep rising?

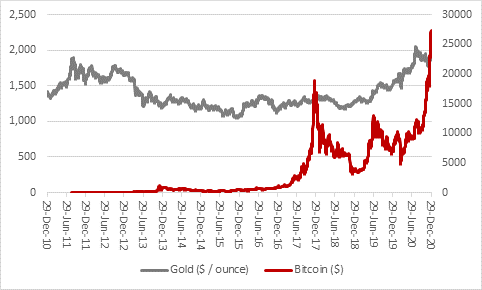

“Nelson Bunker Hunt once espoused the view that ‘Almost anything is better than paper money. Any fool can run a printing press.’ Although the magnate’s attempt to corner the silver market came to grief in 1980 some investors appear to agree with him right now, given how gold and especially bitcoin are performing. Gold reached a new all-time high in 2020 and bitcoin has set a string of new peaks, more than trebling in the second half of the year to pass the $28,000 mark for the first time.

Source: Refinitiv data

“Some will argue that there is more to come from both gold and bitcoin, especially if Governments keep piling up debts and central banks do their best to fund that borrowing through the backdoor with QE, zero interest rates and bond yield manipulation, thanks to their scarcity value relative to cash. Bitcoin’s supply is fixed at 21 million units and gold supply grows at barely 2% a year, as the metal is hard to find and expensive to mine.

Source: FRED - St. Louis Federal Reserve, Bank of England, Bank of Japan, European Central Bank, Swiss National Bank, US Federal Reserve

“Others will argue neither gold nor bitcoin have intrinsic value, as they do not generate cash. Some will even argue that bitcoin is just a glorified Ponzi scheme, as new money flows in at the bottom to help the smart money that got in early bail out at the top. In 2021 investors will get their chance to pay their money and take their choice as to whether they see bitcoin and gold as stores of value, and useful portfolio diversifiers, as governments and central banks conjure money out of thin air, or more trouble than whatever they may (or may not) be worth.”